Global Yacht Fuel, Inc

Fuel & lubeoil supplies, united states, www.globalyachtfuel.com.

At Global Yacht Fuel we have been arranging fuel supplies exclusively for yachts since 1990 and are considered one of the industry’s top and most trusted suppliers. It is our goal to achieve long-term relationships with our clients. No one will work as hard to ensure that your experience a trouble-free delivery at the best price. Contact us today for more information and to open an account!

Tel (954) 462-6050 or [email protected]

- Fort Lauderdale United States

News summary

Sign up to the superyachtnews bulletin.

Receive unrivalled market intelligence, weekly headlines and the most relevant and insightful journalism directly to your inbox.

The SuperyachtNews App

Follow us on

Media Pack Request

Please select exactly what you would like to receive from us by ticking the boxes below:

Membership Login

To view our digital library and complete intelligence data, please login below Alternatively please join here

SuperyachtNews.com

Pioneering next wave fuel solutions

We are Dan-Bunkering, a global leader in fuel solutions for the maritime industry. With more than 40 years of experience, 90 international fuel suppliers across 11 offices, we’re committed to pioneering the next wave of fuel solutions together with our customers and partners.

Looking for a fuel solutions expert?

SELECT OFFICE

Related insights

Webinar April 15, 2024: Transitioning to Biofuels on Board: Technical Considerations

Mar. 11, 2024

EU Allowances

Dec. 13, 2023

Completed - We are attending WindEurope 2024 in Bilbao, March 20-22, 2024

Feb. 27, 2024

Extensive experience across industries

Container vessels.

We know that on-time refuelling is key to meeting tight time schedules. By focusing on an in-depth understanding of the industry, we help you transport containers from one port to the next.

Bulk vessels

Operating bulk vessels often takes you to remote locations and you might not even know where you are going next. We are here to help you navigate uncertainty in shipping routes, price volatility and different local procedures to secure optimal operations.

Tanker vessels

Tanker vessels operate under short and complicated supply windows. We understand the importance of ensuring a timely and flexible delivery of fuel. And we are dedicated to assisting your business on achieving optimal operations.

We know that yachts are nothing like the ordinary shipping business. We focus on supplying high-quality fuel to yachts at anchor in remote destinations or along the quay in busy ports, providing convenient pricing models.

Nothing should stop your passengers from getting an experience of a lifetime and ensuring on-time departure and arrival is a crucial aspect of tourism operations. We provide spot and contract fuel solutions that support ferries, cruises and tourism companies throughout every step of their scheduled activities.

Fishing vessels

We understand the need to keep operations running, even when seas are rough. And that often includes fast and flexible refuelling on location. Through our extensive bunker locations, we are ready to supply your vessel, wherever you may be located.

The construction of new offshore windmill parks, oil exploration and other offshore projects requires a holistic understanding. We provide end-to-end solutions and advice – from planning to installation.

Pioneering the next wave of fuel solutions

Our company.

Dan-Bunkering was founded in 1981 with the mission to pioneer the bunker trading business and fuel solutions for the maritime industry. And we have specialised in providing our customers with high-quality bunker fuel, lubricants, and other vessel services ever since.

Global presence meets local know-how

years of experience

fuel solution experts

local offices

Are you taking advantage of price volatility?

Volatility in prices, changes in regulations, supply chain shocks and geopolitical tensions have turned the bunker fuel market into a highly dynamic and rapidly changing industry.

Are you ready to establish safer industry standards?

On-going sanctions and geopolitical conflicts increase the complexity of dealing with risks and compliance in the maritime industry.

Are you taking action to decarbonise our industry?

As the maritime industry is faced with new legislative mandates to reduce C02 emissions, we experience an increasing demand for new and more alternative fuel solutions.

Looking for new ways to optimise operations?

The maritime industry continues to advance with new technological developments emerging every day. Yet, traditional operational issues persist – and your operations and refuelling have to be coordinated accordingly.

- Agile pricing and financing

- Safe trading

- Alternative fuels and CO2 reductions

- Smarter operations

Join us in shaping the future of fuel solutions

We continuously work to innovate and navigate the latest challenges in our industry. To do so, we are always on the lookout for the best talents to bring new perspectives on board.

Let’s find the right person for you

Our dedicated teams of experts always strive to find the optimum solution for you.

* required fields

Thank you for your request!

A fuel solution expert will contact you shortly. For immediate assistance, call our Head Office available 24/7 at +45 6441 5401.

Our Solutions

Streamline bunkering with effective fuel management Why pay more? We can help you reduce costs. We offer start-to-finish fuel management that makes it easy, from procurement to inventory management and delivery options.

Fuel your fleet at strategic physical supply locations

Manage your budget with cost-effective lubricants, outsource fuel procurement for less headaches, be more efficient with technology that works.

Transactions

Global Sea Ports

Billion Gallons

* Figures as of December 31, 2020

Why Partner With Us

Featured content.

Expansion of Strategic Partnership with Shell Marine Lubricants

Mass Flow Metering - Going With The Flow

Bunker Fuels: The benefits of working with a strong counter party

- Marine General Terms and Conditions

- ISO Standards

- Website Terms and Conditions

- Privacy Center

- Cookies Policy

- UK Modern Slavery Act

©2024 World Kinect Corporation. All rights reserved.

Fuelling Superyachts around the world

With over 30 years of experience supplying fuel to luxury yachts, we deliver the highest quality marine fuels at competitive prices, with outstanding levels of service.

Comprehensive network

A vast network of suppliers with reach to over 1000 ports and marinas worldwide.

100% independent

We are proud to be privately owned by our directors and care about our customers.

Competitive pricing

We always strive to offer the best possible prices without compromising on service or quality.

Why choose Revolution Fuel as your yacht fuel supplier

Worldwide coverage.

The highest quality marine fuels for yachts at marinas, ports and anchors throughout the world.

Revolution Fuel supply yachts at thousands of delivery locations around the world and works with countless port agents and local representatives to provide flawless all-encompassing service.

Outstanding service

Detailed and useful information for all aspects of your fuel delivery from clear pricing and product specifications to procedures, formalities and calling instructions.

- Detailed product analysis

- Tax breakdowns

- Tax exemption information

- Logistics and timing

Attention to detail

Even the smallest details are important when it comes to making a delivery that is as smooth and efficient as possible. That is why we provide clear and comprehensive information surrounding all aspects of your fuel delivery.

Decades of experience

Revolution Fuel has over 30 years of experience supplying fuel to luxury yachts the world over.

With our head office located in London we are ideally placed to negotiate with suppliers throughout the world.

Here to help 24/7

Available to help you 24 hours a day, 7 days a week.

On call for short notice and emergency fuel requirements.

Competitively priced fuels and lubricants

Your expert fuel partners

Barnaby Skipwith

An expert and leader in the field of superyacht fuelling, Barnaby is highly respected by those who require technical expertise, precise communication and an exceptional standard of professionalism. His understanding of detailed technical specifics, in addition to his ability to provide comprehensive worldwide logistical and regulatory information, guarantee an unparalleled, individualised and tailored global service.

John Sipson

With over a decade of outstanding service within the global yacht fuel industry, John has amassed a wealth of technical skill and extensive logistical knowledge, in addition to the expertise required to provide a high end service for the most discerning of clients. John's professionalism, technical knowledge and dedication to achieve the best solutions for his clients on every occasion is highly regarded and trusted.

What our clients are saying about us

"I have used John Sipson and Barney Skipwith of Revolution Fuel globally and I find them faultless!"

"I have used Revolution Fuel for years. Always well organised, quick and convenient. The service is good and the prices have been excellent"

"I have relied on John and Barnaby now at Revolution Fuel for as long as I can remember"

Top quality fuels and lubricants. Anywhere in the world

Make a fuel enquiry or give us a call today

IMO 2020 and the outlook for marine fuels

Imo 2020 and lower sulfur-content requirements.

In 2016, the International Marine Organization (IMO) agreed to limit the sulfur content in all marine fuels to 0.5 percent beginning in 2020, with the exception of fuel burned in Sulfur Emission Control Area regions, which are already at lower sulfur limits. The volume of oil demand affected by this change is significant. Demand for high-sulfur residual fuel oil for ship bunkers was 3.5 million barrels per day in 2018—out of 7 million barrels per day of total resid demand—and the global refining system is not yet equipped to make this volume of residual fuel oil at 0.5 percent sulfur once the regulation goes into effect.

Stay current on your favorite topics

Traditionally, the bunker-fuel market has been a sink for refiners to put high-sulfur resid material into and thereby avoid the need for expensive upgrading and hydrotreating processes. While there are currently about two million barrels per day of vacuum resid below 0.5 percent sulfur generated from atmospheric distillation, even this limited volume is not readily available for fuel-oil blending. Because many refiners lack hydrotreating capacity, those with conversion capacity are forced to use low-sulfur resid as a feedstock. Finally, most of this low-sulfur material is currently used as fuel in sectors that cannot switch to products with higher sulfur content.

The next-best source of low-sulfur fuel for shippers is marine gasoil, and we expect that this will initially be the path that most shippers take to satisfy IMO requirements. Ship engines can be switched to use marine gasoil with minimal operational change and no significant capital expense or time out of service. As marine gasoil is diesel-range material, the sulfur content can be controlled through the same hydroprocessing steps used to make low-sulfur diesel, and as global diesel sulfur limits have been lowered over the years, refiners have significantly expanded this capacity. However, diesel-range material is far more valuable than resid because of its ability to blend into diesel. Even with no change in current pricing conditions, switching to marine gasoil would significantly increase fuel costs for shippers.

As a result, many shippers are looking for alternatives, such as adding on-board exhaust scrubbers or switching to liquefied natural gas (LNG) as a fuel. Installing scrubbers would allow shippers to continue to burn high-sulfur fuel oil (HSFO), though it comes at a high conversion cost both from the capital expense of the scrubber equipment and the lost time in service while the ship is in dry dock. Switching to LNG also incurs some significant up-front costs, but the biggest deterrent thus far has been concern about the availability of LNG as a bunker fuel.

For these reasons, we expect the market to—at least initially—shift to using marine gasoil as the new regulation goes into effect. Based on the resulting impact on prices, we foresee subsequent waves of investment in shipping and refining.

Global Downstream Outlook to 2030

Market impact from shifting from resid bunker to marine gasoil.

As shippers switch from resid bunker to marine gasoil, we expect to see two key changes. First, the higher demand for gasoil will largely have to be met by higher crude runs, putting upward price pressure on global crude prices, distillate premiums to other fuels, and refining margins in general. We estimate that the switch to marine gasoil will add about 1.5 million barrels per day to distillate demand globally, leading refiners to run an additional 2.2 million barrels per day of crude oil through distillation. This should increase refining utilization in the major hub markets by 2.9 to 6.7 percentage points. Margins will rise as a result, with European Brent cracking margins expected to be up $3 per barrel.

This should also tighten distillate markets relative to gasoline, adding to the cost of marine gasoil. Recently, the spread between gasoline and diesel prices has been relatively constant—about $4–$6 per barrel—due to the similar growth rates of the two products. However, history shows that when diesel demand accelerates relative to gasoline, diesel prices shift to premiums of $10–$12 per barrel over gasoline, which we expect to see in 2020 when diesel/gas-oil demand jumps due to the International Convention for the Prevention of Pollution from Ships (MARPOL) (exhibit).

Second, falling demand for high-sulfur fuel resid will cause its price to decline, widening the spread between traditional high-sulfur resid bunker and marine gasoil. In recent years, resid markets have been fairly tight, reflecting resid being valued as a feedstock in marginal refinery-conversion capacity. With an oversupply of resid, the marginal barrel will have to find a home in a lower-valued use.

In the past, such a use has typically been in competition with natural gas in power markets that have the ability to switch to fuel oil. A shift to this level of pricing would widen the fuel-oil spread to Brent from $6 per barrel in 2019 to $20 per barrel in 2020. However, given the volume of excess resid predicted and the fact that it will all be very-high-sulfur material, this could overwhelm the traditional substitution market. If it were to do so, then resid would likely have to find a home competing with even lower-value coal in the Asian power sector, causing HSFO prices to reach as low as $15 per barrel.

Combined, these market effects mean a potential widening of the spread between gasoil and HSFO in the Singapore market from current levels of $20 per barrel to as much as $100 per barrel in the coal-substitution scenario. This would result in refining margins for full-conversion coking/hydrocracking plants going from 2018 levels of $6–$7 per barrel to $30–$40 per barrel.

Under these market conditions, there would be a huge incentive for shippers and refiners to contemplate capital investments to capture value from this spread. To allow shippers to continue using low-cost HSFO, the payout time for scrubber investments on ships would fall to months. For refiners, the expected rate of return for coking and hydrocracking investments would also be huge.

Powered by Energy Insights

Energy Insights’ world-class team of data scientists and analysts leverage data and advanced analytics to power our insights and advise clients across the energy value chain.

Opportunities for different sectors

A market shift of this magnitude creates both threats and opportunities for players across the value chain:

- HSFO marketing. Current producers of high-sulfur bunker fuel will need to look for alternative end uses, but there will be strong competition to capture the opportunities for power generation and other industrial uses. Some end uses—like substitution against direct crude burn and against coal—may currently be considering fuel oil as an option and could become viable should differentials widen significantly.

- Low-sulfur fuel oil blending. If reliable supplies materialize, demand for 0.5 percent resid should grow. Capturing this opportunity will require segregating and aggregating existing volumes of low-sulfur resid material from refiners that are currently feeding it to conversion. This will likely require new commercial agreements and some investment in tankage and logistics.

- Refinery investment. Much wider differentials should make investments in conversion (such as coking) attractive, but the time to capitalize on this opportunity has likely passed, given how long it takes to complete a project. History would suggest that a wave of investments is likely to follow a widening of differentials, but many of the projects will come online too late to capture the full upside potential.

- Bunker-fuel sourcing. Shippers will face a growing array of options for fueling their fleets, including shifting to marine gasoil, sourcing low-sulfur resid, and investing in scrubbers or LNG. Making the right move at the right time should have big economic consequences.

This article appeared in the September 2018 edition of Tank Storage Magazine and is reprinted here by permission.

Emily Billing is an analyst in McKinsey’s Houston office, where Tim Fitzgibbon is a senior expert and Anantharaman Shankar is a consultant.

Explore a career with us

Related articles.

MARPOL implications on refining and shipping markets

MARPOL uncertainty not stopping some refiners from acting

Surge in global refinery additions could cut margins in 2019

- S&P Global

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Merger Information

- Stock & Dividends

- Shareholder Services

- Español

- Português

- English (Australia)

- Get Support

- System Notifications

- Delivery Platforms

- Regulatory Engagement

- Commodity Insights Login

- Access IHS Markit Products

Marine Fuel

Latest marine fuel market insights, essential marine fuel products.

- Marine Fuels

Platts Bunkerwire

A daily global picture of the physical bunker fuels market, providing you with the latest marine fuel prices for all major ports along with an insight...

Platts Clean Tankerwire

The latest in tanker freight and fixture rates, giving you a full view of the most important developments, so you can effectively analyze the tanker m...

Platts cFlow

View, monitor and analyze the key factors affecting the supply chain and impacting prices such as vessel movement, cargo data and freight and bunker p...

Latest Marine Fuel Events

S&p global commodity insights apac shipping forum.

- 17 Apr 2024

- The Fullerton Hotel Singapore

S&P Global Commodity Insights Shipping Webinar

- 20 Jul 2022

Latest Marine Fuel Methodology

- Oil, Shipping

Specifications Guide Global Bunker Fuels

Get in touch with a member of the sales team about S&P Global Commodity Insights Marine Fuel Services

Complete the form below and a member of our sales team will contact you to discuss how our products and service can help you grow and succeed.

Thanks for your interest in Marine Fuel. We will be in touch shortly.

- First Name * Please enter first name.

- Last Name * Please enter last name.

- Business Email Address * Please enter email address.

- Company (full legal entity) * Please enter company name

- Select a job function Job Function Acct/Back Office/Settlement Academic Administration Analyst Broker Compliance Consultant Economist Engineer Finance Executive Forecasting Government IT Journalist Knowledge management/Library Legal Librarian Marketer Marketing/Communications Market Research Operations Management Project Management Public/Investor relations Publishing Procurement/Purchasing Research and Development Risk/Product Ctrl/Mid Office Sales/Business Development Strategic Planning Student Trader

- Select a country Country/Region United States Canada Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antigua and Barbuda Argentina Armenia Aruba Ascension Island Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bosnia and Herzegovina Botswana Bouvet Island Brazil British Indian Ocean Territory Brunei Darussalam Bulgaria Burkina Faso Burundi Cambodia Cameroon Cape Verde Cayman Islands Central African Republic Chad Channel Islands Chile China (Mainland) Christmas Island Cocos (Keeling) Islands Colombia Comoros Congo Congo, Democratic Republic of Cook Islands Costa Rica Croatia Cuba Curacao Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic East Timor Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Falkland Islands (Malvinas) Faroe Islands Fiji Finland France French Guiana French Polynesia French Southern Territories Gabon Gambia Georgia Germany Ghana Gibraltar Greece Greenland Grenada Guadeloupe Guam Guatemala Guinea Guinea-Bissau Guyana Haiti Heard and McDonald Islands Holy See / Vatican City Honduras Hong Kong SAR Hungary Iceland India Indonesia Iran Iraq Ireland Israel Italy Ivory Coast Jamaica Japan Jordan Kazakhstan Kenya Kiribati Korea, Republic of Korea, Democratic People's Rep Kosovo Kuwait Kyrgyzstan Laos Latvia Lebanon Lesotho Liberia Libyan Arab Jamahiriya Liechtenstein Lithuania Luxembourg Macao SAR Macedonia Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Martinique Mauritania Mauritius Mayotte Mexico Micronesia Moldova, Republic of Monaco Mongolia Montenegro Montserrat Morocco Mozambique Myanmar Namibia Nauru Nepal Netherlands Netherlands Antilles New Caledonia New Zealand Nicaragua Niger Nigeria Niue Norfolk Island Northern Mariana Islands Norway Oman Pakistan Palau Palestinian Authority Panama Papua New Guinea Paraguay Peru Philippines Pitcairn Islands Poland Portugal Puerto Rico Qatar Reunion Romania Russian Federation Rwanda Samoa San Marino Sao Tome and Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Singapore Slovakia Slovenia Solomon Islands Somalia South Africa South Georgia/South Sandwich Spain Sri Lanka St. Helena St. Kitts and Nevis St. Lucia St. Pierre and Miquelon St. Vincent and Grenadines Sudan Suriname Svalbard and Jan Mayen Islands Swaziland Sweden Switzerland Syrian Arab Republic Taiwan Tajikistan Tanzania, United Republic of Thailand Togo Tokelau Tonga Trinidad and Tobago Tunisia Turkey Turkmenistan Turks and Caicos Islands Tuvalu Uganda Ukraine United Arab Emirates United Kingdom Uruguay Uzbekistan Vanuatu Venezuela Viet Nam Virgin Islands (British) Virgin Islands (U.S.) Wallis and Futuna Islands Western Sahara Yemen Zambia Zimbabwe

- Please enter country of residence Country/Region of Residence United States Canada Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antigua and Barbuda Argentina Armenia Aruba Ascension Island Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bosnia and Herzegovina Botswana Bouvet Island Brazil British Indian Ocean Territory Brunei Darussalam Bulgaria Burkina Faso Burundi Cambodia Cameroon Cape Verde Cayman Islands Central African Republic Chad Channel Islands Chile China (Mainland) Christmas Island Cocos (Keeling) Islands Colombia Comoros Congo Congo, Democratic Republic of Cook Islands Costa Rica Croatia Cuba Curacao Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic East Timor Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Falkland Islands (Malvinas) Faroe Islands Fiji Finland France French Guiana French Polynesia French Southern Territories Gabon Gambia Georgia Germany Ghana Gibraltar Greece Greenland Grenada Guadeloupe Guam Guatemala Guinea Guinea-Bissau Guyana Haiti Heard and McDonald Islands Holy See / Vatican City Honduras Hong Kong SAR Hungary Iceland India Indonesia Iran Iraq Ireland Israel Italy Ivory Coast Jamaica Japan Jordan Kazakhstan Kenya Kiribati Korea, Republic of Korea, Democratic People's Rep Kosovo Kuwait Kyrgyzstan Laos Latvia Lebanon Lesotho Liberia Libyan Arab Jamahiriya Liechtenstein Lithuania Luxembourg Macao SAR Macedonia Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Martinique Mauritania Mauritius Mayotte Mexico Micronesia Moldova, Republic of Monaco Mongolia Montenegro Montserrat Morocco Mozambique Myanmar Namibia Nauru Nepal Netherlands Netherlands Antilles New Caledonia New Zealand Nicaragua Niger Nigeria Niue Norfolk Island Northern Mariana Islands Norway Oman Pakistan Palau Palestinian Authority Panama Papua New Guinea Paraguay Peru Philippines Pitcairn Islands Poland Portugal Puerto Rico Qatar Reunion Romania Russian Federation Rwanda Samoa San Marino Sao Tome and Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Singapore Slovakia Slovenia Solomon Islands Somalia South Africa South Georgia/South Sandwich Spain Sri Lanka St. Helena St. Kitts and Nevis St. Lucia St. Pierre and Miquelon St. Vincent and Grenadines Sudan Suriname Svalbard and Jan Mayen Islands Swaziland Sweden Switzerland Syrian Arab Republic Taiwan Tajikistan Tanzania, United Republic of Thailand Togo Tokelau Tonga Trinidad and Tobago Tunisia Turkey Turkmenistan Turks and Caicos Islands Tuvalu Uganda Ukraine United Arab Emirates United Kingdom Uruguay Uzbekistan Vanuatu Venezuela Viet Nam Virgin Islands (British) Virgin Islands (U.S.) Wallis and Futuna Islands Western Sahara Yemen Zambia Zimbabwe

- Zip/Postal Code * Please enter zip/postal code.

- City * Please enter city.

- Mobile Phone Number * Please enter telephone

- Select a state State

- [Yes] I would like to receive S&P Global Commodity Insights promotional emails.

- Clicking on the confirm button means that you acknowledge that you have read and agree to our Terms of Use and Privacy Policy , including transfer of your personal information outside of the jurisdiction in which you are located.

Maritime Directory

Global Yacht Fuel, Inc.

- 954-462-6050

- www.globalyachtfuel.com

- 954-462-7467

Ft. Lauderdale USA

Maritime news.

FBI Opens Criminal Probe Into Deadly Baltimore Bridge Collapse

Kalypso, Royal IHC Partner to Build US' First Jones Act Cable Layer for Offshore Wind

First US-built WTIV Charybdis Launched

Somali Pirates Release Ship after Ransom Paid

Cruise Industry Reports Record Passenger Volumes

- Charter & Brokerage

- Yacht Design & New Builds

- Tenders & Toys

- Superyacht Events Calendar

- Career & Training

- Departments

- Superyacht Crew Finances

- Sustainability

- Shipyards and Marinas

- Health & Wellbeing

- Polar Region

- Our Services

- Meet the Team

Yachts And Fuel – How Much Do They Really Consume?

.png)

Fuel is one of many annual running costs of a yacht. Not only does the yacht need fuel for cruising; the generators require it to keep the vessel running while at anchor and underway. As well as this, many of the water sports toys require it too.

Some yachts cross the Atlantic Ocean twice a year between the Mediterranean and Caribbean while others embark on world cruises. That equates to a lot of fuel.

So How Much Do They Really Consume?

According to the Yachting Pages, the longest Superyacht in the world, 180m M/Y Azzam, holds 1,000,000 litres of fuel. To put it into perspective, that is the equivalent of filling a regular hatchback car 23,800 times. Or, six Boeing 747 commercial airliners.

West Nautical’s Vessel Manager, Tony Hildrew, a former Yacht Chief Engineer said:

“Fuel is the single biggest expense when it comes to yacht operations, it is estimated that the global spend on fuel is around $150bn annually however this shouldn’t put you off, there are a number of ways to ensure your fuel consumption doesn’t get out of hand. Implementing a Ships Energy Efficiency Management Plan or SEEMP for short is a great way to keep fuel costs down without compromising on your cruising experience.”

Each yacht will consume fuel differently for a number of reasons. It could be the size and make of the engines. Or, how often the yacht is using generators. As well as the number of tenders and water sports toys on board that require fuel. For example, if the yacht is out at anchor and running on generators 90% of the time, the fuel consumption will be much higher than a yacht that is in a marina at night and connected to shore power and water.

Another factor that will affect fuel consumption is the yacht’s itinerary. This is because the sea conditions will impact how much fuel the engines consume.

How Is Consumption Measured?

You will be able to input the start and ending points of your cruise on the map. This will automatically update the distance table. The next step is to enter the speed, fuel consumption and cost of fuel per litre to determine the cost of the trip.

Here is an example: A fast 30m yacht cruising at 20 knots will consume roughly 400 – 500 litres depending on the engine type. This would equate to the total consumption of 2500 litres for a distance of 100 nautical miles.

Another example is, a 70m yacht looking to travel 100 nautical miles with the engines burning 1000 litres per hour would add up to a total consumption of 8335L for that passage. Depending on where the yacht bunkered, the estimated cost with the price per litre being on the low end at €0.90 per litre would cost a total of €7501.50. An example of a 100 nautical mile passage would take you from Saint Tropez to The North Coast of Corsica.

How Much Does It Cost?

Fuel prices fluctuate depending on which country you bunker in and some places you bunker offer tax free fuel such a Gibraltar and Montenegro. Fuel prices can vary but typically costs between €0.80 and €1.30 per litre.

Yacht charter, sales and management company West Nautical added:

“Fuel costs should be at the top of any yacht owner and captain’s minds for two reasons: to minimise costs as well as reduce the environmental impact of burning unnecessary fuel. The superyacht charter market, more than most other markets, relies on pristine waters for their guests to enjoy their holiday. If the oceans in popular charter destinations are not maintained, it will decrease the demand for yacht charter and therefore the revenue for owners.” “If you are looking for expertise in operational management and engineering in order to plan a SEEMP, West Nautical would be delighted to assist.”

About West Nautical

West Nautical sell, charter and manage superyachts from their head office in Newcastle upon Tyne. The business currently employs a team of 21 staff throughout their offices based in the UK, Russia, France and Cyprus.

Since their inception over 25 years ago, West Nautical have become recognised as one of the most respected, trusted, knowledgeable and accountable professional services firms in yachting – largely due to their relentless determination to act in our clients’ best interests. Their approach and attitude is transparent, refreshing and focused on providing value-added services delivered simply, elegantly and affordably.

Visit West Nautical’s website here: https://westnautical.com

For Media enquiries please contact sarah.mackenzie@westnautical.com

To keep up to date with the latest Superyacht Content News, click here .

Sign up to our Newsletter below:

Newsletter Signup

- Your Name First Last

- Your Email *

West Nautical

Related articles, the crew network – top jobs this week, refreshing springtime cocktails for superyachts, navigating nutrition: healthy eating for the high seas, tender of the week: h10 superyacht tender.

Popular articles

Superyacht Content

Social media influencer and digital brand expert.

Superyacht Content brings you the latest in social news for the superyacht industry.

Keep up to date with us across our social channels, and don’t forget to hit that share button!

- Superyacht News

- Superyacht Jobs

- Superyacht Marketing

Join our Newsletter

Copyright © 2023 Superyacht Content | Website Design by Zonkey

Privacy | Credits | Get in Touch

- Transportation & Logistics ›

Water Transport

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

- Global fuel consumption by ships by fuel type 2019-2020

Annual fuel consumption by ships worldwide from 2019 to 2020, by fuel type (in million metric tons)

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

September 2021

Includes only ships of 5,000 GT and above.

Other statistics on the topic Green maritime shipping

- Main countries based on dwt of their merchant fleet 2022

Size of the global LNG fleet by status 2010-2027

LNG bunkering availability in ports worldwide by region 2022

- Global energy consumption by shipping 2019-2070, by fuel type

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Statistics on " Green maritime shipping worldwide "

- Transport volume of worldwide maritime trade 1990-2021

- Number of merchant ships by type 2022

- Limits on fuel sulfur content for the shipping industry by area 2020

- Areas in the maritime industry that will become more important 2021-2023

- Breakdown of CO₂ emissions in the transportation sector worldwide 2022, by sub sector

- Breakdown of GHG emissions in the shipping sector worldwide 2018, by emission type

- International shipping CO2 emissions outlook worldwide 2019-2070

- Estimated share of maritime CO₂ emissions 2021, by flag country

- CO₂ emissions in international shipping 2020, by ship type

- Ranking of ports by scrubber washwater discharged by ships 2020

- Location of global scrubber washwater discharges by distance from the shore 2020

- Global scrubber washwater discharges by ship type 2020

- Expected investments in ship upgrades due to emission regulations 2021

- Fuel demand expectations in the shipping industry 2022, by fuel type

- Annual costs of using different types of alternative fuels in container shipping 2030

- Number of vessels fitted with scrubbing systems worldwide 2007-2020

- Vessels fitted with scrubbing systems globally 2019-2021

- Vessels fitted with scrubbing systems worldwide by type 2020

- Monthly penetration rate of scrubbers in the global fleet by vessel type 2019-2020

- Vessels fitted with ballast water treatment systems worldwide by type 2019

- Moeller-Maersk's energy consumption by source 2017-2022

- Moeller-Maersk's GHG emissions 2017-2022, by scope

- COSCO SHIPPING Lines' fuel oil consumption 2017-2021

- COSCO Shipping Ports Group's GHG emissions by scope 2017-2020

- COSCO SHIPPING Lines GHG emissions 2018-2022

- CMA CGM Group's fuel consumption 2017-2021

- CMA CGM Group's maritime GHG emissions 2017-2022

- Hapag-Lloyd's GHG emissions 2017-2022

Other statistics that may interest you Green maritime shipping worldwide

- Premium Statistic Transport volume of worldwide maritime trade 1990-2021

- Premium Statistic Main countries based on dwt of their merchant fleet 2022

- Premium Statistic Number of merchant ships by type 2022

- Premium Statistic Global energy consumption by shipping 2019-2070, by fuel type

- Premium Statistic Global fuel consumption by ships by fuel type 2019-2020

- Basic Statistic Limits on fuel sulfur content for the shipping industry by area 2020

- Premium Statistic Areas in the maritime industry that will become more important 2021-2023

- Basic Statistic Breakdown of CO₂ emissions in the transportation sector worldwide 2022, by sub sector

- Premium Statistic Breakdown of GHG emissions in the shipping sector worldwide 2018, by emission type

- Basic Statistic International shipping CO2 emissions outlook worldwide 2019-2070

- Premium Statistic Estimated share of maritime CO₂ emissions 2021, by flag country

- Premium Statistic CO₂ emissions in international shipping 2020, by ship type

- Premium Statistic Ranking of ports by scrubber washwater discharged by ships 2020

- Premium Statistic Location of global scrubber washwater discharges by distance from the shore 2020

- Premium Statistic Global scrubber washwater discharges by ship type 2020

- Premium Statistic Expected investments in ship upgrades due to emission regulations 2021

- Premium Statistic Fuel demand expectations in the shipping industry 2022, by fuel type

- Premium Statistic Annual costs of using different types of alternative fuels in container shipping 2030

- Premium Statistic Number of vessels fitted with scrubbing systems worldwide 2007-2020

- Premium Statistic Vessels fitted with scrubbing systems globally 2019-2021

- Premium Statistic Vessels fitted with scrubbing systems worldwide by type 2020

- Premium Statistic Monthly penetration rate of scrubbers in the global fleet by vessel type 2019-2020

- Premium Statistic Vessels fitted with ballast water treatment systems worldwide by type 2019

- Premium Statistic Moeller-Maersk's energy consumption by source 2017-2022

- Premium Statistic Moeller-Maersk's GHG emissions 2017-2022, by scope

- Premium Statistic COSCO SHIPPING Lines' fuel oil consumption 2017-2021

- Premium Statistic COSCO Shipping Ports Group's GHG emissions by scope 2017-2020

- Premium Statistic COSCO SHIPPING Lines GHG emissions 2018-2022

- Premium Statistic CMA CGM Group's fuel consumption 2017-2021

- Premium Statistic CMA CGM Group's maritime GHG emissions 2017-2022

- Premium Statistic Hapag-Lloyd's GHG emissions 2017-2022

Further related statistics

- Premium Statistic Marine bunkers product demand by fuel type 2018-2024

- Premium Statistic Volume of cargo handled at the port of Aalborg 2019, by type of goods

- Premium Statistic Volume of loaded cargo handled at the port of Esbjerg 2019, by country

- Premium Statistic Volume of unloaded cargo handled at the port of Copenhagen 2019, by country

- Premium Statistic Volume of loaded cargo handled at the port of Aarhus 2019, by country

- Premium Statistic Volume of unloaded cargo handled at the port of Esbjerg 2019, by country

- Premium Statistic Volume of loaded cargo handled at the port of Fredericia 2019, by country

- Premium Statistic Volume of unloaded cargo handled at the port of Fredericia 2019, by country

- Premium Statistic Volume of cargo handled at the port of Copenhagen 2009-2019

- Premium Statistic Volume of cargo handled at the port of Copenhagen 2019, by type of goods

- Premium Statistic Volume of unloaded cargo handled at the port of Aalborg 2019, by country

- Premium Statistic Number of water transport employees in China 2020, by region

- Premium Statistic Volume of cargo handled at the port of Esbjerg 2019, by type of goods

- Premium Statistic Volume of unloaded cargo handled at the port of Aarhus 2019, by country

- Premium Statistic Volume of cargo handled at the port of Fredericia 2019, by type of goods

- Premium Statistic Impinj Inc. - revenue 2017 & 2018

- Basic Statistic WPP: operating profit from 2011-2022

- Premium Statistic Scania's operating income 2010-2021

Further Content: You might find this interesting as well

- Marine bunkers product demand by fuel type 2018-2024

- Volume of cargo handled at the port of Aalborg 2019, by type of goods

- Volume of loaded cargo handled at the port of Esbjerg 2019, by country

- Volume of unloaded cargo handled at the port of Copenhagen 2019, by country

- Volume of loaded cargo handled at the port of Aarhus 2019, by country

- Volume of unloaded cargo handled at the port of Esbjerg 2019, by country

- Volume of loaded cargo handled at the port of Fredericia 2019, by country

- Volume of unloaded cargo handled at the port of Fredericia 2019, by country

- Volume of cargo handled at the port of Copenhagen 2009-2019

- Volume of cargo handled at the port of Copenhagen 2019, by type of goods

- Volume of unloaded cargo handled at the port of Aalborg 2019, by country

- Number of water transport employees in China 2020, by region

- Volume of cargo handled at the port of Esbjerg 2019, by type of goods

- Volume of unloaded cargo handled at the port of Aarhus 2019, by country

- Volume of cargo handled at the port of Fredericia 2019, by type of goods

- Impinj Inc. - revenue 2017 & 2018

- WPP: operating profit from 2011-2022

- Scania's operating income 2010-2021

Peninsula is the leading provider of marine energy services and solutions globally. For the last 25 years, we have positioned ourselves as the benchmark for quality in our industry. We offer local knowledge on a global scale.

Peninsula Values

YACHT SERVICES

PENINSULA FOUNDATION

SPONSORSHIP

Our future is energy.

We operate as a physical distributor as well as a reseller of global marine fuel (bunker). With an international network of offices and operations in the world’s busiest ports, we guarantee high quality products and first-class customer care at all times.

Our highly skilled team is available 24 hours a day, seven days a week, 365 days a year. We provide professional, cost-effective ways of meeting marine fuel needs, swiftly and efficiently – anywhere in the world. Working with a variety of verticals across the marine spectrum, we understand and adapt to the subtle differences that each individual sector requires and provide a bespoke service suited to each customer.

Yacht Services

In recognition of the fact that yachts require a bespoke, flexible and above all reliable service, we set up the Peninsula Yacht Services team over 10 years ago. Based out of Monaco, Gibraltar, London and Fort Lauderdale, our dedicated yacht team are here to make sure you have everything you need, when you need it.

Service is everything

We understand that in yachting you need suppliers that you can rely on. You need to be able to trust that we can react quickly, provide clear concise information and do everything possible to ensure a smooth, painless transaction. The Peninsula brand is formed from three strategic pillars: customer centricity, sustainability and technology. They remain at the core of everything we do and are what drive us to be the best in every sector. Our yacht team is available 24/7 and 365 days of the year, constantly working to get the best service for you.

Peninsula Foundation

The Peninsula Foundation forms a part of vision to become a truly sustainable energy provider.

As a global player we have a responsibility to help preserve the planet and help those less fortunate. The foundation supports several local and international charities that have a link to the marine industry.

More details on the Peninsula foundation can be found here on our corporate website.

Sponsorship

Gonet geneva atp 250 open.

As the leading global independent bunker suppler with deep roots in Geneva, there is an appropriate synergy between the city, the tournament and Peninsula. Peninsula’s values are synonymous with Geneva and the Gonet Geneva Open.

As a hub for the marine industry, Geneva is a natural place to engage with customers and stakeholders. Switzerland itself is considered to be one of the greenest and most sustainable countries in the world, something which Peninsula is delivering within its own industry. Its updated business strategy focusses heavily on creating a more sustainable future for the marine fuel industry. As an early adopter of LNG and having already completed a number of LNG deals, one of which record breaking at the time, Peninsula is well on its way to leading this transition.

Classified as an ATP 250 tournament since 2015, under the umbrella of Geneva Trophy Promotion Sàrl, the Geneva Open is played in the unique setting of the Tennis Club of the Parc des Eaux-Vives in Geneva, offering a unique environment and conditions that make it one of the most popular tournaments among players on the European circuit. Its usual place in the calendar, the week before the Roland-Garros Grand Slam Tournament, ensures it attracts special attention from the tennis community. Recognised champions include two-time winner Stan Wawrinka (2016 and 2017) and Alexander Zverev, 2019 winner.

Peninsula RC44 International Sailing Team

The John A. Bassadone owned and skippered Peninsula Sailing Team joined the RC44 Championship Tour for the first time at the 2010 RC44 World Championships in Puerto Calero, Lanzarote. Since then the team has competed at the highest level across the globe.

Sailing is the purest form of marine energy and our passion for the ocean is limitless. Just like the company it represents, Peninsula’s sailing team is experienced and ambitious.

As RC44 World Championship winners in 2012 and Cascais Cup winners in 2014, we will continue to support and compete in this extraordinary championship.

Get in touch today

Whatever your enquiry is about, our team are happy to help.

- Quality Control

- Sustainability

- News & Events

© 2024 Peninsula Yacht Services. Terms of Use Privacy Policy Cookie Policy

Website design by Piranha Designs

GLOBAL YACHT FUEL, LLC NORFOLK, VA

Global yacht fuel, llc, norfolk, key facts about global yacht fuel, llc.

- US Businesses

- Companies in Florida

- Leon County Companies

GLOBAL YACHT FUEL, LLC NEAR ME

Officers and Directors

Matthew hpres lipkin, matthew hpres lipkin related companies, registered agent is corporate access, inc., annual reports.

- Bioenergy Technologies Office

- Accomplishments

- National Biotechnology & Biomanufacturing Initiative

- Bold Goals for U.S. Biotechnology & Biomanufacturing

- 2023 Multi-Year Program Plan

- Bioproduct Production

- CO2 Utilization

- Deconstruction & Fractionation

- Synthesis & Upgrading

- Conversion Technologies Related Links

- Sustainability

- Data, Modeling, & Analysis Related Links

- Feedstock-Conversion Interface R&D

- Feedstock Technologies Related Links

- Algal Logistics

- Algal Production

- Algal Related Links

- Development

- Infrastructure

- Systems Development & Integration Related Links

- Sustainable Aviation Fuels

- Sustainable Marine Fuels

- Waste-to-Energy

- CO2 Reduction & Upgrading for e-Fuels Consortium

- Consortium for Computational Physics & Chemistry

- Co-Optimization of Fuels & Engines

- Feedstock-Conversion Interface Consortium

- Bioenergy FAQs

- Biofuel Basics

- Biopower Basics

- Bioproduct Basics

- Biomass Feedstocks

- Career Exploration Wheel

- Career Grid

- Workforce Training Opportunities Map

- Algae Technology Educational Consortium

- Workforce Development Strategy

- Bioenergy Jobs at BETO

- BRIDGES Events

- BRIDGES Webinar Recordings and Presentations

- Internships & Fellowships

- Teacher & Classroom Resources

- BioenergizeME Infographic Challenge

- Wood Heater Design Challenge

- Funding Opportunities

- Analytical Tools

- Bioenergy Publications

- Bioenergy Related Links

- State Biomass Contacts

- BioProse: Bioenergy R&D Blog

- Bioenergy News

- Bioeconomy 2020

- Bioeconomy 2018

- Bioeconomy 2017

- Bioenergy 2016

- Bioenergy 2015

- Biomass 2014

- Biomass 2013

- Biomass 2012

- Biomass 2011

- Inaccessible

- Biomass 2009

- Peer Review 2023

- Peer Review 2021

- Peer Review 2019

- Peer Review 2017

- Peer Review 2015

- Peer Review 2013

- Peer Review 2011

- Past Meetings & Workshops

- Bioenergy Newsletter

The U.S. Department of Energy (DOE) Bioenergy Technologies Office (BETO) invests in research, development, and demonstration of low- and net-zero-carbon sustainable marine fuels to help decarbonize maritime transport.

International maritime transport accounts for approximately 3% of global greenhouse gas (GHG) emissions, this includes a wide variety of vessels, from small recreational boats to massive, ocean-going container ships. Although smaller marine vessels may be powered by batteries or hydrogen fuel cells, many larger vessels need energy-dense fuels to support global voyages.

With a far lower carbon footprint than petroleum-based fuels, sustainable marine fuels are critical for lowering GHG emissions, achieving environmental justice, and promoting energy security in the maritime sector.

The maritime sector accounts for 3% of global carbon dioxide emissions, primarily through the combustion of heavy fuel oil to power massive container ships. With a far lower carbon footprint than petroleum-based fuels, sustainable marine fuels are critical for decarbonizing the movement of goods across oceans. Photo courtesy of iStock.

Sustainable Marine Fuels Lower Greenhouse Gas Emissions

More than 90% of global goods are carried by cargo ships, and many of these ships are powered by heavy fuel oil (HFO), a residual fuel produced from petroleum refining which emits relatively large amounts of GHG when combusted. Sustainable marine fuels are a recognized pathway for lowering GHG emissions compared to HFO and other petroleum-based marine fuels.

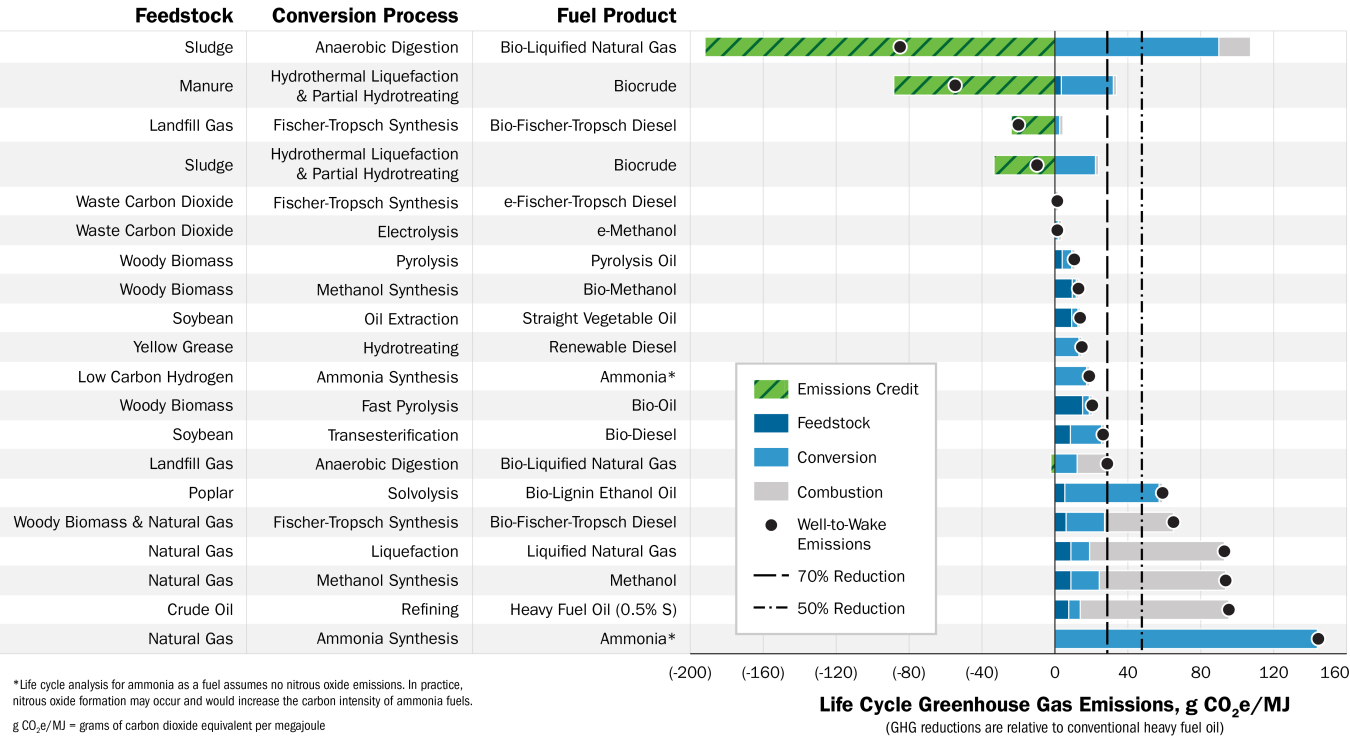

Many emerging sustainable marine fuels enable a greater than 70% reduction in well-to-wake greenhouse gas emissions, depending on the exact feedstock and conversion process. Data courtesy of Argonne National Laboratory.

Sustainable marine fuels are produced using a variety of materials, methods, and technologies that convert domestic fuel resources—called “feedstocks”—into energy-dense fuels with the correct properties and characteristics to be safely used in marine engines.

These feedstock types include:

- Forestry and agricultural wastes

- Non-food energy crops like switchgrass and miscanthus

- Waste oils, fats, and greases

- Manure, sewage sludge, and other wet wastes

- Landfill gas

- Algae biomass

- Municipal solid waste.

To maximize the emission advantage, BETO research focuses on near-term and emerging marine biofuels with the potential for negative or near-negative life cycle GHG emissions.

DOE national laboratories are actively developing drop-in biofuels that support deep reductions in GHG emissions compared to petroleum-based fuels. Figure courtesy of Werner Slocum, National Renewable Energy Laboratory.

Drop-In Fuels

Drop-in sustainable marine fuels can be used in existing infrastructure and marine engines without major modifications. As a result, marine vessels may begin using these fuels in as little as a few years to support immediate reductions in GHG emissions. Examples include:

- Renewable diesel

- Hydrotreated vegetable oil

Emerging Marine Fuels

The maritime industry is also pursuing emerging sustainable marine fuels with the potential for zero or near-zero GHG emissions, including:

- Bio-methanol

- Lignin-alcohol mixes

- Bio-based natural gas.

These emerging marine fuels offer flexibility and some performance advantages but may require new engine designs and other mechanical modifications. Some global shipping companies have already announced plans to use these fuels in the coming years.

A Pathway for Improving Air Quality in Port Communities

Sustainable marine fuels can improve air quality around the nation’s largest seaports, including the Port of Los Angeles pictured here. Photo courtesy of iStock.

HFO and other petroleum-based marine fuels often contain relatively high levels of sulfur, which is emitted as sulfur oxide during combustion. This, along with other toxic air pollutants created during combustion, contributes to poor air quality for the millions of people that live close to seaports.

Sustainable marine fuels are a reliable solution for improving air quality and supporting environmental justice in port communities without the need to add costly emissions controls to marine engines. Naturally low in sulfur, sustainable marine fuels produce lower levels of air pollutants, including:

- Sulfur oxide

- Nitrogen oxides

- Particle pollution.

As a result, the maritime industry is better equipped to meet increasingly stringent air quality regulations set by the International Maritime Organization.

Strategic Research Lowers the Risk of Adoption

According to BETO’s 2016 Billion Ton Report , the United States has enough feedstocks to sustainably produce millions of gallons of sustainable biofuels every year. Every year, the global maritime industry consumes an estimated 105 billion gallons of fuel, which is expected to double by 2030 as global trade expands. To increase production of sustainable marine fuels to meet this demand, the industry needs reliable analyses and data to:

- Understand regulatory requirements

- Scope biofuel performance

- Address challenges to large-scale commercialization.

BETO supports research designed to guide investments in demonstration and deployment of sustainable marine fuels. This includes a whole-system approach to ensure the maritime sector can reap the advantages of sustainable marine fuels without shouldering significant risks:

- Analyses to understand costs, emissions, and resource constraints, as well as social and environmental implications

- Combustion/engine testing to understand how sustainable marine fuels interact with current and future marine vessels

- Fuel property and consumption assessments to ensure new fuels meet quality standards

- Pilot-scale demonstrations of promising production technologies, such as hydrothermal liquefaction and pyrolysis, to lower the risk of commercial production at refineries across the country.

Learn more about BETO-supported biofuel process development units at Pacific Northwest National Laboratory and the National Renewable Energy Laboratory .

Partnerships

Supported by capabilities and expertise from DOE national laboratories, BETO works across DOE offices and other federal agencies for a strategic approach for building a robust and stable economy for production and use of sustainable marine fuels.

DOE is a member of Mission Innovation, an initiative of 22 countries and the European Commission to accelerate progress toward net zero GHG emissions. As a co-lead for the initiative’s Zero-Emissions Shipping Mission , DOE coordinates international efforts with other countries, private industry, research organizations, and communities to set international shipping on an ambitious zero-emission trajectory.

Related Sustainable Marine Fuels Resources

- Webinar: Current State of Sustainable Marine Fuels

- Bioenergy KDF Marine Biofuels

- Mission Innovation Shipping

- U.S. Department of Transportation Maritime Environmental and Technical Assistance Program

- News Archive

- Get Daily Email

- News & Features

- Bunker Prices

- Bunker Intelligence

- Latest News

ANALYSIS: Singapore Q1 Bunker Demand Hits Record High on Red Sea Diversions

- 15 Apr XPower Trading Hires Derivatives Trader From Monjasa Kenneth Rosenmeyer will join Xpower as of May 1, a company representative tells Ship & Bunker. Read in Full

- 15 Apr MAN Energy to Supply Methanol Dual-fuel Units to Bunker Tanker Newbuild Vessel will operate in Singapore under charter. Read in Full

- 15 Apr Adani Bunkering Completes Large Physical Supply Operation in India The firm recently supplied 3,000 mt of marine fuel to a container ship at Mundra, a company representative tells Ship & Bunker. Read in Full

- 15 Apr FBI Opens Criminal Investigation Into Baltimore Bridge Collapse The investigation is examining whether the crew left Baltimore with the knowledge that something could be wrong with the ship. Read in Full

- 15 Apr Plea for More Ammonia-related Emissions Data Ngos have called on engine manufacturers to deliver greater transparency on emissions from ammonia-fuelled engines. Read in Full

- 15 Apr Singapore to Develop Seafarer Training on Handling Alternative Marine Fuels Maritime Energy Training Facility involves range of partners to deliver training on new marine fuels. Read in Full

- 15 Apr Monjasa Athens Branch Manager Leaves Company The Athens branch manager of global marine fuel supplier and trading firm Monjasa has stepped down from his role at the company. Read in Full

- 15 Apr BUNKER PRICES: G20-VLSFO Index Advances for First Session in Four Ship & Bunker's G20-VLSFO Index gained $0.50/mt to $672/mt on Friday, reversing the previous day's loss of the same size. Read in Full

- 15 Apr Singapore-Rotterdam Green Corridor Plans Bio-LNG Bunkering Pilots in 2024-5 Partners to the initiative plan to carry out the operations in 2024 and 2025. Read in Full

- 15 Apr BUNKER JOBS: CMA CGM Seeks Bunker Control Expert in Marseilles The company is looking for candidates with a postgraduate degree in the maritime operational sector or experience as a superintendent with knowledge of marine fuel specifications. Read in Full

Bunker Demand

Bunker Demand at Key Global Hubs up 1.8% in 2023

Rise follows a rise in demand during Q4 of 2023, according to the latest market survey from Ship & Bunker and consultancy 2050 Marine Energy.

Read in Full

FEATURED: Which Shipping Fuels are Fit For 55?

The impact of fuel choices on allowance exposure under the EU Emissions Trading System and penalties under FuelEU Maritime requires careful consideration.

Insights & Analysis More

Demand at the 17 hubs overall at 138.1 million mt in 2023, up by 1.8% on the year and the most since 2021.

Click to Read in Full

Baltimore Bridge Collapse

Red Sea Attacks

Top Stories More

Decarbonisation and Alternative Marine Fuels & Power More

Tricks of the Bunker Trade

Tricks of the Bunker Trade: Cappuccino Bunkers, an Illustrated Guide to Loss Prevention

Cappuccino bunkers remain one of the most common and widely used 'mal-practices' in the bunkering industry to-date.

Tricks of the Bunker Trade: Fuel Delivered with High Water Content

Water can originate from number of sources, but deliberate injection cannot be ruled out.

Tricks of the Bunker Trade: Double Losses for Operators from Undeclared Fuel

Sometimes the receiving vessel will be as much as involved as the supplier in dubious bunkering practices.

Latest Bunker Prices See All Bunker Prices

Also in the news more.

Plea for More Ammonia-related Emissions Data

Ngos have called on engine manufacturers to deliver greater transparency on emissions from ammonia-fuelled engines.

Singapore to Develop Seafarer Training on Handling Alternative Marine Fuels

Maritime Energy Training Facility involves range of partners to deliver training on new marine fuels.

3% of Maersk's Cargo Shipments Powered by Green Fuels in 2023

The company has set a target of 25% of its shipments using green fuels by 2030.

Top Bunker Prices All Prices

Bunker jobs.

Popular Now More

- Terms of Use

- Privacy Policy

- Americas News

- Asia/Pacific News

- Regional Bunker Prices

- Americas Bunker Prices

- EMEA Bunker Prices

- Asia/Pacific Bunker Prices

- Latest Bunker Prices

- LA / Long Beach Bunker Prices

- Houston Bunker Prices

- New York Bunker Prices

- Rio de Janeiro Bunker Prices

- Rotterdam Bunker Prices

- Fujariah Bunker Prices

- Singapore Bunker Prices

- Hong Kong Bunker Prices

- RSS & Twitter

Please use a modern browser to view this website. Some elements might not work as expected when using Internet Explorer.

- Landing Page

- Luxury Yacht Vacation Types

- Corporate Yacht Charter

- Tailor Made Vacations

- Luxury Exploration Vacations

- View All 3594

- Motor Yachts

- Sailing Yachts

- Classic Yachts

- Catamaran Yachts

- Filter By Destination

- More Filters

- Latest Reviews

- Charter Special Offers

- Destination Guides

- Inspiration & Features

- Mediterranean Charter Yachts

- France Charter Yachts

- Italy Charter Yachts

- Croatia Charter Yachts

- Greece Charter Yachts

- Turkey Charter Yachts

- Bahamas Charter Yachts

- Caribbean Charter Yachts

- Australia Charter Yachts

- Thailand Charter Yachts

- Dubai Charter Yachts

- Destination News

- New To Fleet

- Charter Fleet Updates

- Special Offers

- Industry News

- Yacht Shows

- Corporate Charter

- Finding a Yacht Broker

- Charter Preferences

- Questions & Answers

- Add my yacht

- Yacht Charter Fleet

Project COSMOS: First superyacht with fuel cell technology launched by Lürssen

- Share this on Facebook

- Share this on X

- Share via Email

By Steph Loseby 9 March 2023

The first yacht to feature fuel cell technology onboard, the 114m (374ft) superyacht Project Cosmos , previously known as Project 13759, has been technically launched from Lürssen’s facility in Rendsburg, Germany. The technology will allow the motor yacht to operate with minimal environmental impact and will reduce its carbon footprint significantly.

At the forefront of innovation, Lürssen has been involved in research projects aimed at using fuel cells on ships since 2009, and since 2012, the development of a modular fuel cell system using methanol has been underway.

The impressive 114m vessel Project COSMOS has not only been designed to become one of the most luxurious yachts in the world, but it is the first to feature this groundbreaking fuel cell technology onboard.

Video footage by @redcharlie1 for @luerssenyachts

This is a milestone in the yachting industry David Seal

At a Lürssen Live show last year, Peter Lürssen explained: "Fuel cells have very little maintenance and are more efficient than a diesel engine, which is already a very efficient way to produce power." He also mentioned that the fuel cell will allow the owner more than 15 nights emission-free at anchor, or the owner will be able to slow cruise his superyacht for more than 1000 miles emission-free.

How does fuel cell technology work?

Describing the science behind the innovation, Peter Lürssen explained "The core element is a cell which consists of two bipolar plates and one membrane electrode-assembly, in between you build these cells, hundreds of cells are stacked to form a fuel cell stack. Several fuel cell stacks, the FC balance of the plant (compressor, DC/DC, etc.) and the fuel reforming unit, will be combined to a highly integrated fuel cell system. The fuel cell systems, which already meet the specific maritime rules, will be connected with the methanol supply system, the ventilation and electrical infrastructure. Then the magic can start, out comes electrical power and warm, moist air” as by-product."

Superyacht Project COSMOS

Much of the 6,3000 GT yacht’s details have been shrouded in secrecy, including her exterior and interior designers, however, images reveal the vessel appears to have a bold explorer -style profile with the superstructure placed forward to create a large aft deck complete with a swimming pool and a large cut-out, which we can expect to host a large tender.

Crowning her four decks, there appears to be an observation lounge and a helipad on the bridge deck below in true explorer style.

Project COSMOS has been confirmed as the 5th largest project underway for the German shipyard, with seven additional vessels over 100 meters currently in build at Lürssen, including the 125m (410ft) Project Jag that is due for delivery sometime this year and the 116m (380ft) Project Alibaba, due for delivery in 2024.

It is expected that Project COSMOS will be delivered in 2025.

It is not yet known whether the vessel will become a luxury yacht for charter . If you'd like to charter a yacht of a similar caliber, you can view and compare all Lürssen superyachts for charter or get in touch with a recommended yacht charter broker for more information about making a booking.

Largest Lurssen yachts available for charter

126m Lurssen 2003 / 2021

115m Lurssen 2021

95m Lurssen 2014

90m Lurssen 2010 / 2024

85m Lurssen 2013 / 2022

73m Lurssen 1994 / 2022

- READ MORE ABOUT:

- Technical launch

- Lurssen yacht

- Project Cosmos

- Lurssen yacht launch

- fuel cell technology yacht

RELATED STORIES

Previous Post

ENTOURAGE makes a splash onto the luxury charter fleet

Yacht HOSPITALITY announces special offer for Bahamas yacht charters

EDITOR'S PICK

Latest News

12 April 2024

11 April 2024

10 April 2024

- See All News

Yacht Reviews

- See All Reviews

Charter Yacht of the week

Join our newsletter

Useful yacht charter news, latest yachts and expert advice, sent out every fortnight.

Please enter a valid e-mail

Thanks for subscribing

Featured Luxury Yachts for Charter

This is a small selection of the global luxury yacht charter fleet, with 3594 motor yachts, sail yachts, explorer yachts and catamarans to choose from including superyachts and megayachts, the world is your oyster. Why search for your ideal yacht charter vacation anywhere else?

446ft | Lurssen

from $4,268,000 p/week ♦︎

378ft | Lurssen

from $2,770,000 p/week ♦︎

279ft | Golden Yachts

from $959,000 p/week ♦︎

289ft | Golden Yachts

from $1,172,000 p/week ♦︎

274ft | Feadship

from $1,067,000 p/week ♦︎

305ft | Feadship

from $1,492,000 p/week ♦︎

Maltese Falcon

289ft | Perini Navi

from $490,000 p/week

400ft | Lurssen

from $3,000,000 p/week

As Featured In

The YachtCharterFleet Difference

YachtCharterFleet makes it easy to find the yacht charter vacation that is right for you. We combine thousands of yacht listings with local destination information, sample itineraries and experiences to deliver the world's most comprehensive yacht charter website.

San Francisco

- Like us on Facebook

- Follow us on Twitter

- Follow us on Instagram

- Find us on LinkedIn

- Add My Yacht

- Affiliates & Partners

Popular Destinations & Events

- St Tropez Yacht Charter

- Monaco Yacht Charter

- St Barts Yacht Charter

- Greece Yacht Charter

- Mykonos Yacht Charter

- Caribbean Yacht Charter

Featured Charter Yachts

- Maltese Falcon Yacht Charter

- Wheels Yacht Charter

- Victorious Yacht Charter

- Andrea Yacht Charter

- Titania Yacht Charter

- Ahpo Yacht Charter

Receive our latest offers, trends and stories direct to your inbox.

Please enter a valid e-mail.

Thanks for subscribing.

Search for Yachts, Destinations, Events, News... everything related to Luxury Yachts for Charter.

Yachts in your shortlist

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

JavaScript appears to be disabled on this computer. Please click here to see any active alerts .

Global Greenhouse Gas Overview

On This Page:

Global Emissions and Removals by Gas

Global emissions by economic sector, trends in global emissions, emissions by country.

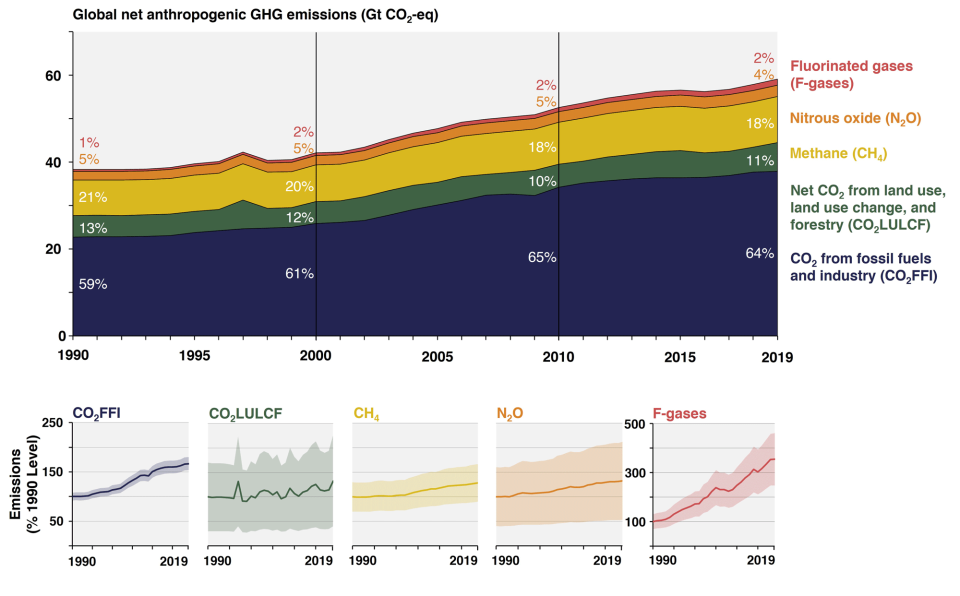

At the global scale, the key greenhouse gases emitted by human activities are:

- Carbon dioxide (CO 2 ) : Fossil fuel use is the primary source of CO 2 . CO 2 can also be emitted from the landscape through deforestation, land clearance for agriculture or development, and degradation of soils. Likewise, land management can also remove additional CO 2 from the atmosphere through reforestation, improvement of soil health, and other activities.

- Methane (CH 4 ) : Agricultural activities, waste management, energy production and use, and biomass burning all contribute to CH 4 emissions.

- Nitrous oxide (N 2 O) : Agricultural activities, such as fertilizer use, are the primary source of N 2 O emissions. Chemical production and fossil fuel combustion also generates N 2 O.

- Fluorinated gases (F-gases) : Industrial processes, refrigeration, and the use of a variety of consumer products contribute to emissions of F-gases, which include hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and sulfur hexafluoride (SF 6 ).

Additional compounds in the atmosphere including solid and liquid aerosol and other greenhouse gases, such as water vapor and ground-level ozone can also impact the climate. Learn more about these compounds and climate change on our Basics of Climate Change page .

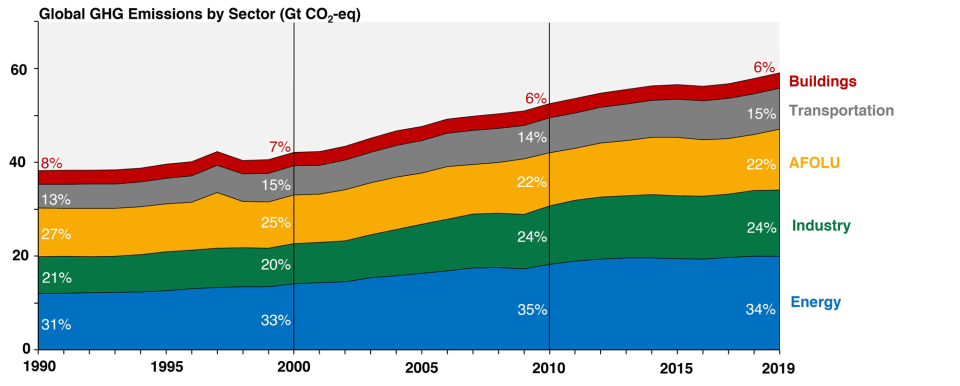

Global greenhouse gas emissions can also be broken down by the economic activities that lead to their atmospheric release. [1]

- Electricity and Heat Production (34% of 2019 global greenhouse gas emissions): The burning of coal, natural gas, and oil for electricity and heat is the largest single source of global greenhouse gas emissions.

- Industry (24% of 2019 global greenhouse gas emissions): Greenhouse gas emissions from industry primarily involve fossil fuels burned on site at facilities for energy. This sector also includes emissions from chemical, metallurgical, and mineral transformation processes not associated with energy consumption and emissions from waste management activities. (Note: Emissions from industrial electricity use are excluded and are instead covered in the Electricity and Heat Production sector.)

- Agriculture, Forestry, and Other Land Use (22% of 2019 global greenhouse gas emissions): Greenhouse gas emissions from this sector come mostly from agriculture (cultivation of crops and livestock) and deforestation. This estimate does not include the CO 2 that ecosystems remove from the atmosphere by sequestering carbon (e.g. in biomass, soils). [2]

- Transportation (15% of 2019 global greenhouse gas emissions): Greenhouse gas emissions from this sector primarily involve fossil fuels burned for road, rail, air, and marine transportation. Almost all (95%) of the world's transportation energy comes from petroleum-based fuels, largely gasoline and diesel. [3]

- Buildings (6% of 2019 global greenhouse gas emissions): Greenhouse gas emissions from this sector arise from onsite energy generation and burning fuels for heat in buildings or cooking in homes. Note: Emissions from this sector are 16% when electricity use in buildings is included in this sector instead of the Energy sector.

Note on emissions sector categories.

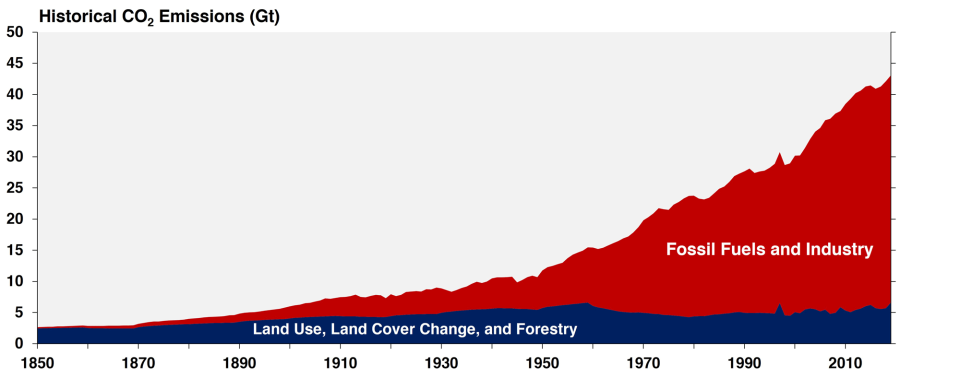

Emissions of non-CO 2 greenhouse gases (CH 4 , N 2 O, and F-gases) have also increased significantly since 1850.

- Globally, greenhouse gas emissions continued to rise across all sectors and subsectors, most rapidly in the transport and industry sectors.

- While the trend in emissions continues to rise, annual greenhouse gas growth by sector slowed in 2010 to 2019, compared to 2000 to 2009, for energy and industry, however remained roughly stable for transport.

- The trend for for AFOLU remains more uncertain, due to the multitude of drivers that affect emissions and removals for land use, land-use change and forestry.

- rising demand for construction materials and manufactured products,

- increasing floor space per capita,

- increasing building energy use,

- travel distances, and vehicle size and weight.

To learn more about past and projected global emissions of non-CO 2 gases, please see the EPA report, Global Non-CO 2 Greenhouse Gas Emission Projections & Mitigation Potential: 2015-2050 . For further insights into mitigation strategies specifically within the U.S. forestry and agriculture sectors, refer to the latest Climate Economic Analysis report on Greenhouse Gas Mitigation Potential in U.S. Forestry and Agriculture .

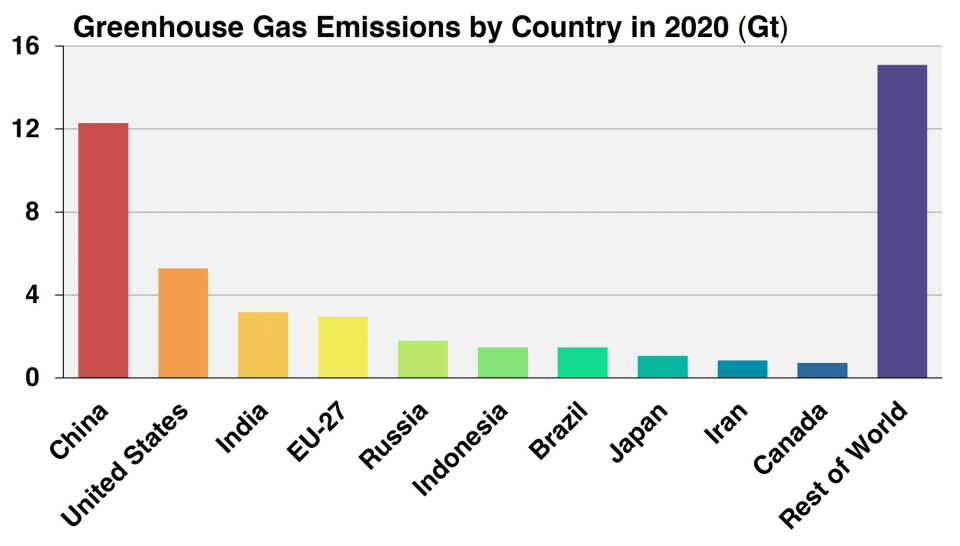

In 2020, the top ten greenhouse gas emitters were China, the United States, India, the European Union, Russia, Indonesia, Brazil, Japan, Iran, and Canada. These data include CO 2 , CH 4 , N 2 O, and fluorinated gas emissions from energy, agriculture, forestry and land use change, industry, and waste. Together, these top ten countries represent approximately 67% of total greenhouse gas emissions in 2020.

Emissions and sinks related to changes in land use are not included in these estimates. However, changes in land use can be important: estimates indicate that net global greenhouse gas emissions from agriculture, forestry, and other land use were approximately 12 billion metric tons of CO 2 equivalent, [2] or about 21% of total global greenhouse gas emissions. [3] In areas such as the United States and Europe, changes in land use associated with human activities have the net effect of absorbing CO 2 , partially offsetting the emissions from deforestation in other regions.

EPA resources

- Greenhouse Gas Emissions

- Sources of Greenhouse Gas Emissions (in the United States)

- Non-CO 2 Greenhouse Gases: Emissions and Trends

- Capacity Building for National GHG Inventories

Other resources

- UNFCCC GHG Data Interface

- European Commission Emission Database for Global Atmospheric Research

- World Development Indicators

- Climate Watch

- Carbon Dioxide and Information Analysis Center (CDIAC)

- Greenhouse Gas Emissions from Energy Data Explorer (IEA)

1. IPCC (2022), Emissions Trends and Drivers. In IPCC, 2022: Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge, UK and New York, NY, USA. doi: 10.1017/9781009157926.004

2. Jia, G., E. Shevliakova, P. Artaxo, N. De Noblet-Ducoudré, R. Houghton, J. House, K. Kitajima, C. Lennard, A. Popp, A. Sirin, R. Sukumar, L. Verchot, 2019: Land–climate interactions . In: Climate Change and Land: an IPCC special report on climate change, desertification, land degradation, sustainable land management, food security, and greenhouse gas fluxes in terrestrial ecosystems [P.R. Shukla, J. Skea, E. Calvo Buendia, V. Masson-Delmotte, H.-O. Pörtner, D.C. Roberts, P. Zhai, R. Slade, S. Connors, R. van Diemen, M. Ferrat, E. Haughey, S. Luz, S. Neogi, M. Pathak, J. Petzold, J. Portugal Pereira, P. Vyas, E. Huntley, K. Kissick, M, Belkacemi, J. Malley, (eds.)]. https://doi.org/10.1017/9781009157988.004

3. U.S. Energy Information Administration, Annual Energy Outlook 2021 , (February 2021), www.eia.gov/aeo

Note on emissions sector categories: