- Leisure Products

Yacht Market by Type, Application, and Geography - Forecast and Analysis 2023-2027

- Published: May 2023

- SKU: IRTNTR75339

Enjoy complimentary customisation on priority with our Enterprise License!

Yacht Market Analysis Report 2023-2027:

The yacht market size is estimated to grow at a CAGR of 6.71% between 2022 and 2027. The market size is forecast to increase by USD 3,388.26 million . The growth of the market depends on several factors, including the growing popularity of recreational tourism, an increasing HNWI population, and increasing eco-friendly yacht demand.

The yacht market report extensively covers market segmentation by type (motor and sailing), application (commercial and private), and geography (Europe, North America, APAC, South America, and Middle East and Africa). It also includes an in-depth analysis of drivers, trends, and challenges. Furthermore, the report includes historic market data from 2017 to 2021.

What will be the Size of the Yacht Market During the Forecast Period?

To learn more about this report , View Report Sample

Yacht Market: Key Drivers, Trends, Challenges, and Customer Landscape

The growing popularity of recreational tourism notably drives the market growth, although factors such as high maintenance and operating costs impede the market growth. Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Yacht Market Driver

The growing popularity of recreational tourism is a major driver influencing the growth of the yacht market during the forecast period. Yachting is often associated with leisure and luxury and demand for yachts will increase as disposable income increases and free time for leisure activities such as surfing, water skiing, diving, and swimming increases. Recreational activities have increased across the world as people seek ways to enjoy leisure time and maintain a healthy lifestyle. Hence, such factors drive market growth during the forecast period.

Significant Yacht Market Trends

Increased demand for superyachts is an emerging trend boosting the yacht market during the forecast period. The demand for superyachts, which are vessels over 80 feet in length has been steadily increasing. This is due to more buyers seeking larger and more luxurious yachts. The demand for luxury yachts is consistently high as wealthy individuals and families seek the ultimate luxury experience and exclusivity on the water. Supery yachts offer unparalleled comfort, style, and personalized service, which makes them popular for high-net-worth individuals, celebrities, and business executives. Superyacht demand in developed countries like the US and the UK tends to be relatively high. Hence, such trends boost market growth during the forecast period.

Major Challenge

High maintenance and operating costs are major challenges hindering market growth during the forecast period. Owning a yacht is expensive in terms of the purchase price, maintenance, and operating costs, which can make it difficult for some buyers to justify the expense of owning a yacht, especially in times of economic uncertainty. Hence, high maintenance and operating costs can significantly impact the sales of yachts. In addition to the initial purchase price, buyers of yachts must consider the ongoing expenses of fuel, maintenance, repairs, and insurance. Thus, the high maintenance and operating expenses cost can make yacht ownership unaffordable for many people, which can impact sales and hamper the growth of the global yacht market during the forecast period.

Key Yacht Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Yacht Market Customer Landscape

Who are the Major Yacht Market Vendors?

Vendors are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alexander Marine International Co Ltd. - The company offers yacht such as azimut grande tri deck, 37 legend ocean alexander, and 35 revolution ocean alexander.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market vendors, including:

- Alexander Marine International Co Ltd.

- Azimut Benetti SpA

- Cantieri Navali Codecasa Tre SpA

- Dalian Wanda Group

- Damen Shipyards Group

- Feadship Holland BV

- Fincantieri Spa

- Flensburger Schiffbau Gesellschaft mbH

- Fr. Lurssen Werft GmbH

- Heesen Yachts Sales BV

- Horizon Yacht USA

- KPS Capital Partners LP

- Oceanco SAM

- Overmarine Group Spa

- Palmer Johnson

- Palumbo Group Spa

- Sanlorenzo Spa

- THE ITALIAN SEA GROUP SpA

- Viking Yacht Co.

- Westport Yachts

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

What is the Fastest-Growing Segments in the Yacht Market?

The market share growth by the motor segment will be significant during the forecast period. In 2022, the motor yacht segment has a major share of the global yacht market. Motor yachts are typically faster and more powerful than sailing yachts, which allows quicker and more efficient travel over longer distances. They also offer more space and amenities like larger cabins, luxurious interiors, and modern entertainment systems. Motor yachts are also easier to maneuver, which makes them more suitable for navigating narrow waterways or docking in tight spaces. The high share of this segment is because of the advantages offered by motor yachts, such as high speed and performance, and long-range coverage.

Get a glance at the market contribution of various segments View the PDF Sample

The motor segment shows a gradual increase in the market share of USD 5,784.56 million in 2017 and continue to grow by 2021 . T hese yachts are highly preferred by people because of the advanced systems and equipment, such as connected devices on board. Modern equipment is a major factor in selling such yachts globally. The robust demand for motor yachts indicates a strong interest in purchasing or using motor yachts for various purposes, such as cruising, fishing, or leisure activities. Hence, such trends will boost the segment growth during the forecast period.

Which are the Key Regions for the Yacht Market?

For more insights on the market share of various regions Download PDF Sample now!

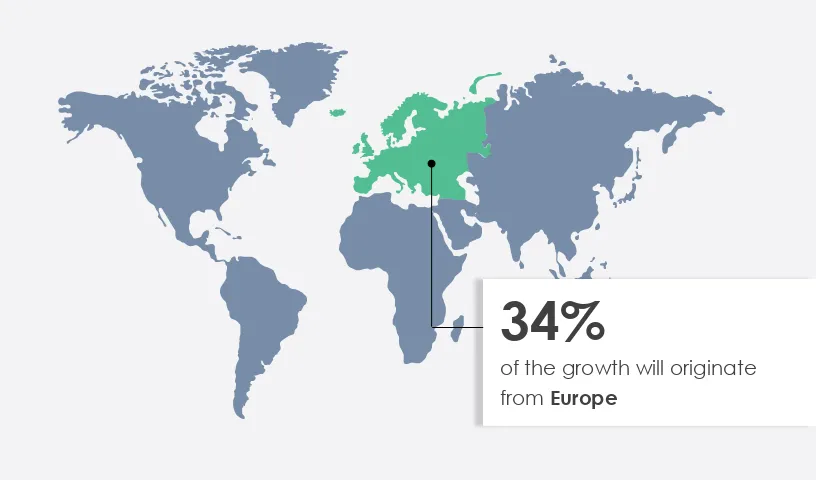

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In 2022, Europe had the highest market share of the global yacht market. The demand for yachts in Europe is driven by many factors, which include the region's vast coastline, a high concentration of wealthy individuals, and favorable weather conditions for boating activities. The demand is mostly driven by increased fishing and other water sports such as water skiing, diving, and swimming in European countries.

- Segment Overview

The yacht market report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2017 to 2027.

- Rest of Europe

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

Parent Market Analysis

Technavio categorizes the global yacht market as a part of the global leisure products market within the global household durables market. The parent global leisure products market covers various categories, including yachts, musical instruments, camping equipment, recreational vehicles, bicycles, toys, and other consumer-oriented games. Our market research report has extensively covered external factors influencing the parent market growth during the forecast period.

View PDF Sample

What are the Key Data Covered in this Yacht Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the market with a focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of market vendors

We can help! Our analysts can customize this market research report to meet your requirements.

Get in touch

Frequently Asked Questions?

How big is the yacht market , what is the yacht market growth, which segment accounted for the largest yacht market share , who are the key players in the yacht market , what are the factors driving the yacht market .

- Growing popularity of recreational tourism

- Increased demand for superyachts

[Avail subscription at 50% off, with report purchase]

One user only. Quick & easy download option

Enterprise:

Unlimited user access (Within your organization) Complimentary Customization Included

*For Enterprise license, go to checkout page

*Avail subscription at 50% off, with report purchase - limited to a week

[5 reports/month/user]

Basic Plan [5000 USD/Year]:

Single User Download 5 Reports/Month View 100 Reports/Month Add upto 3 Users at 625 USD/user

Teams Plan [7500 USD/Year]:

5 User Download 5 Reports/Month/User View 100 Reports/Month/User Add upto 30 Users at 500 USD/user

*You can upgrade to Teams plan at Subscription page

Subscribe & Save

Get lifetime access to our Technavio Insights

- Quick Report Overview:

- Market Size

- Table of Contents

- Market Scope

- Key Question Answered

- Technavio Subscriptions

Cookie Policy

The Site uses cookies to record users' preferences in relation to the functionality of accessibility. We, our Affiliates, and our Vendors may store and access cookies on a device, and process personal data including unique identifiers sent by a device, to personalise content, tailor, and report on advertising and to analyse our traffic. By clicking “I’m fine with this”, you are allowing the use of these cookies. Please refer to the help guide of your browser for further information on cookies, including how to disable them. Review our Privacy & Cookie Notice.

- Automotive and Transport /

Global Yacht Market (by Propulsion, Category, Type, Length, & Region): Insights and Forecast with Potential Impact of COVID-19 (2022-2026)

- September 2023

- Region: Global

- Koncept Analytics

- ID: 5879779

- Description

Table of Contents

Companies mentioned, related topics, related reports.

- Purchase Options

- Ask a Question

- Recently Viewed Products

This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A yacht is a maritime vessel that is only utilised for leisure or pleasure reasons, such as cruising, entertainment, water sports, fishing, or year-round lodgings. Yachts are normally large enough to accommodate sleeping rooms, a kitchen and a restroom on board for overnight voyages. They are also huge enough to require more than human effort (such as rowing) to move them forward.

Many experts in the luxury yacht building industry are concentrated in a few nations, notably Italy, Turkey, the Netherlands, the US, and Germany. The Italian producers enjoy a global reputation for quality and flair. Customers in this sector are highly rich individuals who can afford the high purchase price of a big yacht as well as the ongoing maintenance requirements. Some of the variables driving market growth include a rise in income inequality, increased disposable income, and a favourable macroeconomic outlook. The global yacht market is expected to reach US$12.36 billion in 2023, growing at a CAGR of 7.02% during the forecast period.

Segment Covered

- By Propulsion: The market report has segmented the global yacht market into three segments in terms of propulsion: Outboard & Inflatables, Inboard, and Sailing. The outboard & inflatables segment accounted for the maximum share in the global yacht market owing to benefits such as high speed, power, and large distance coverage, among others. The Inboard segment is further segmented into three categories: Composite, Made-to-measure, and Super. The global made-to-measure inboard yacht market is expected to experience significant growth during the forecasted period driven by the increasing awareness and acceptance of yachting culture in the Asia Pacific and a series of favorable policies supporting the yacht industry promulgated in major countries.

- By Type: According to report, the market has been segmented into five segments on the basis of type: Super Yacht, Sport Yacht, Flybridge Yacht, Long Range Yacht, and Others. The super yacht segment is holding the dominating share in the market. The growth of the market is driven by the increase in the number of potential end customers i.e., VHNWIs and UHNWIs.

- By Length: The report further provided the segmentation according to the length of the yacht: Below 20 meters, 20-50 meters, and Above 50 meters. The global above 50-meter yacht segment would grow at the highest CAGR during the forecasted year, owing to the increasing leisure trips and voyages taken by generation Z along with the growing preference to live a luxury life.

Geographic Coverage

According to this report, the global yacht market is divided into five regions: Europe, North America, Asia Pacific, Latin America, and Middle East & Africa. The countries covered in Europe region include Italy, Netherlands, Germany, UK, France, and Rest of Europe, while North America includes the US, Canada, and Mexico. Moreover, China, Japan, and the Rest of the Asia Pacific are included in the Asia Pacific region. Europe dominated the market with largest share of the global market as it is one of the main destinations for marine culture, especially Northern Europe, which has a very rich ecosystem for yacht charter. Countries like Italy, Ireland, Scotland, Denmark, Sweden, Germany and Russia offer a variety of options to choose from including crewed yachts, luxury yachts and motor yachts. Moreover, Asia Pacific is expected to provide lucrative opportunities to the overall market during the forecast period, due to the rising popularity of recreational activities and increased marine tourism in nations such as Thailand, Malaysia, Singapore, China, Japan, and Australia.

Top Impacting Factors

Growth drivers.

- Increase in the UHNWI (Ultra-high-net-worth individuals) Population

- Growing Demand for Luxury Tourism

- Rising Construction of Super Yachts

- Growing Number of Boat Shows

- High Investments and Upkeep Costs Associated with Yachts

- Cyclicality of the Yachting Industry

- Customization and Personalization

- Acute Focus on Eco-friendly and Sustainable Products

- The Internet Of Things

- Yachts Run Quieter due to Tech Advances

Driver: Increase in the UHNWI (Ultra-high-net-worth individuals) Population

The UHNWI populations, the main target customers of the yacht market, have increased in the past years and are expected to continue to increase in upcoming years. As the HNWI increases, the addressable customer base of the yacht industry also increases. This provides a strong tailwind for the manufacturers of yachts. In addition to a growing customer base of UHNWIs, the size of their wealth is also expected to grow in the coming years. This would translate into an increasing average size of yachts or customers shifting towards models with a higher degree of customization and premium features. In both cases, this should support growth in the average selling price of yachts. Therefore, the market would experience tremendous growth.

Challenge: Cyclicality of the Yachting Industry

One of the major hurdles the yachting industry is facing is that the yachting industry is cyclical. Buying a yacht is a discretionary expense that a household can easily decide to delay if the economic environment deteriorates. As such, yacht manufacturing is sensitive to changes in economic growth, employment levels, purchasing power, and consumer confidence. This was highlighted during the 2008-09 Global Financial Crisis, which had a significant toll on the recreational boating industry. Indeed, the deterioration of the economic environment at that time led to a 40-60% decline in the volume of boats sold. Therefore, the cyclical nature of the industry comes forward as a huge factor that can affect the sale of yachts in times of economic downturn.

Trend: Yachts Run Quieter due to Tech Advances

When boats and yachts run at cruising speed, the noise can be quite intense. The utilization of high-tech materials is changing this and making it possible for boaters to enjoy a much quieter experience. The Quiet Ride from Sea Ray is an excellent example of this type of technology in action. Innovations in electrical motors are also having a big impact on the ability of boats and yachts to run quietly. Battery power has also improved dramatically as well. This means that an increased number of boating enthusiasts can take advantage of a quieter experience by getting rid of combustion engines completely. This is expected to support the market growth in the coming years.

The COVID-19 Analysis

The COVID-19 pandemic has adversely affected the yacht market in the first half of 2020. However, COVID-19 has changed the way target customers live. People tend to start spending more on leisure activities. This has increased the sale of both motor yachts and sailing yachts in the year 2021. Moreover, as the number of billionaires grows and COVID-19 has added to incentives for avoiding crowds, the multi-billion-dollar global yacht industry is rebounding fast after near-paralysis at the onset of the pandemic. On the other hand, the pandemic has prompted digitalization initiatives in the market.

Analysis of Key Players

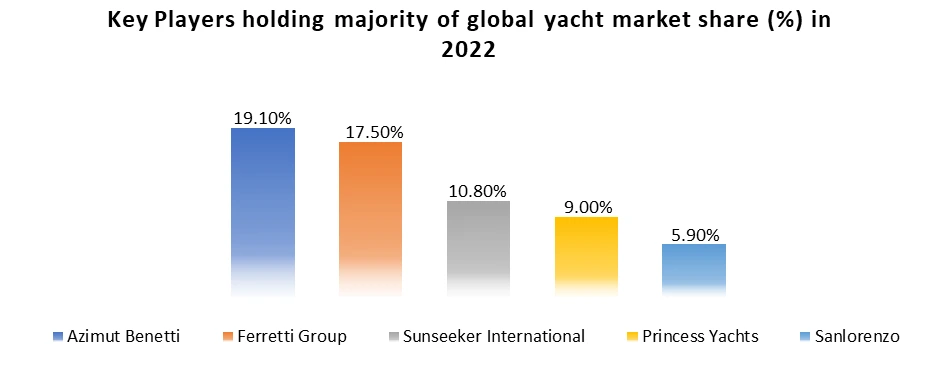

The global yacht market is moving toward consolidation. Following the 2008 financial crisis, some yacht companies went bankrupt (e.g. Aicon, Rodriguez, Royal Denship, etc.), others were rescued (e.g. Ferretti itself, Baglietto, Bavaria, Dalla Pietà, Perini) or decided to join forces together with other smaller shipyards and form a larger conglomerate (e.g., Tecnomar, Admiral, Cantieri Apuania combined as Italian Sea Group). The key players of the global yacht market are LVMH Moët Hennessy Louis Vuitton (Princess Yachts Ltd.), Sunseeker International Ltd., Ferretti Group, Lurssen Yachts, Sanlorenzo S.p.a, Azimut Yachts, HanseYachts AG, Westport LLC, Bilgin Yachts, Alexander Marine Co., Ltd. & Subsidiaries, The Italian Sea Group, Oceanco and Feadship Yachts.

Please note: 10% free customization equates to up to 3 hours of analyst time.

- Types of Yacht

- Yacht Segmentation

- Global Yacht Market by Value; 2017-2021 (US$ Billion)

- Global Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Yacht Market by Propulsion; 2021 (Percentage, %)

- Global Yacht Market by Type; 2021 (Percentage, %)

- Global Yacht Market by Length; 2021 (Percentage, %)

- Global Yacht Market by Region; 2021 (Percentage, %)

- Global Outboard & Inflatables Yacht Market by Value; 2017-2021 (US$ Billion)

- Global Outboard & Inflatables Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Inboard Yacht Market by Value; 2017-2021 (US$ Billion)

- Global Inboard Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Inboard Yacht Market by Category; 2021 (Percentage, %)

- Global Composite Inboard Yacht Market by Value; 2017-2021 (US$ Billion)

- Global Composite Inboard Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Made-to-Measure Inboard Yacht Market by Value; 2017-2021 (US$ Million)

- Global Made-to-Measure Inboard Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Super Inboard Yacht Market by Value; 2017-2021 (US$ Million)

- Global Super Inboard Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Inboard Yacht Market by Export; 2020 (US$ Million)

- Global Sailing Yacht Market by Value; 2017-2021 (US$ Billion)

- Global Sailing Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Super Yacht Market by Value; 2017-2021 (US$ Billion)

- Global Super Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Sport Yacht Market by Value; 2017-2021 (US$ Billion)

- Global Sport Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Flybridge Yacht Market by Value; 2017-2021 (US$ Billion)

- Global Flybridge Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Long Range Yacht Market by Value; 2017-2021 (US$ Billion)

- Global Long Range Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Others Yacht Market by Value; 2017-2021 (US$ Million)

- Global Others Yacht Market by Value; 2022-2026 (US$ Million)

- Global 20-50 Meter Yacht Market by Value; 2017-2021 (US$ Billion)

- Global 20-50 Meter Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Above 50 Meter Yacht Market by Value; 2017-2021 (US$ Billion)

- Global Above 50 Meter Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Below 20 Meter Yacht Market by Value; 2017-2021 (US$ Billion)

- Global Below 20 Meter Yacht Market by Value; 2022-2026 (US$ Billion)

- Global Super Yacht Operational Fleet 30m+ by Length and Hull Material by Total Operational Fleet; 2021

- Europe Yacht Market by Value; 2017-2021 (US$ Billion)

- Europe Yacht Market by Value; 2022-2026 (US$ Billion)

- Europe Yacht Market by Region; 2021 (Percentage, %)

- Italy Yacht Market by Value; 2017-2021 (US$ Billion)

- Italy Yacht Market by Value; 2022-2026 (US$ Billion)

- Netherlands Yacht Market by Value; 2017-2021 (US$ Million)

- Netherlands Yacht Market by Value; 2022-2026 (US$ Million)

- Germany Yacht Market by Value; 2017-2021 (US$ Million)

- Germany Yacht Market by Value; 2022-2026 (US$ Million)

- The UK Yacht Market by Value; 2017-2021 (US$ Million)

- The UK Yacht Market by Value; 2022-2026 (US$ Million)

- France Yacht Market by Value; 2017-2021 (US$ Million)

- France Yacht Market by Value; 2022-2026 (US$ Million)

- Rest of Europe Yacht Market by Value; 2017-2021 (US$ Million)

- Rest of Europe Yacht Market by Value; 2022-2026 (US$ Million)

- North America Yacht Market by Value; 2017-2021 (US$ Billion)

- North America Yacht Market by Value; 2022-2026 (US$ Billion)

- North America Yacht Market by Region; 2021 (Percentage, %)

- The US Yacht Market by Value; 2017-2021 (US$ Billion)

- The US Yacht Market by Value; 2022-2026 (US$ Billion)

- The US Yacht Market by Type; 2021 (Percentage, %)

- The US Super Yacht Market by Value; 2017-2021 (US$ Million)

- The US Super Yacht Market by Value; 2022-2026 (US$ Billion)

- The US Sport Yacht Market by Value; 2017-2021 (US$ Million)

- The US Sport Yacht Market by Value; 2022-2026 (US$ Billion)

- The US Flybridge Yacht Market by Value; 2017-2021 (US$ Million)

- The US Flybridge Yacht Market by Value; 2022-2026 (US$ Million)

- The US Long Range Yacht Market by Value; 2017-2021 (US$ Million)

- The US Long Range Yacht Market by Value; 2022-2026 (US$ Million)

- The US Others Yacht Market by Value; 2017-2021 (US$ Million)

- The US Others Yacht Market by Value; 2022-2026 (US$ Million)

- Canada Yacht Market by Value; 2017-2021 (US$ Billion)

- Canada Yacht Market by Value; 2022-2026 (US$ Billion)

- Asia Pacific Yacht Market by Value; 2017-2021 (US$ Billion)

- Asia Pacific Yacht Market by Value; 2022-2026 (US$ Billion)

- Asia Pacific Yacht Market by Region; 2021 (Percentage, %)

- China Yacht Market by Value; 2017-2021 (US$ Billion)

- China Yacht Market by Value; 2022-2026 (US$ Billion)

- Japan Yacht Market by Value; 2017-2021 (US$ Million)

- Japan Yacht Market by Value; 2022-2026 (US$ Million)

- Rest of Asia Pacific Yacht Market by Value; 2017-2021 (US$ Million)

- Rest of Asia Pacific Yacht Market by Value; 2022-2026 (US$ Million)

- Latin America Yacht Market by Value; 2017-2021 (US$ Million)

- Latin America Yacht Market by Value; 2022-2026 (US$ Million)

- Middle East & Africa Yacht Market by Value; 2017-2021 (US$ Million)

- Middle East & Africa Yacht Market by Value; 2022-2026 (US$ Million)

- Global New Superyacht Sales From 30 Meters Up, 2019-2021

- Global Number of UHNWIs; 2020-2025 (Thousand)

- Global Luxury Tourism Revenue by Region; 2020-2024 (US$ Billion)

- Global Yacht Players by Market Share; 2021 (Percentage, %)

- Top 5 Global Yacht Market Players’ Aggregated Market Share By Segment and Estimated Number of Players; 2021 (Percentage, %)

- Global Yacht Market Players by Merger & Acquisition; 2017-2021

- HanseYachts AG Revenues by Segment; 2021 (Percentage, %)

- LVMH Revenue by Operating Business Group; 2021 (Percentage, %)

- Sanlorenzo S.p.a Net Revenues New Yachts by Division; 2021 (Percentage, %)

- Ferretti Group Net Revenue by Production Type; 2021 (Percentage, %)

- Global Superyacht Construction Book by Country; 2021-2022

- Global Yacht Market Players by Yacht Length

- Global Yacht Market Players by Total Length and Number of Projects; 2021

- Alexander Marine Co., Ltd. & Subsidiaries

- Azimut Yachts

- Bilgin Yachts

- Feadship Yachts

- Ferretti Group

- HanseYachts AG

- Lurssen Yachts

- LVMH Moët Hennessy Louis Vuitton (Princess Yachts Ltd.)

- Sanlorenzo S.p.a

- Sunseeker International Ltd.

- The Italian Sea Group

- Westport LLC

Global Yacht Market - Outlook & Forecast 2024-2029

- Report

Yacht Industry - Global Strategic Business Report

Yacht Global Market Report 2024

- February 2024

Yacht Global Market Opportunities and Strategies to 2032

- August 2023

Global Yacht Market by Type (Flybridge Yacht, Long Range Yacht, Sport Yacht), Yacht Length (20-50 Meters, Above 50 Meters, Up to 20 Meters), Propulsion, Application - Forecast 2024-2030

About the yacht market.

The Yacht market is a segment of the Maritime industry that focuses on the production, sale, and maintenance of luxury vessels. Yachts are typically used for recreational purposes, such as leisurely cruising, fishing, and entertaining. Yacht owners may also use their vessels for competitive sailing, racing, and other water sports. Yacht manufacturers typically produce vessels ranging from small, trailerable boats to large, ocean-going vessels. Many yachts are custom-built to meet the specific needs of the owner. Yacht brokers and dealers are responsible for the sale of new and used yachts, and often provide services such as financing, insurance, and maintenance. Marinas and boatyards provide services such as storage, repairs, and maintenance for yachts. They may also offer amenities such as fuel, supplies, and restaurants. Some companies in the Yacht market include Azimut Yachts, Beneteau, Ferretti Group, Princess Yachts, and Sunseeker. Show Less Read more

ASK A QUESTION

We request your telephone number so we can contact you in the event we have difficulty reaching you via email. We aim to respond to all questions on the same business day.

Request a Quote

YOUR ADDRESS

YOUR DETAILS

PRODUCT FORMAT

Yacht Market Dynamics

Yacht market regional insights, yacht market segment analysis, yacht market competitive landscape.

Yacht Market Scope: Inquire before buying

Yacht market by region, yacht key players are:, about this report.

- INQUIRE BEFORE BUYING

Related Reports

Our clients, report payment, get call back from us.

- IT & Telecommunication

- Electronics

- Chemical & Material

- Energy & Power

- Food & Beverages

- Automotive & Transportation

- Aerospace & Defense

- Life Science

- Biotechnology

- Automation & Process Control

- Mining & Metals

- Engineering Equipment

- Medical Devices

- Consumer Goods & Services

- Subscription Model

- Competitive Intelligence

- Advance Analytics

- Technologies

- Go-To-Market Strategy

- Market Potential

- Mergers and Acquisitions

- Pricing Analysis

- Supply Chain Consultation

- Press Releases

The US Yacht Charter Market is estimated to be USD 3.12 Bn in 2022 and is expected to reach USD 4.2 Bn by 2027, growing at a CAGR of 6.11%.

The report provides a detailed analysis of the competitors in the market. It covers the financial performance analysis for the publicly listed companies in the market. The report also offers detailed information on the companies' recent development and competitive scenario.

Some of the companies covered in this report are Sunsail Limited, EDMISTON, Fraser Yachts Florida Inc., Yachtico Inc., MarineMax, Boatsetter, Northrop & Johnson, Super Yacht Logistics, Beneteau SA, Sunseeker International Ltd., CharterWorld LLP, Yachtcharter - Connection, etc.

The report includes Competitive Quadrant, a proprietary tool to analyze and evaluate the position of companies based on their Industry Position score and Market Performance score.

The tool uses various factors for categorizing the players into four categories. Some of these factors considered for analysis are financial performance over the last 3 years, growth strategies, innovation score, new product launches, investments, growth in market share, etc.

The report presents a detailed Ansoff matrix analysis for the US Yacht Charter Market. Ansoff Matrix, also known as Product/Market Expansion Grid, is a strategic tool used to design strategies for the growth of the company.

The matrix can be used to evaluate approaches in four strategies viz. Market Development, Market Penetration, Product Development and Diversification. The matrix is also used for risk analysis to understand the risk involved with each approach.

The analyst analyses US Yacht Charter Market using the Ansoff Matrix to provide the best approaches a company can take to improve its market position.

Based on the SWOT analysis conducted on the industry and industry players, the analyst has devised suitable strategies for market growth.

Company Profiles

- Sunsail Limited

- Fraser Yachts Florida Inc.

- Yachtico Inc.

- Northrop & Johnson

- Super Yacht Logistics

- Beneteau SA

- Sunseeker International Ltd.

- CharterWorld LLP

- Yachtcharter - Connection

- Camper & Nicholsons International Ltd.

- Sailogy S.A.

Key Topics Covered:

1 Report Description

1.1 Study Objectives

1.2 Market Definition

1.3 Currency

1.4 Years Considered

1.5 Language

1.6 Key Stakeholders

2 Research Methodology

2.1 Research Process

2.2 Data Collection and Validation

2.3 Market Size Estimation

2.4 Assumptions of the Study

2.5 Limitations of the Study

3 Executive Summary

3.1 Introduction

3.2 Market Size, Segmentation, and Outlook

4 Market Dynamics

4.1 Drivers

4.1.1 Rise In Number of Private Islands and Cruises

4.1.2 Rising Disposable Income

4.1.3 Shift Toward Alternative Sources of Energy

4.1.4 Rising Yacht Tourism and Remote Exploration

4.2 Restraints

4.2.1 Rise in Environmental Concerns

4.2.2 High Cost of Yacht Charter

4.3 Opportunities

4.3.1 Rising Customization and Personalization

4.3.2 Technological Upgrades in Yacht Infrastructure

4.4 Challenges

4.4.1 Lack of Skilled Labor

4.4.2 Natural Calamities

5 Market Analysis

5.1 Regulatory Scenario

5.2 Porter's Five Forces Analysis

5.3 Impact of COVID-19

5.4 Ansoff Matrix Analysis

6 US Yacht Charter Market, By Charter Type

6.1 Introduction

6.2 Bareboat

7 US Yacht Charter Market, By Source

7.1 Introduction

7.2 Sailing Yacht

7.3 Motorboat Yacht

8 US Yacht Charter Market, By Size

8.1 Introduction

8.2 Up to 20 ft

8.3 20 to 50 ft

8.4 More than 50 ft

9 US Yacht Charter Market, By Type of Contract

9.1 Introduction

9.2 Bareboat Charter contract

9.3 Crew Charter Contract

10 Competitive Landscape

10.1 Competitive Quadrant

10.2 Market Share Analysis

10.3 Strategic Initiatives

10.3.1 M&A and Investments

10.3.2 Partnerships and Collaborations

10.3.3 Product Developments and Improvements

11 Company Profiles

For more information about this report visit https://www.researchandmarkets.com/r/b2e1lk .

ResearchAndMarkets.com Laura Wood, Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

- Automotive Industry

Luxury Yacht Market

Luxury yacht market report by type (sailing luxury yacht, motorized luxury yacht, and others), size (75-120 feet, 121-250 feet, above 250 feet), material (frp/ composites, metal/ alloys, and others), application (commercial, private), and region 2024-2032.

- Report Description

- Table of Contents

- Methodology

- Request Sample

Market Overview:

The global luxury yacht market size reached US$ 7.9 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 16.9 Billion by 2032, exhibiting a growth rate (CAGR) of 8.6% during 2024-2032. The increasing wealth among affluent individuals and their interest in exclusive leisure activities, the growing emphasis on experiential luxury, and the expansion of marine tourism and the advent of luxury charter services are some of the factors that are propelling the market.

A luxury yacht is a highly sophisticated vessel that combines performance, comfort, and style, catering to the tastes of affluent individuals. Often ranging from under one hundred feet to several hundred feet in length, these yachts are characterized by elegant design, state-of-the-art technology, and remarkable amenities. Equipped with advanced navigation systems, powerful engines, and intricate craftsmanship, ensuring optimal functionality and aesthetic appeal. The working mechanism involves the seamless integration of various systems, such as propulsion, stabilization, communication, and entertainment, to provide an unparalleled sailing experience. They are commonly used for private leisure activities, offering privacy, freedom, and a personalized experience. Besides as modes of transportation, these yachts are utilized as a symbol of status and luxury, featuring amenities such as Jacuzzis, gyms, cinemas, and fine dining facilities.

The global market is primarily driven by the increasing wealth among affluent individuals and their interest in exclusive leisure activities. In line with this, the rise in private charters and a preference for customized, high-end designs tailored to individual tastes are also providing an impetus to the market. Moreover, the burgeoning tourism industry and the desire for remote, luxurious travel experiences are also acting as significant growth-inducing factors. In addition to this, technological advancements in navigation, propulsion, and on-board entertainment are resulting in an enhanced appeal for these vessels. The market is further driven by strategic partnerships and collaborations among yacht manufacturers and designers. Some of the other factors contributing to the market include the increasing importance of status symbols among the elite, the influence of global travel trends on luxury spending, the development of advanced docking facilities and extensive investment in research and development (R&D) for innovative yacht features and technologies.

-(1).webp)

Luxury Yacht Market Trends/Drivers:

Implementation of stricter environmental regulations The introduction of stricter environmental regulations is having a profound impact on the market. As global awareness of environmental issues grows, there is increasing pressure on industries to reduce their carbon footprint and adhere to sustainable practices. In line with this, yacht manufacturers are compelled to innovate and develop eco-friendly yachts that align with both regulatory requirements and the values of environmentally conscious consumers. The integration of renewable energy sources such as solar panels, wind turbines, and hybrid propulsion systems are part of this initiative. Manufacturers are also focusing on using sustainable materials and reducing waste during construction. These environmentally friendly practices are not only meeting legal obligations but also enhancing the appeal of luxury yachts among a new generation of affluent clients who prioritize sustainability. This combination of regulatory compliance and consumer demand is driving substantial investment in research, development, and implementation of green technologies within the industry, setting a new standard for the entire sector.

Growing emphasis on experiential luxury The concept of experiential luxury is another pivotal driver in the market. The high-net-worth individuals are increasingly seeking unique and personalized experiences that reflect their individual tastes and values. This goes beyond mere ownership and extends to how the yacht can provide a one-of-a-kind, luxurious experience. Customized interiors, exclusive amenities, on-board chefs offering gourmet cuisine, and personalized itineraries are some examples of how this trend is being realized. The ability to create memories and offer experiences that are not easily replicable elsewhere is becoming a defining factor in luxury consumption. Yacht manufacturers and designers are collaborating closely with clients to understand their specific needs and desires, allowing them to craft yachts that are more than mere vessels but extensions of their owners' personalities and lifestyles. This focus on experiential luxury is not only meeting but exceeding customer expectations, reinforcing the allure of owning a luxury yacht.

Expansion of marine tourism and the advent of luxury charter services

The remarkable expansion of marine tourism and the advent of luxury yacht charter services have emerged as essential factors driving the luxury yacht market. In recent years, marine tourism has seen significant growth, particularly among affluent travelers seeking unique and opulent vacation experiences. Simultaneously, the rise of luxury yacht charter services has made it possible for more individuals to experience the grandeur of yachting without the need for ownership. These charter services provide flexibility, allowing clients to choose from a wide range of vessels, destinations, and durations, all tailored to individual preferences and budgets. Moreover, partnerships between tourism boards, travel agencies, and yacht charter companies are further promoting marine tourism and making luxury yachts more accessible. This synergy is not only expanding the customer base but is also encouraging continuous innovation in amenities, services, and destinations, ensuring that the luxury yacht market remains vibrant, competitive, and responsive to evolving consumer needs and desires.

Note: Information in the above chart consists of dummy data and is only shown here for representation purpose. Kindly contact us for the actual market size and trends.

To get more information about this market, Request Sample

Luxury Yacht Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global luxury yacht market report, along with forecasts at the global, regional and country levels from 2024-2032. Our report has categorized the market based on type, size, material and application.

Breakup by Type:

To get more information about this market, Request Sample

- Sailing Luxury Yacht

- Motorized Luxury Yacht

Motorized luxury yacht represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes sailing luxury yacht, motorized luxury yacht, and others. According to the report, motorized luxury yacht represented the largest segment.

Motorized luxury yachts are favored for their higher speeds and convenience, appealing to clients seeking efficient and swift travel between multiple destinations. Additionally, these yachts provide abundant deck space and luxury amenities, catering to those desiring opulence and entertainment options while on board.

On the other hand, the sailing luxury yacht segment is driven by its strong nautical tradition and the romantic appeal of cruising on the open sea, offering a unique and authentic maritime experience. Moreover, the growing focus on environmental consciousness attracts individuals who view sailing yachts as a greener and more eco-friendly option compared to motorized yachts. Breakup by Size:

- 75-120 Feet

- 121-250 Feet

- Above 250 Feet

75-120 feet accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the size. This includes 75-120 feet, 121-250 feet, and above 250 feet. According to the report, 75-120 feet represented the largest segment.

Yachts in the 75-120 feet size range strike a balance between spaciousness and maneuverability, attracting clients seeking versatility and access to various cruising destinations. This segment appeals to both private owners looking for a personal yacht and those interested in charter services, supporting market growth through diverse usage.

On the other hand, yachts ranging from 121 to 250 feet offer exclusivity, grandeur, and long-range cruising capabilities, appealing to high-net-worth individuals looking for opulent experiences and the ability to explore remote destinations.

Furthermore, the superyacht category, or yachts above 250 feet provide the ultimate luxury with unparalleled customization possibilities, making them the preferred choice of the most discerning clientele. Furthermore, some yachts in this category are designed for corporate events or operate as charter vessels, catering to both private and commercial demand. Breakup by Material:

- FRP/ Composites

- Metal/ Alloys

- Others

FRP/Composites represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the material. This includes FRP/composites, metal/ alloys, and others. According to the report, FRP/ composites represented the largest segment.

Yachts constructed with fiberglass-reinforced plastics (FRP) and composites offer innovative design possibilities, allowing for unique and modern aesthetics. Additionally, the lightweight nature of these materials contributes to fuel efficiency, reducing operational costs and appealing to environmentally conscious clients.

On the other hand, metal and alloy construction are known for their durability, making them ideal for clients seeking sturdy and long-lasting yachts capable of withstanding challenging sea conditions. The customization potential in large yachts made from metals and alloys further enhances their appeal to affluent buyers. Breakup by Application:

- Private

Commercial accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial and private. According to the report, commercial represented the largest segment. The commercial segment thrives on the demand for charter services, corporate events, and luxury tourism, offering a reliable stream of revenue for yacht companies. Additionally, having a diversified portfolio that includes charter services and events provides stability and growth opportunities in the luxury yacht industry.

On the other hand, the private segment caters to individuals seeking an exclusive and personalized yacht ownership experience, reflecting status and individual preferences. Offering discreet, high-end services such as onboard staff, personalized itineraries, and access to private events enhances the allure of private yacht ownership, driving demand in this segment. Breakup by Region:

To get more information on the regional analysis of this market, Request Sample

United States

- South Korea

United Kingdom

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest luxury yacht market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and Others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and Others); Latin America (Brazil, Mexico, and Others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest market. North America's luxury yacht market thrives on the significant population of high-net-worth individuals who prioritize exclusive leisure experiences. The region's affluent clientele, renowned for their discerning tastes and desire for opulent living, fuel the demand for luxury yachts as the epitome of sophisticated indulgence.

Moreover, the well-established yachting infrastructure in North America plays a pivotal role in supporting and nurturing the luxury yacht market. The presence of world-class marinas, state-of-the-art shipyards, and a plethora of supporting services, ranging from yacht maintenance to concierge assistance, ensures a seamless and lavish yachting experience for clients. This infrastructure not only enhances the convenience of yacht ownership but also fosters a thriving ecosystem for yacht enthusiasts.

Furthermore, the augmenting demand of cruising along the coasts and islands of North America along with the experience of luxurious waterfront destinations contributes to the market growth in the region. As a result, North America offers a diverse range of cruising opportunities that appeal to the elite travelers seeking extraordinary and unforgettable journeys.

Competitive Landscape:

The major yacht manufacturers are heavily investing in research and development. This investment is focused on introducing innovative features, enhancing the sustainability of yachts, and incorporating cutting-edge technology such as advanced navigation systems, hybrid propulsion, and personalized on-board entertainment solutions. In line with the trend towards experiential luxury, many yacht manufacturers are emphasizing customization. They are working closely with clients to create tailor-made yachts with unique designs and features that reflect the individual tastes and lifestyles of their owners. As sustainability becomes a key concern for consumers, leading yacht manufacturers are working towards developing eco-friendly models, including the use of renewable energy, sustainable materials, and energy-efficient designs. They are also working closely with clients to create tailor-made yachts with unique designs and features that reflect the individual tastes and lifestyles of their owners.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alexander Marine International

- Azimut - Benetti S.P.A.

- Brunswick Corporation

- Christensen Shipyards LLC

- Damen Shipyards Group N.V.

- Feadship Holland B.V.

- Fincantieri S.p.A. (CDP Industria S.p.A.)

- Heesen Yachts Sales B.V.

- Horizon Yacht USA

- Palumbo Group S.P.A

- Princess Yachts Limited

- Sanlorenzo S.p.A.

- Sunseeker International (Wanda Group)

- Viking Yacht Company

Recent Developments:

- In June 2023, Azimut - Benetti S.P.A. and ENI sustainable mobility have signed an agreement for the supply and use of hvolution, the biofuel produced from 100% renewable raw materials. This is the first yachting industry agreement that targets decarbonization.

- In July 2023, Mercury Marine, a division of Brunswick Corporation announced that it has begun serial production of its new 20e and 35e Avator electric propulsions systems, with release for sale planned for later in 2023. Mercury has committed to the introduction of five Avator products in 2023.

- Damen Shipyards Group announced the first sale of its innovative Damen Air Cavity System (DACS) to Amisco on July 2023. Damen will retrofit the DACS system to Amisco’s cargo vessel Danita in Tallinn, Estonia. DACs is an air lubrication system, borne out of a collaboration between Damen and the Delft University of Technology (TU Delft). It maintains a thin layer of air over the flat bottom of a vessel’s hull, reducing resistance in the water, thereby lowering drag and friction. As a result, the efficiency of the vessel is improved with fuel consumption reduced by up to 15%.

Luxury Yacht Market Report Scope:

Key benefits for stakeholders:.

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the luxury yacht market from 2018-2032.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global luxury yacht market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the luxury yacht industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global luxury yacht market was valued at US$ 7.9 Billion in 2023.

We expect the global luxury yacht market to exhibit a CAGR of 8.6% during 2024-2032.

The expanding recreational tourism sector, along with the widespread availability of luxury yachts on lease by yacht fleet operators for organizing business meetings, recreational activities, and events, is primarily driving the global luxury yacht market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary halt in various recreational activities and demand fluctuations for luxury yacht.

Based on the type, the global luxury yacht market has been segmented into sailing luxury yacht, motorized luxury yacht, and others. Currently, motorized luxury yacht holds the majority of the total market share.

Based on the size, the global luxury yacht market can be divided into 75-120 feet, 121-250 feet, and above 250 feet, where 75-120 feet currently exhibits a clear dominance in the market.

Based on the material, the global luxury yacht market has been categorized into FRP/ composites, metal/ alloys, and others. Among these, FRP/ composites account for the majority of the global market share.

Based on the application, the global luxury yacht market can be segregated into commercial and private. Currently, the commercial sector holds the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global luxury yacht market include Alexander Marine International, Azimut - Benetti S.P.A., Brunswick Corporation, Christensen Shipyards LLC, Damen Shipyards Group N.V., Feadship Holland B.V., Fincantieri S.p.A. (CDP Industria S.p.A.), Heesen Yachts Sales B.V, Horizon Yacht USA, Palumbo Group S.P.A, Princess Yachts Limited, Sanlorenzo S.p.A., Sunseeker International (Wanda Group), Viking Yacht Company, etc.

India Dairy Market Report Snapshots Source:

Statistics for the 2022 India Dairy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports.

- India Dairy Market Size Source

- --> India Dairy Market Share Source

- India Dairy Market Trends Source

- India Dairy Companies Source

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Purchase options

Benefits of Customization

Personalize this research

Triangulate with your data

Get data as per your format and definition

Gain a deeper dive into a specific application, geography, customer, or competitor

Any level of personalization

Get in Touch With Us

UNITED STATES

Phone: +1-631-791-1145

Phone: +91-120-433-0800

UNITED KINGDOM

Phone: +44-753-713-2163

Email: [email protected]

Client Testimonials

IMARC made the whole process easy. Everyone I spoke with via email was polite, easy to deal with, kept their promises regarding delivery timelines and were solutions focused. From my first contact, I was grateful for the professionalism shown by the whole IMARC team. I recommend IMARC to all that need timely, affordable information and advice. My experience with IMARC was excellent and I can not fault it.

The IMARC team was very reactive and flexible with regard to our requests. A very good overall experience. We are happy with the work that IMARC has provided, very complete and detailed. It has contributed to our business needs and provided the market visibility that we required

We were very happy with the collaboration between IMARC and Colruyt. Not only were your prices competitive, IMARC was also pretty fast in understanding the scope and our needs for this project. Even though it was not an easy task, performing a market research during the COVID-19 pandemic, you were able to get us the necessary information we needed. The IMARC team was very easy to work with and they showed us that it would go the extra mile if we needed anything extra

Last project executed by your team was as per our expectations. We also would like to associate for more assignments this year. Kudos to your team.

.webp)

We would be happy to reach out to IMARC again, if we need Market Research/Consulting/Consumer Research or any associated service. Overall experience was good, and the data points were quite helpful.

The figures of market study were very close to our assumed figures. The presentation of the study was neat and easy to analyse. The requested details of the study were fulfilled. My overall experience with the IMARC Team was satisfactory.

The overall cost of the services were within our expectations. I was happy to have good communications in a timely manner. It was a great and quick way to have the information I needed.

My questions and concerns were answered in a satisfied way. The costs of the services were within our expectations. My overall experience with the IMARC Team was very good.

I agree the report was timely delivered, meeting the key objectives of the engagement. We had some discussion on the contents, adjustments were made fast and accurate. The response time was minimum in each case. Very good. You have a satisfied customer.

.webp)

We would be happy to reach out to IMARC for more market reports in the future. The response from the account sales manager was very good. I appreciate the timely follow ups and post purchase support from the team. My overall experience with IMARC was good.

IMARC was a good solution for the data points that we really needed and couldn't find elsewhere. The team was easy to work, quick to respond, and flexible to our customization requests.

- Competitive Intelligence and Benchmarking

- Consumer Surveys and Feedback Reports

- Market Entry and Opportunity Assessment

- Pricing and Cost Research

- Procurement Research

- Report Store

- Aerospace and Defense

- Agriculture

- Chemicals and Materials

- Construction and Manufacturing

- Electronics and Semiconductors

- Energy and Mining

- Food and Beverages

- Technology and Media

- Transportation and Logistics

Quick Links

- Press Releases

- Case Studies

- Our Customers

- Become a Publisher

134 N 4th St. Brooklyn, NY 11249, USA

+1-631-791-1145

Level II & III, B-70, Sector 2, Noida, Uttar Pradesh 201301, India

+91-120-433-0800

30 Churchill Place London E14 5EU, UK

+44-753-713-2163

Level II & III, B-70 , Sector 2, Noida, Uttar Pradesh 201301, India

We use cookies, including third-party, for better services. See our Privacy Policy for more. I ACCEPT X

More From Forbes

Despite wars and sanctions, superyacht market continues recent growth.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

The Phi has been detained in Canary Wharf since March 2022.

A superyacht is a status symbol and the ultimate pleasure boat. What ordinary people envisage doing on cruise ships, the super-rich do on their mega-yachts. Space and change of scenery have appealed to humans from time immemorial. However, with luxury yacht ownership requiring vast sums of disposable income, one would think that factors putting the global economy under pressure, such as inflation, Houthi terrorists and Somali pirates attacking ships in the Red Sea, sanctions following the Russian invasion of Ukraine, and before that, the COVID-19 pandemic, would slow down the demand for superyachts. Instead, despite severe disruptions, mainly because of the post-Ukraine 2022 Russian invasion sanctions, with billions sloshing around in the global economy, demand for these vessels has reached a high point, driven by changes in the tastes of the ultra-rich, innovative new uses for superyachts, and the number of buyers able to splurge on such craft.

Expensive Mega-Toys The unique uses of a superyacht are driven by the size and crew demands that separate it from a regular yacht. A superyacht is considered to be a pleasure vessel larger than 24m (80ft) with a full-time captain and crew. This is a costly outlay. There are added costs for not including maintenance, fuel, and expensive power plant, navigation, and communications gear.

The desire for seclusion and social distancing exhibited by the rich since the 2020 pandemic lends itself perfectly to these large, customizable ships that can be taken out to sea. A fully crewed ship is also needed to keep up with for new trend in exploration and environmental sailing, with boat owners venturing outside of the Mediterranean and Caribbean to experience more varied habitats. Other luxury sectors are taking note of these trends driving demand for superyachts, with hotel chains like The Four Seasons and The Ritz-Carlton aiming to offer bespoke superyacht experiences by 2025. By introducing this option, hotel chains are responding to the increased market demand for exploration while creating an experience that is more exclusive and private than a luxury cruise.

Demand has also been driven by an expanding number of prospective superyacht buyers as the number of ultra-high-net-worth individuals continues to increase globally. The growth is primarily driven by American buyers, with significant potential in regions like China and Southeast Asia, where ultra-rich buyers with disposable income are growing at a faster pace than they are in the West. This increase in wealthy customers in Southeast Asia, combined with miles of islands and coastlines, creates the conditions for a robust scene for superyachts in the area. The emergence of a new customer base wealthy enough to purchase super- and mega-yachts has made the industry resilient in the face of government sanctions against one of the industry’s largest consumer bases: Russian oligarchs.

The megayacht Nord, believed to belong to sanctioned Russian oligarch Alexey Mordashov, is seen in ... [+] Hong Kong on Friday, Oct. 7.

Best High-Yield Savings Accounts Of 2024

Best 5% interest savings accounts of 2024.

Target: Russia Beginning in the early 2000s, Russian billionaires developed a taste for luxury superyachts, with some like Roman Abramovich (who is reported to own 16 vessels , including the Aquamarine, Eclipse, Garcon, Halo, Pelorus, Solaris and Sussurroo), Alexei Mordashov ( Lady M and Nord ) and Eduard Khudainatov ( Scheherazade , Amadea , Crescent ) placing orders for multiple vessels. According to Superyacht News, an industry publication, Russians account for a significant piece of the world's superyacht market. Their estimated share represents about 10% of superyachts exceeding 40 meters in length. The percentage of Russian ownership rises even further for mega-yachts exceeding 80 meters, where Russians hold the number two spot globally, owning 20% of these vessels. Research by Boat International estimates the contribution of Russian buyers to the global superyacht order book (valued between €35 and €40 billion) to be €3.9 billion.

The popularity of superyachts among Russia’s wealthy has caused them to become a focus of the sanctions imposed on Russia following its invasion of Ukraine in February 2022. Alongside traditional targets, including Russian financial holdings, banks, and energy, the assets of oligarchs are actively being seized and frozen by Western powers when possible through initiatives like the Russian Elites, Proxies, and Oligarchs (REPO) task force launched by the G7 and the U.S. Treasury’s Kleptocracy Asset Recovery Rewards (KARR) program.

The seizure of superyachts as assets will likely continue through the end of the invasion of Ukraine and possibly beyond. Recently, there have been increasing calls to sell or transfer these assets, allowing Ukraine to use or sell them to compensate for the damages caused by the war.

Eclipse | 162.5m Built in 2010 , Germany

Europe Suffers Even though the superyacht industry has a sizeable consumer base in Russia, the companies building and managing these yachts are primarily based in Western Europe. Many of these boats are built by shipbuilders such as Lürssen in Germany and Heesen Yachts and Oceanco in the Netherlands. This has led one of the shipyards, Damen, to sue the Dutch government over damages it claims it suffered from the EU sanctions. Additionally, companies like Burgess in the UK, Imperial Yachts and Edmiston in Monaco, and Moran Yacht & Ship in the US, in charge of servicing, managing, and brokering superyachts, are also concentrated in the West.

While Western shipyards and management companies may lose revenue because of sanctions and asset seizure of the Russian oligarchs, keeping the yachts frozen generates additional costs for the countries where they are being held. Some Western countries devised a solution to ease the burden on taxpayers, granting owners and their representatives special licenses to pay for the frozen vessels. Notably, France and Spain have allowed the billionaire owners of at least four mega-yachts to pay for their upkeep. In the UK, the Office of Financial Sanctions Implementation (OFSI) has allowed the management company Burgess to pay for pre-sanction crew salaries of a yacht frozen in the UK.

Though the media associated superyachts with Russian oligarchs, this archetypal image of a superyacht owner may soon grow obsolete if the sanctions regime remains or even strengthens, causing multi-million dollar losses to the industry. Instead, growth in the sector is driven by a new class of rich being created in places like the United States and the Pacific Rim, seeking luxury lifestyles that can be provided by a superyacht. The superyacht industry will capitalize on the unprecedented wave of demand to increase its resilience in the stormy global security and economic environment.

Quin Buckley & Henry Tsai contributed to the production of this article.

- Editorial Standards

- Reprints & Permissions

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Leisure Boats Market

Leisure Boats Market By Type, Propulsion System & Region | Forecast 2022 to 2032

Integration of IoT transforming the demand pattern for with leisure boat sales- Opportunities ahead

- Report Preview

- Request Methodology

Leisure Boats Market Outlook (2022 to 2032)

[250 Pages Report] The Leisure boat market was valued at around US$ 42.6 Billion in 2021. With a projected CAGR of 5.8% for the next ten years, the market is likely to reach a valuation of nearly US$ 78.4 Billion by the end of 2032.

Future Market Insights’ analysis reveals that the largest contribution to market revenue is grossed from Used Leisure Boats, which witnessed a CAGR of 4.2% from 2017 to 2021. Diesel continues to be the top choice of a propulsion system, with a CAGR of 4.4% from 2017 to 2021 and a forecasted CAGR of 5.0% in the forecast period of 2022 to 2032.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Sales Analysis of Leisure Boats from 2017 to 2021 Vs Market Outlook for 2022 to 2032

The global market for Leisure Boats expanded at a CAGR of 4.7% over the last five years (2017 to 2021). The global Leisure Boat market is predicted to surge ahead at a CAGR of 5.8% and record sales worth US$ 78.4 Billion by the end of 2032. The US will continue to be the largest procurer of Leisure Boats throughout the analysis period accounting for an absolute dollar growth opportunity of US $10.1 Billion.

Why are Leisure Boats gaining popularity?

Recent years have seen growing popularity in the leisure boat industry. Boat sales in the US rose nearly 40% from 2019 to 2020. The growth of experience-based events and tourism is boosting the market, with boat charters and renting platforms witnessing large volumes of customers. Boat shows like the Dubai International Boat Show, and races like the Race to Alaska, are rising in popularity; and the high-profile sponsorships being brought in are contributing to demand.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

How are the developments in Electric Boats driving demand?

Electric boats are gaining popularity in the current environment of global concern amongst both consumers and authorities about emissions and pollution. They are drawing consumers for several reasons. They have emission-free propulsion and do not contribute to water pollution in the way diesel engines do in the event of oil spills. This is vital since studies have found that even a single liter of an oil spill can cause damage to 1 Million liters of water. These boats are also charged from the grid, which means they can be charged with even renewable energy, and acquiring this energy is far easier than the extraction process of fossil fuels.

These boats are significantly cheaper once fuel costs are factored in, and are relatively noiseless. Some amount of demand comes from previous owners who want to switch to electric. Evolutions in marine electric technology mean that even electric boats have equivalent ability to traditional engines at much lower refueling costs. The maintenance and upkeep of the charging unit are also easier, and electric engines have fewer moving parts and last longer on average. There are also laws that favor the use of electric boats. For example, motorized boats are banned in marine protected areas of the US, but electric boats are often permitted because they are cleaner and noiseless.

How are new technologies such as IoT influencing the market?

Increasingly consumers are choosing boats that harness IoT or Internet-of-Things technology. IoT technology is boosting demand in several ways. First, it can improve the connectivity of entertainment systems in boats, which is important in leisure crafts. However, one important feature that is making IoT technology a driver for growth is the safety and security benefits. Using these IoT systems, a boat owner can remotely be aware of battery levels, possible leaks or water entering the boat through water detectors and bilge alarms, possible intrusions, and smoke alarms.

There is also the option to connect these systems directly to the marina a boat may be docked, so they can take action even when owners are far away. Further developments in this technology will ensure that buyers feel more secure in purchasing a new boat, since damages come with hefty costs, and may even lead to accidents if they remain undetected while ships operate.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Why are used boats the key contributor to revenue?

Used Leisure boats are the leading contributor to revenue, having witnessed a CAGR of 4.2% from 2017 to 2022 and having a forecasted CAGR of 5.4% for the next decade. Used boats are significantly cheaper than buying brand new, which is a bonus both for first-timers buying a first vehicle and for repeat buyers. Used boats are also available immediately, which is a prominent advantage. In the US, the current boom in the past few years in the boating industry has led to shipments that would at one point be delivered in a few weeks suddenly having a waiting period of several months.

Unlike a brand new boat, a consumer can physically see and immediately try out the exact boat they wish to purchase instead of a trial model. Consumers may also prefer to buy used ones because old boats are often already kitted out by the past owners, which means they will be significantly cheaper than equivalently equipped new boats. They have also already been tested for time and can be tested by hired professionals on the spot immediately by the potential buyers, unlike in new boats where one must place the order, wait for it to arrive, perform any tests, and then undergo complicated return processes if standards are not met.

Region-wise Insights

How is europe shaping up to be a significant component of global leisure boat demand.

Europe benefits from having 37,000 Km of inland waterway and a more than 70,000 Km long coastline. It contributes to around 25.1% of the global Leisure Boat Demand. According to data from the International Council of Marine Industry Associations, the boating industry in Europe consists of over 32,000 companies and employs over 280,000 people. Approximately 48 million Europeans take part in leisure boat activities, and this market is expected to continue growing, reaching a forecasted market value of US $19.6 Billion with a CAGR of 5.8% by 2032.

Country-wise Insights

The usa remains the largest contributor to market demand..

According to the USA Department of Commerce’s Bureau of Economic Analysis (BEA), recreational boating and fishing contribute the most to the outdoor recreation economy, with a 30% increase from 2019 to 2020. The boating industry in the US accounts for over 4.3 Million jobs. The US is also currently experiencing a boating boom, with sales numbers reaching a record high. The USA Bureau of Economic Analysis data for 2020 showed that boating and fishing in general contributed US$ 30.8 Billion in current-dollar value added in 2020, a record high after 13 years. The US witnessed a CAGR OF 4.4% from 2017 to 2021 and presents an absolute dollar opportunity of US$ 10.1 Billion. The forecasted market value by 2032 is US$ 26.3 Billion at a CAGR of 5%.

Category-wise Insights

Why are diesel propulsion systems so popular.

Diesel is the most revenue-contributing type of leisure boat. Diesel is nearly 20% more efficient than a gasoline engine. The quality of oil required by these engines is also not very high, with most using very cheap fuel. The key factor, however, is the additional torque a diesel engine can provide, caused by the fact that there is a higher compressing ratio needed for compression ignition. The greater crankshaft offset required by this process gives a greater torque even at lower RPMs. Diesel-based propulsion systems witnessed a CAGR of 4.4% from 2017 to 2021 and the forecasted CAGR for the 2022 to 2032 time period is 5.3%.

Competitive Landscape

Leisure boat manufacturers are largely aiming at developing their products and harnessing new technologies. The key companies operating in the leisure boat market include Avon Marine, Azimut Benetti Group, Baja Marine, Bavaria Yachtbau GmbH, Bombardier Recreational Products Inc., Brunswick Corporation, Chaparral Boats, Inc., Catalina Yachts, Farr Yacht Design, Ltd., Ferretti S.P.A., Fountain Powerboats, Inc., Groupe Beneteau, Sunseeker International Limited, Malibu Boats, Marine Product Corporation, MasterCraft Boat Company, Polaris Inc., and Ranger Boats among others.

Some of the recent developments by key providers of Leisure Boats are as follows

- In February 2022, Norway-based companies Hynion AS, a hydrogen fuel company, and Hyrex AS, a hydrogen technology company, established a Joint Venture. They have announced plans to launch a floating hydrogen station to refuel leisure boats.

- In January 2022, Yamaha Marine Systems Company, a subsidiary of Yamaha Motor Corporation acquired Siren Marine, an IoT solutions provider for marine applications.

- In November 2021, Arc Boat Company, a stealth-mode start-up raised US $30 Million in Series A funding. The company plans to join the movement for the shift to electric and aims to release its limited edition US$ 300,000, 24-foot battery-powered boat, Arc One later in 2022.

Similarly, recent developments related to companies manufacturing Leisure Boats have been tracked by the team at Future Market Insights, which is available in the full report.

Key Segments Covered in Leisure Boats Industry Survey

Leisure boats market by type:.

- Motorized/Power Boats

- Non-motorized Boats

- Boat and Yacht Monitoring Solutions

- IoT Sensors

- Telematics Solutions

- Other Equipment

Leisure Boats Market by Propulsion System:

- Electric / Hybrid

Leisure Boats Market by Region:

- North America Leisure Boats Market

- Europe Leisure Boats Market

- Asia Pacific Leisure Boats Market

- Middle East & Africa Leisure Boats Market

- Latin America Leisure Boats Market

Frequently Asked Questions

How much is the global leisure boats market currently worth.

The global Leisure Boats Market was valued at US$ 42.6 Billion in 2021 and witnessed a CAGR of 4.7% from 2017 to 2021.

What is the Leisure Boats Market Forecast through 2032?

The Leisure Boat industry is set to witness a growth rate of 5.8% over the forecast period and be valued at US$ 78.4 Billion by 2032.

At what rate did demand for the Leisure boat Market increase over the past 5 years?

The Leisure Boats Market expanded at a CAGR of 4.7% from 2017 through 2021.

Who are the key players shaping the Leisure boat industry?

Avon Marine, Azimut Benetti Group, Baja Marine, Bavaria Yachtbau GmbH, Bombardier Recreational Products Inc., Brunswick Corporation, and Chaparral Boats, Inc. are the key players in the Leisure boat market.

Who are the top 5 countries driving the highest sales of Leisure boats?

The USA, UK, China, Japan, and South Korea are expected to drive the most sales growth of leisure boats.

Table of Content

List of tables, list of charts.

Explore Automotive Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )