Η είσοδος των επισκεπτών επιτρέπεται μόνο με επίδειξη πιστοποιητικού εμβολιασμού ή νόσησης

Για το site της έκθεσης της Θεσσαλονίκης πατήστε εδώ

thessaloniki.boatfishingshow.gr

MEC ΠΑΙΑΝΙΑΣ 13-16 ΜΑΡΤΙΟΥ 2025

- BOAT & FISHING SHOW

- SEA & TOURISM EXPO

- SPEARFISHING EXPO

- WATERSPORTS EXPO

- ΓΙΝΕ ΕΚΘΕΤΗΣ

- ΕΚΘΕΤΕΣ 2024

- ΕΚΘΕΤΕΣ 2023

- ΕΚΘΕΤΕΣ 2022

- ΕΚΘΕΤΕΣ 2020

- ΕΚΘΕΤΕΣ 2019

- ΕΠΙΚΟΙΝΩΝΙΑ

Alpha Tango Yachts

BOAT & FISHING SHOW

Το νέο φουσκωτό από ναυπηγικό αλουμίνιο at 35 της alpha tango yachts σε πρώτη παρουσίαση στην έκθεση σκαφών boat & fishing show 2024, 7 – 10 μαρτίου, mec παιανίας..

Alpha Tango Yachts, μια νέα Ελληνική εταιρία που έρχεται να ταράξει τα νερά. Το καινοτόμο AT 35 είναι το πρώτο μοντέλο της Γκάμας της, κατασκευασμένο από 100% ναυπηγικό αλουμίνιο.

Αυτό το καθιστά το πρώτο ελληνικό αλουμινένιο φουσκωτό και ένα από τα λίγα στεπατα αλουμινένια σκάφη στον κόσμο.

Θα κάνει την πρώτη του παρουσίαση στο κοινό στην έκθεση #boatandfishingshow, όπου θα μπορέσετε να το δείτε από κοντά και να ανακαλύψετε τα πλεονεκτήματα του αλουμινίου.

Σχετική εικόνα

ΤΕΛΕΥΤΑΙΑ ΝΕΑ

HELEXPO ΘΕΣΣΑΛΟΝΙΚΗ

H Έκθεση ΣΚΑΦΟΣ ΨΑΡΕΜΑ, έρχεται ξανά στο προσκήνιο με την διοργάνωση της 2ης ναυτικής έκθεσης για τη Βόρεια Ελλάδα, την Thessaloniki Boat & Fishing Show 2025 που θα πραγματοποιηθεί στο Διεθνές Εκθεσιακό & Συνεδριακό Κέντρο Θεσσαλονίκης, 17 – 19 Οκτωβρίου 2025.

ΜΕΙΝΕΤΕ ΕΝΗΜΕΡΩΜΕΝΟΙ

Γραφτείτε στο newsletter μας για να είστε συνέχεια συντονισμένοι με τα νέα της έκθεσης.

TO BE ANNOUNCED

INSURANCE SPONSOR

SILVER SPONSOR

POOL SPONSOR

ΤΙΜΩΜΕΝΗ ΠΕΡΙΟΧΗ

ΥΠΟ ΤΗΝ ΑΙΓΙΔΑ

ΜΕ ΤΗΝ ΥΠΟΣΤΗΡΙΞΗ

ΧΟΡΗΓΟΙ ΕΠΙΚΟΙΝΩΝΙΑΣ

INTERNATIONAL MEDIA PARTNER

@Copyright 2024 Boatfishing Show. All rights reserved.

Handcrafted By WhiteΗat

Continuing Coverage

US Seizes Super Yacht ‘Tango' Owned by Oligarch With Close Ties to Putin From Spanish Port

The doj alleges in a warrant the yacht should be forfeited because billionaire viktor vekselberg violated u.s. bank fraud, money laundering and sanctions statutes, by francisco ubilla, aritz parra and michael balsamo • published april 4, 2022.

The U.S. government on Monday seized a 254-foot yacht in Spain owned by an oligarch with close ties to Russian President Vladimir Putin, a first by the Biden administration under sanctions imposed after the Kremlin's invasion of Ukraine and targeting pricey assets of Russian elites.

Spain's Civil Guard and U.S. federal agents descended on the Tango at the Marina Real in the port of Palma de Mallorca, the capital of Spain’s Balearic Islands in the Mediterranean Sea. Associated Press reporters at the scene saw police going in and out of the boat.

STAY IN THE KNOW

news for free, 24/7, wherever you are. | |

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. . |

The U.S. Justice Department, which obtained a warrant from a federal judge in Washington, alleges the yacht should be forfeited for violating U.S. bank fraud, money laundering and sanctions statutes.

Superyachtfan.com , a specialized website that tracks the world’s largest and most exclusive recreational boats, values the 78-meter vessel, which carries the Cook Islands flag, at $120 million.

‘Under the Counter Diplomacy': Why Sanctioned Oligarch Roman Abramovich Is Brokering Peace in Ukraine

Turkey May Become the New Playground for Russian Oligarchs — But It's a Risky Strategy

The yacht is among the assets linked to Viktor Vekselberg, a billionaire and close Putin ally who heads the Moscow-based Renova Group, a conglomerate encompassing metals, mining, tech and other assets, according to U.S. Treasury Department documents .

All of Vekselberg’s assets in the United States are frozen and American companies are barred from doing business with him and his entities. The Ukrainian-born businessman built his fortune by investing in the aluminum and oil industries in the post-Soviet era.

Prosecutors allege Vekselberg bought the Tango in 2011 and has owned it since then, though they believe he has used shell companies to try to obfuscate his ownership and to avoid financial oversight.

They contend Vekselberg and those working for him continued to make payments using U.S. banks to support and maintain the yacht, even after sanctions were imposed on him in 2018. Those payments included a stay in December 2020 at a luxury water villa resort in the Maldives and fees to moor the yacht.

It's the first U.S. seizure of an oligarch’s yacht since U.S. Attorney General Merrick Garland and U.S. Treasury Secretary Janet Yellen assembled a task force known as REPO — short for Russian Elites, Proxies and Oligarchs — as an effort to enforce sanctions after Russia invaded Ukraine in late February.

"It will not be the last,” Garland said in a statement. “Together, with our international partners, we will do everything possible to hold accountable any individual whose criminal acts enable the Russian government to continue its unjust war.”

Vekselberg has long had ties to the U.S., including a green card he once held and homes in New York and Connecticut. He was also questioned in special counsel Robert Mueller's investigation into Russian interference in the 2016 U.S. presidential election and has worked closely with his American cousin, Andrew Intrater, who heads the New York investment management firm Columbus Nova.

Vekselberg and Intrater were thrust into the spotlight in that investigation after the lawyer for adult film star Stormy Daniels released a memo that claimed $500,000 in hush money was routed through Columbus Nova to a shell company set up by Donald Trump's personal attorney, Michael Cohen. Columbus Nova denied that Vekselberg played any role in its payments to Cohen.

Vekselberg and Intrater met with Cohen at Trump Tower, one of several meetings between members of Trump's inner circle and high-level Russians during Trump's 2016 campaign and the transition before his presidency.

The 64-year-old Vekselberg founded Renova Group more than three decades ago. The group holds the largest stake in United Co. Rusal, Russia’s biggest aluminum producer, among other investments.

Vekselberg was first sanctioned by the U.S. in 2018, and again in March of this year, shortly after the invasion of Ukraine began. Vekselberg has also been sanctioned by authorities in the United Kingdom.

The yacht sails under the Cook Islands flag and is owned by a company registered in the British Virgin Islands administered by different societies in Panama, the Civil Guard said, “following a complicated financial and societal web to conceal its truthful ownership.”

Agents confiscated documents and computers inside the yacht that will be analyzed to confirm he real identity of the owner, it said.

The U.S. Justice Department has also launched a sanctions enforcement task force known as KleptoCapture, which also aims to enforce financial restrictions in the U.S. imposed on Russia and its billionaires, working with the FBI, the U.S. Treasury and other federal agencies. That task force will also target financial institutions and entities that have helped oligarchs move money to dodge sanctions.

The White House has said that many allied countries, including Germany, the United Kingdom, France, Italy and others are involved in trying to collect and share information against Russians targeted for sanctions. In his State of the Union address on March 1, President Joe Biden warned oligarchs that the U.S. and European allies would “find and seize your yachts, your luxury apartments, your private jets.”

“We are coming for your ill-begotten gains,” he said.

Monday's capture is not the first time Spanish authorities have been involved in the seizure of a Russian oligarch’s superyacht. Officials said they had seized a vessel valued at over $140 million owned by the CEO of a state-owned defense conglomerate and a close Putin ally.

French authorities have seized superyachts, including one believed to belong to Igor Sechin, a Putin ally who runs Russian oil giant Rosneft, which has been on the U.S. sanctions list since Russia annexed Crimea in 2014.

Italy has seized several yachts and other assets.

Italian financial police moved quickly seizing the superyacht Lena belonging to Gennady Timchenko, an oligarch close to Putin, in the port of San Remo; the 65-meter (215-foot) Lady M owned by Alexei Mordashov in nearby Imperia, featuring six suites and estimated to be worth 65 million euros; as well as villas in Tuscany and Como, according to government officials.

Parra reported from Madrid and Balsamo reported from Washington.

This article tagged under:

We have received your message and will get back to you shortly.

We will call you back.

Consultation, answering your questions.

Your email:

or your telephone:

Industry leader in

sales and service of boats, ships since 1959.

Unfortunately, this boat is not available for sale. It will be removed from the website soon.

TIARA - available for sale:

Yachts with similar parameters:

Find a yacht

ALPHA TANGO - TIARA

Specifications

- All Specifications

- Detailed Information

Basic Information

Builder: TIARA Sub Category: Cruiser Model Year: 2014 Year Built: 2014 Country: United States

LOA: 45' 0" (13.72m) LWL: 45' 0" (13.72m) LOD: 45' 0" (13.72m) Beam: 14' 7" (4.44m) Max Draft: 3' 5" (1.04m) MFG Length: 45' 0" (13.72m)

Speed, Capacities and Weight

Cruise Speed: 24 Kts. (28 MPH) Cruise Speed RPM: 3100 Kts. Cruise Speed Range: 240 Max Speed: 31 Kts. (36 MPH) Max Speed RPM: 3500 Kts. Displacement: 26700 Pounds Water Capacity: 120 Gallons Holding Tank: 50 Gallons Fuel Capacity: 350 Gallons

Accommodations

Sleeps: 4 Total Heads: 1

Hull and Deck Information

Hull Material: Fiberglass

Engine Information

Engines: 2 Manufacturer: Volvo Model: IPS 600 Fuel Type: Diesel

MOTIVATED SELLER - RECENT PRICE REDUCTION - LOWEST PRICED VESSEL IN HER CLASS

Volvo ESC until 1000 hours

Engine Services Up to Date

POD Services Up to Date

Fresh Bottom Job 2019

Clean Oil Analysis Just Received

2014 45' Tiara Sovran, "Alpha Tango" has been professionally maintained to the highest standards and it shows.

The large sliding sunroof and integrated windshield provide maximum airflow along with optimum visibility and sightlines. The beautifully appointed interior includes a roomy salon with an L-shaped dinette/lounge that converts to an additional berth, and a galley with Corian countertops, two under-mount sinks and plenty of storage. Accommodations include a large master stateroom with private head and a guest stateroom with separate guest/day head.

Powered by twin Volvo IPS 600’s with joystick control for pinpoint docking and maneuverability and accompanied by a powerful, easy to use suite of Garmin electronics, “Alpha Tango” is sure to provide you with the comfort and confidence to enjoy cruising the coastline or heading for open waters.

This 2014 Tiara Sovran has been maintained to the highest standards and it shows. The large sliding sunroof and integrated windshield provide maximum airflow along with optimum visibility and sightlines. Technological advances like IPS power systems and joystick control provide pinpoint docking and maneuverability. This 45 Sovran has a very nice Touchscreen Garmin electronics package that is very user friendly.

Volvo ESC until 4/25/19 or 1000 hours.

- Teak companionway entry steps with storage underneath (accessed from guest stateroom)

- Companionway safety handrail

- Polk Audio® 3000 HT Surround Bar® with wireless subwoofer, Panasonic® Blu-Ray

- Wi-Fi DVD player, and game port

- Starboard L-shaped dining area. Includes high gloss dinette table & filler cushion for conversion to berth; short pedestals included for conversion to berth. Planned storage for the table is provided under the master stateroom berth.

- One (1) Cable TV outlet

- Two (2) 120V outlets 32" LCD TV

- Marine Air Systems® 16,000 BTU air conditioner with reverse cycle heat; controls in salon

- Corian® countertop with tile backsplash

- Two (2) S.S. undermount sinks with Corian® covers and hot/cold water faucet

- Upper and lower cabinet storage

- Recessed two-burner electric cooktop with Corian® cover and safety shut-off switch

- Microwave/convection oven

- Isotherm® over/under refrigerator/freezer, 4.6 cu. ft. refrigerator, 2.3 cu. ft. freezer (units wired AC & DC)

- Storage for cooktop and sink covers

- Exhaust fan

- Waste basket

- GFI outlets

Master Stateroom

- Full frame teak door separating the master stateroom from the salon

- Private entry to forward master head

- Manually actuated pedestal berth with pillow-top innerspring mattress

- Storage compartments under berth

- Port and starboard overhead storage cabinets

- Cedar backed hanging locker, starboard

- Two (2) reading lights, independently switched

- Marine Air Systems® 6,000 BTU air conditioner with reverse cycle heat; controls in the stateroom.

- Two (2) 120V outlets

Master Head

- Full frame door with entry from the master stateroom

- Fiberglass stall shower with integrated seat, glass shower door and shower sump pump

- Corian ® vanity countertop with glass vessel sink

- Lighted upper medicine cabinet with mirror

- Lower vanity storage

- Vacuflush ® toilet

- Air conditioning discharge/vent (controls in master stateroom)

Guest Stateroom

- Full frame door with entry from the salon/galley

- Entry to day/guest head

- Twin berths with deep quilted innerspring mattresses

- Cedar-backed hanging locker, port. Includes removable shelves and closet rod for hangers.

- Storage cabinet in forward bulkhead and access to storage under companionway steps

- Upholstered headboards

- Corian® vanity countertop with glass vessel sink

- Marine Air Systems® 6,000 BTU air conditioner with reverse cycle heat; controls in guest stateroom.

- Emergency egress through upper cockpit floor

Guest/Day Head

- Full frame door with entry from guest stateroom

- Fiberglass shower with sump pump and shower curtain

- Vacuflush ® toilet with cover

Instrumentation, Safety & Equipment

- Tiara custom 12V DC and 120V/240V AC electrical system with master distribution panel in the lower cockpit

- One (1) 120V/240V AC 50 amp 65' dockside power cord with Glendinning® cable recoiler and adapter for 30 amp service

- Cable TV inlet/outlets with 65' dockside power cord

- TV and AM/FM antennas

- Onan® 11.5kw diesel generator with sound shield and helm indicator

- Battery charger (1) 80 amp

- Emergency battery interconnect between each engine bank and the house bank

- Electrical bonding system

- Zincs - transom and trim tabs. Volvo galvanic corrosion system for drive units

- Volvo Penta® electronic engine controls and steering system

- Volvo Penta® IPS Joystick Plus control

- Volvo Penta® digital engine monitoring system (7" color display) includes fuel level and rudder angle indicators. Separate volt meters for house & engine battery banks in the distribution panel.

- Ritchie® SuperSport SS-2000 compass

- High output alternators, 115 amps

- Engine room acoustical insulation with overhead fiberglass liner and 12V lighting

- Electric engine hatch actuator

- Racor® fuel filters/water separators for engines and generator

- Raw water intake strainers on engines and generator

- Vibration mounts for engines

- Plate mounted, thru-bolted engine system

- Three-port oil changing system for main engines and generator

- One (1) engine room blower, 250 CFM

- Three (3) automatic/manual bilge pumps with monitors at helm, 2000 GPH each: One (1) forward, one (1) mid engine room, and one (1) aft engine room

- One (1) composite fuel tank with in-line fuel vent filters and fuel shut-off valve on top of tank

- Dockside water inlet

- One (1) fresh water tank, 120 gallons

- Fresh water pressure system with Shurflo ® variable speed pump, five (5) GPM

- One (1) holding tank, 50 gallons, with deck discharge and holding tank vent filter

- Fresh water tank/holding tank monitor

- One (1) water heater with exchanger, 20 gallons

- Kahlenberg ® chrome dual trumpet air horn

- USCG/international LED navigation lighting

- NMMA certified using ABYC standards

Lower Cockpit

- Day hatch for engine room access

- Actuated aft cockpit floor hatch for engine room access

- Aft facing seating

- Wrap-around lounge with drink holders and storage below

Electronics

- 2 Garmin 8212 12" displays

- Garmin VHF 200

- Garmin Radar GRM404 Open Array

- Garmin Transducer Depth smart ducer

- Garmin Auto Pilot GHP 10

- ACR-RL 100 Led Searchlight

- Lumitec underwater lights, blue

- Macerator System for waste

- Transom Platform Seat

- Hull color Imron Metallic

- Swim Platform Transom Lift

- Solid Teak Cabin Sole

Owners Personal Property not included

Learn more on the “Search results”

To learn more on the “Search results” or to get advice on how to buy or sell a yacht or get a great price for a yacht charter, please call: +1-954-274-4435 (USA)

Only deal with professionals!

Το πιο ολοκληρωμένο περιοδικό για το ψάρεμα και το σκάφος!

Γιώργος Πολυχρονίου

Σκάφος ΑΤ 35: Το πρώτο Ελληνικό φουσκωτό κατασκευασμένο από 100% ναυπηγικό αλουμίνιο

Η ALPHA TANGO YACHTS σχεδίασε και κατασκεύασε το AT 35, ένα καινοτόμο ελληνικό 11μετρο φουσκωτό σκάφος κατασκευασμένο από 100% ναυπηγικό αλουμίνιο.

Ο Γιάννης και ο Μάρκος, ιδρυτές της Alpha Tango, γνωρίστηκαν το 2013 σαν συμφοιτητές στο πανεπιστήμιο Strathclyde της Γλασκόβης όπου σπούδαζαν μηχανολόγοι ναυπηγοί. Το όραμα τους ήταν να σχεδιάσουν ένα μοναδικό σκάφος και να το βγάλουν σε παραγωγή.

Πρώτη παρουσίαση του ΑΤ 35 της Alpha Tango Yachts στην έκθεση Boat & Fishing Show 2024 , 7 -10 Μαρτίου, MEC Παιανίας.

Δέκα χρόνια μετά, αποφάσισαν να πραγματοποιήσουν το όνειρο τους και να συνεργαστούν στον σχεδιασμό του πρώτου σκάφους με την υπογραφή της εταιρίας τους. Κύριος στόχος τους ήταν να δημιουργήσουν ένα σκάφος γρήγορο, ελαφρύ αλλά στιβαρό, που να προσφέρει σχεδιαστική ελευθερία στην διαρρύθμιση και την λειτουργικότητα του, ώστε να να προσαρμόζεται στις ανάγκες του κάθε πελάτη.

Έτσι λοιπόν γεννήθηκε το AT 35, ένα από τα λίγα αλουμινένια σκάφη με διπλό στεπ και έδρα στην βάση του V και το πρώτο που κατασκευάστηκε στην Ελλάδα. Έχει ολικό μήκος 10.70m. Ο σχεδιασμός της ιδιαίτερης γάστρας του ΑΤ 35 βασίζεται στις απαιτητικές θάλασσες του Αιγαίου, ενώ έχει αγωνιστικές επιρροές.

Με 24 μοίρες στον καθρέφτη, τρία μεγάλα παρατροπίδια που διατρέχουν την γάστρα σε όλο τη μήκος της και την εμβληματική ψηλή του πλώρη, το ΑΤ 35 δεν μπορεί παρά να εντυπωσιάσει, τόσο σε όψη όσο και σε απόδοση. Κατασκευαστικά το ΑΤ 35 είναι μελετημένο για στρατιωτική χρήση, πράγμα που ισούται με ψηλές ταχύτητες με μεγάλα φορτία. Συγκεκριμένα ο καθρέφτης του μπορεί να σηκώσει μέχρι 1.500 άλογα, ενώ το σκάφος είναι μελετημένο για ταχύτητες άνω των 90 κόμβων με φουλ φορτία.

Προχωρώντας προς στο κατάστρωμα είναι εμφανές ότι η αισθητική και κατανομή του χώρου θυμίζει αυτή ενός 12μετρου σκάφους, κάτι που δημιουργεί μια ενδιαφέρουσα αντίθεση με την βαρέου τύπου κατασκευής της γάστρας. Η αξιοποίηση του χώρου κατά αυτόν τον τρόπο προσφέρει δυνατότητα μεταφοράς 12 καθήμενων. Όλα τα έπιπλα του σκάφους είναι σχεδιασμένα για να ζουν σε αρμονία με την σχεδιαστική γραμμή του, ενώ τα custom αλουμινένια καθίσματα τραβάνε τα βλέμματα.

Στην πλώρη βρίσκεται ένας μεγάλος καναπές, μήκους 2.10 μέτρων ο οποίος από κάτω φιλοξενεί κρεβάτι 2 ατόμων για τους λάτρεις του ναυτικού Camping. Η εμβληματική κονσόλα του, περιέχει ένα full size WC και μεγάλο αποθηκευτικό χώρο μήκους 1.80m και ύψους 1.75m. Πίσω από την κονσόλα βρίσκονται δυο σειρές καθισμάτων με αποθηκευτικούς χώρους από κάτω και ένα wet bar με νιπτήρα, ψυγείο, παγομηχανή και δυνατότητα εγκατάστασης κουζίνας υγραερίου. Τα παραπάνω προστατεύονται από μεγάλο Hard Top μήκους 2.4 μέτρων.

Στην πρύμνη συναντάμε 2 αντικριστούς καναπέδες 3 ατόμων έκαστος, με αποσπώμενο τραπέζι αναμεσά τους- μια από τις πολλές επιλογές διαρρύθμισης που προσφέρει η εταιρία. Η Alpha Tango Yachts προτείνει και πρυμναίους καναπέδες με διαρρύθμιση «Π», που θα μπορούν να καθίσουν 8 άτομα. Αυτό κάνει τους καθήμενους να ανέρχονται στους 14, γεγονός σπάνιο για 10μέτρο φουσκωτό. Αξιοσημείωτο είναι πως η διαρρύθμιση του deck είναι πλήρως διαμορφώσιμη, χωρίς εξτρά κόστος.

Η Alpha Tango Yachts έχει σχεδιάσει το ΑΤ 35 σε εκδόσεις Open και Cabin, και με πρόωση τόσο από εξωλέμβιους όσο και από έσω/έξω κινητήρες. Στο άμεσο μέλλον αναμένεται να παρουσιαστούν και τα επόμενα μοντέλα της εταιρίας, το ΑΤ 40, με ολικό μήκος τα 12.00m (και φοροαπαλλαγή για επαγγελματική χρήση), το 9 μέτρο ΑΤ30 καθώς και η νέα σειρά, POWER η οποία θα απαρτίζεται από το PR30, το PR 35 και το PR 40 αντίστοιχα.

Γιατί αλουμίνιο:

– Ελαφρύ: Τα Αλουμινένια σκάφη είναι γνωστά για την ελαφριά κατασκευή τους, και το ΑΤ 35 έρχεται για να το επιβεβαιώσει, με το εκτόπισμα του χωρίς υγρά να ανέρχεται στους μόλις 2.2 τόνους.

– Στιβαρή κατασκευή : Παρά την ελαφριά φύση τους, αλουμινένια σκάφη είναι στιβαρά και προσφέρουν εξαιρετική δομική ακεραιότητα, παρέχοντας σταθερότητα και ασφάλεια στο νερό. Ειδικότερα, το ΑΤ 35 είναι κατά 40% πιο άκαμπτο από αντίστοιχα πολυεστερικά σκάφη.

– Ανθεκτικό στη διάβρωση: Το ναυπηγικό αλουμίνιο είναι φυσικά ανθεκτικό στη διάβρωση, εξασφαλίζοντας ένα ανθεκτικό και μακράς διαρκείας σκάφος που μπορεί να αντέξει στις πιο αντίξοες συνθήκες θαλασσινών περιβαλλόντων, πράγμα που επιβεβαιώνει η μακροχρόνια χρήση του συγκεκριμένου υλικού στα επιβατικά πλοία.

– Σχεδιαστική Ευελιξία: Τα αλουμινένια σκάφη δεν κατασκευάζονται με καλούπι όπως τα πολυεστερικά: αυτό εγγυάται ότι κάθε σκάφος της Alpha Tango yachts είναι ξεχωριστό και 100% χειροποίητο, πράγμα που σημαίνει ότι η διάταξη του καταστρώματος αλλά και των λεπτομερειών είναι 100% διαμορφώσιμα.

– Εύκολα Επισκευάσιμο: Το αλουμίνιο είναι ένα υλικό που δεν παρουσιάζει ρωγμές, παρόλα αυτά εάν το σκάφος εμπλακεί σε ατύχημα, αρχικά επισκευάζεται τοπικά εντός λίγων λεπτών με μια ειδική πλαστελίνη, αποτρέποντας την εισροή υδάτων άμεσα, και έπειτα η επιδιόρθωση γίνεται τοπικά μόνο στο σημείο της ζημιάς χωρίς να επηρεάζεται η δομή του σκάφους, σε αντίθεση με τον πολυεστέρα που σε περίπτωση ρωγμής πρέπει να εντοπιστεί η έκταση της, και να επιδιορθωθεί πολύ μεγαλύτερο κομμάτι, επηρεάζοντας την δομική ακεραιότητα του σκάφους.

Πληροφορίες:

web: www.alphatangoyachts.com

Διαβάστε Επίσης

© Copyright 2017 Boatfishing. All rights reserved.

Handcrafted By Whitehat

The Dividends Don't Matter, Except They Do

- Dividends matter in practice, despite academic theories suggesting otherwise.

- Dividends align incentives between management and shareholders, optimizing free cash flow growth and reducing agency costs.

- Dividend investing eliminates sequence risk and provides a reliable source of income without selling principal assets.

- I do much more than just articles at The Dividend Freedom Tribe: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Written by Sam Kovacs.

Introduction

Dividends shouldn't matter.

And under a set of assumptions designed by academics, they really don't. Except those assumptions don't reflect the world we actually live in, and as we'll discuss in this article, dividends do matter.

It is a case which can be best understood by one of my all-time favorite Yogi Berra quotes:

In theory there is no difference between theory and practice. In practice there is.

The idea that dividends are not essential is not new. Modigliani & Miller, two university professors who were employed at the Carnegie Mellon University in the 1950s, came up in 1961 with what became known as the “ dividend irrelevance theorem. ”

Given that they came up with it first, I will only pick on them, and not anyone who has parroted their ideas since.

The idea is simple: You own the company. So whether the company takes your cash out of the company account and puts it into yours, or leaves it in the company account, should be the same.

The academics theorized that on the day a stock goes ex-div, it will drop by the amount of the dividend to be paid. They also theorized that there are no agency costs (incentives between managers and shareholders are perfectly aligned). They also theorized that markets are efficient, and therefore the returns management could get investing the cash vs. investors investing the dividend, would only differ based on beta.

So if there are ex-dividend adjustments (the stock price goes down after the stock goes ex-div), and if we live in an imagined world where managers and shareholders were perfectly aligned, and nobody had any “edge” in the markets other than “risk premiums” then sure I'll agree: dividends don't matter.

But if like me, you've stepped out of a university classroom, and ventured into the world as it is, rather than as it is theorized to be, you know that the above propositions are ludicrous.

The only one that shows some signs of existence, is the ex-div adjustment theory. It should be expected by reasonable, rational people that the stock should go down by the amount of the dividend. I'll talk about this more later.

We'll ask 4 simple questions that debunk the idea that dividends don't matter throughout the rest of this article:

Who is the better allocator?

Where are the customers yachts, up for a game of musical chairs or would you prefer a hot dog, what about total returns.

The first assumption which needs to be debunked is this idea that the markets are efficient. I won't spend much time here, as anybody still believing this in 2024 doesn't deserve a seat at the table.

The idea that the CAPM model (developed by the two academics cited above) which says that the only source of return is risk, doesn't make sense to me.

I certainly didn't feel that when 3 months ago, we said, “Buy Goldman Sachs ( GS )” at $404, we were taking on more risk than investing in an S&P 500 index fund ( SPY ), which at the time was already at a 27x P/E multiple.

Yet for dividends to not matter, you'd first have to believe market efficiency.

GS vs SPY (Dividend Freedom Tribe)

Because if you don't believe in market efficiency, you have to ask the very honest question:

Who is the better capital allocator?

If management has a better use of the funds than you do, then the cash is best kept in the company. If you can get a better return, then it is better if you receive the cash as a dividend.

When you invest in a stock, you're entrusting management to make use of your money to generate a return which is better than you can do by yourself with your money.

You expect management to consider all great moat widening opportunities to redeploy cash. If there are accretive uses of that cash, you want management to deploy it. Once those have been exhausted, you'd like to see that cash come back in the form of dividends or share repurchases. (Otherwise, you set yourself up for a lot of trouble, as we'll see later).

To further drive forward this point, let's go back to Warren Buffett's 2012 letter to shareholders of Berkshire Hathaway ( BRK.A , BRK.B ). (here's the link to the hosted pdf on their site).

The emphasis is mine.

A number of Berkshire shareholders – including some of my good friends – would like Berkshire to pay a cash dividend. It puzzles them that we relish the dividends we receive from most of the stocks that Berkshire owns, but pay out nothing ourselves. So let’s examine when dividends do and don’t make sense for shareholders. A profitable company can allocate its earnings in various ways (which are not mutually exclusive). A company’s management should first examine reinvestment possibilities offered by its current business – projects to become more efficient, expand territorially, extend and improve product lines or to otherwise widen the economic moat separating the company from its competitors. I ask the managers of our subsidiaries to unendingly focus on moat-widening opportunities , and they find many that make economic sense. But sometimes our managers misfire. The usual cause of failure is that they start with the answer they want and then work backwards to find a supporting rationale. Of course, the process is subconscious; that’s what makes it so dangerous. [...] Despite such past miscues, our first priority with available funds will always be to examine whether they can be intelligently deployed in our various businesses. Our record $12.1 billion of fixed-asset investments and bolt- on acquisitions in 2012 demonstrate that this is a fertile field for capital allocation at Berkshire. And here we have an advantage: Because we operate in so many areas of the economy, we enjoy a range of choices far wider than that open to most corporations. In deciding what to do, we can water the flowers and skip over the weeds. Even after we deploy hefty amounts of capital in our current operations, Berkshire will regularly generate a lot of additional cash. Our next step, therefore, is to search for acquisitions unrelated to our current businesses. Here our test is simple: Do Charlie and I think we can effect a transaction that is likely to leave our shareholders wealthier on a per-share basis than they were prior to the acquisition? I have made plenty of mistakes in acquisitions and will make more. Overall, however, our record is satisfactory, which means that our shareholders are far wealthier today than they would be if the funds we used for acquisitions had instead been devoted to share repurchases or dividends. But, to use the standard disclaimer, past performance is no guarantee of future results. That’s particularly true at Berkshire: Because of our present size, making acquisitions that are both meaningful and sensible is now more difficult than it has been during most of our years.

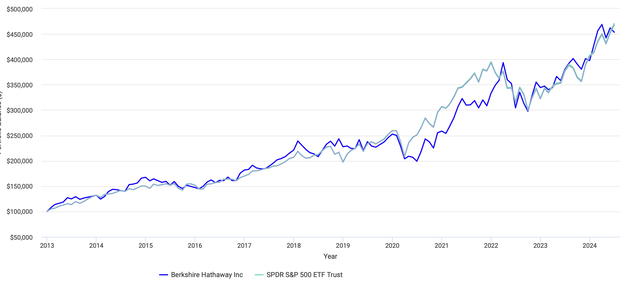

Since then, Berkshire has done as well as the S&P 500, which given their size and scale and difficulty in generating alpha that comes from it, is not bad at all.

Portfolio visualizer

Discussing Berkshire performance is not the point.

As a portfolio manager, you are a mini Warren Buffett, right? You don't get to acquire companies outright (I assume) but you get to pick which ones you own shares of.

I like Realty Income ( O ), but ultimately, I have a lot more flexibility than they do regarding what I can invest in. They can only invest in a very narrow mandate. I believe they do a good job of it. But they know they're going to spit off more cash than they need to grow. So they're structured as a REIT and return the cash to me in the form of dividends.

I get to choose where the cash goes. Paying a dividend sends an extremely positive signal about the character of management.

It says: “Folks we looked, we tried, but we came to the conclusion that we're generating more cash than we can redeploy at rates which meet our IRR benchmarks, so take some of the cash back” .

I can use that cash to buy a piece of another business which will be accretive to my portfolio.

Albert Bourla of Pfizer ( PFE ) has a much narrower subset of opportunities to invest its cashflows into. So it makes sense for them to return the excess to you & me. Otherwise, you run into trouble.

Like when AT&T ( T ) purchased DirecTV and Time Warner ( WBD ) in 2015 and 2018. This was supposed to turn the company into this media giant. Synergies never showed up, and they ended up spinning off the media assets, at great expense to shareholders. Dividend was eventually cut in following years.

The idea that “one in the hand is worth two in the bush” clearly depends on whose bush you're leaving the two in.

This question is inspired by the book of the very same title, which was published in 1940 by Fred Schwed.

The title comes from a story about a visitor to New York who, after being shown all the big yachts belonging to bankers and brokers, asks: “Where are the customers' yachts?”

The implication was that the financial professionals had prospered at the expense of their clients.

It's the perfect metaphor of agency costs, which is the idea that the incentives of management and shareholders aren't always perfectly aligned.

It comes down to incentives. Doesn't it always? Like Charlie Munger said:

Never, ever, think about something else when you should be thinking about the power of incentives.

Well, if management have carte blanche when it comes to the use of cashflows, they have an incentive to self-serve.

They might make acquisitions which are “fun” to them or boost their ego, but destroy shareholder value, as we saw above with the AT&T example. This empire building is a dangerous game which needs to be approached by shrewd management teams.

But worse than this, is when management start seeing the company's coffers as their money to squander.

At the turn of the century, Tyco's then CEO Dennis Kozlowski was notorious for his extravagant spending, which included in 2002 a $2mn birthday party for his wife. He and the rest of the C-suite were accused of looting the company of millions of dollars.

The modern version of this has been WeWork ( OTC:WEWKQ ). Founder Adam Neumann's extravagant lifestyle, including private jets and luxury properties, and dubious accounting practices, were maybe “cues” that the company was being mismanaged.

Now there are very well managed companies that do not pay dividends, do not get me wrong.

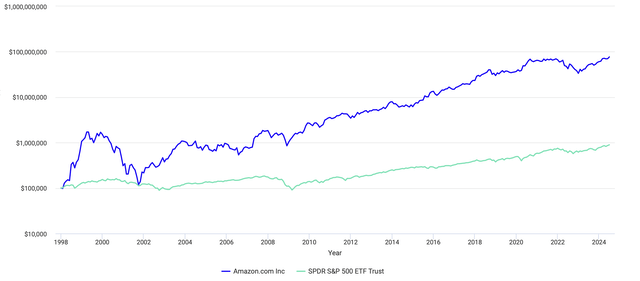

We talked about Berkshire, but there are many others. Jeff Bezos' Amazon ( AMZN ) jumps to mind.

Never paid a dividend, but their capital allocation cannot be disputed, nor can the returns they have gotten for their shareholders.

Portfolio Visualizer

But remember this, here we have just shown 2 extremes of capital stewardship. The very good players on one side, and the very bad players on the other.

The truth is that there is most likely a gradient of how well managers manage client capital. For example, they might mostly be very reasonable, but allow themselves a few luxuries. Or maybe they make an acquisition or an investment which won't rock the boat, won't cost much, but will be a “pet project” for them.

Having a dividend reduces this tendency.

If management commits to a dividend, it creates the expectation of a dividend. If it grows this dividend every year, it creates the expectation of this growing dividend.

Not only has this cash gone out of their hands and into ours, but they will need to come up with more cash next year.

This naturally aligns them towards optimizing free cashflow growth over the years.

It's not foolproof, but it reduces agency costs.

Curiously, then a dividend contributes towards creating the environment required (aligned incentives) for the dividend to be irrelevant.

Therefore, it cannot be irrelevant.

Up to now, we have really looked at microeconomics and why a dividend makes sense to maximize shareholder value. Like Buffett pointed out, it makes sense to pay a dividend if there are no accretive organic investments or bolt-on acquisitions. This helps align incentives, as we've just seen. But there's more.

Dividends mostly replace and delete sequence risk.

Sequence risk is basically musical chairs for your returns.

You know how in musical chairs, whether you win or lose depends mostly on whether you're in front of the chair at the right time?

Well, sequence risk highlights the fact that if you're going to create an “artificial dividend” by selling shares, how well your retirement goes depends on when an adverse unpredictable market outcomes occurs.

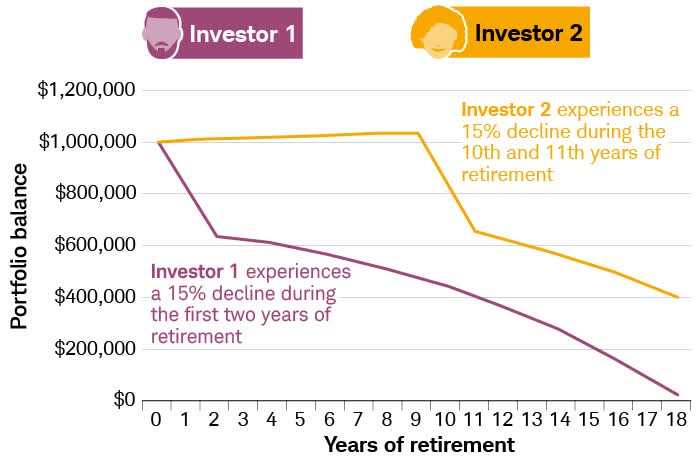

A Charles Schwab article shows this well with a nice chart. The article explains:

The chart below shows what happens to two investors who start with $1 million portfolios, take initial withdrawals of $50,000 (with 2% inflation adjustments each year after), but then experience a 15% drop in portfolio value. The investor who faces such a decline early in retirement runs out of money far sooner than an investor who does so later.

Charlse Schwab

As you can see, the sequence risk shows that if you experience adverse market conditions early in retirement, potentially, you're screwed if you depend on “artificial dividends” (aka: selling stocks to cover living expenses).

I'll demonstrate why this isn't the case when you're a dividend investor.

Again, in theory it shouldn't because of the ex-dividend adjustments that we'd expect, but the real word is far disconnected from the practice.

The academics and closed eyes investors will tell you that because of ex-dividend adjustments, there is no difference between taking an artificial dividend or paying a real one.

If you have $100K in stocks they say, and sell $5K, you have $95K left. If you have $100K in stocks, and they pay a $5K dividend, the value should drop to $95K.

That's the idea of an ex-dividend adjustment. Is it a thing? I'll look at some of my higher yielding stocks, recent dividend payments:

- W. P. Carey ( WPC ) went ex-div on June 28th. A dividend of $0.87 was to be paid. The stock closed on June 27th at $55.65 and opened on June 28th at $55.05. There was a $0.6 drop.

- Blue Owl Capital Corp ( OBDC ) also went ex-div on June 28th. A dividend of $0.37 was to be paid. The stock closed at $15.2 and opened at $15.35, a $0.15 gain.

- Alexandria Real Estate ( ARE ) also went ex-div on June 28th. A dividend of $1.30 was to be paid. The stock closed at $116.4 and opened at $115.76. An $0.76 drop.

- Philip Morris ( PM ) went ex-div on June 21st. It actually declined the exact $1.30 that it paid out in dividend. I had to do a lot of cherry-picking to find this example.

Sometimes it goes up, sometimes it goes down. There is some adjustment made, which is to be expected, but as we'll see, this doesn't make dividends irrelevant, far from it.

Humans often get confused when things get complicated, and when they get confused, they have certain biases which hijack their thinking.

Making the points easier to understand puts one back on the road of clear-headed thinking.

Let's forget about stocks and say you own hot dog stands. Let's say that you own 20 hot dog stands, and the market currently values each of them at $50K. Your total hot dog stand business is worth $1mn.

You need $50K to cover your living expenses each year.

At the end of the year, the hot dog business has free cashflow of $50K, after you've made all maintenance and improvement capital decisions.

You have two options.

- Option a: you can choose to pay yourself that $50K as a dividend and spend it.

- Option b: you can leave the $50K in the company and sell 1 of the hot dog stands for $50K.

Which makes the most sense to you?

If you sell a hot dog stand, you're now left with 19. Sure, the cash is still in the account, but can you really put it to use to grow the business more between now and next year when you need it again?

What if the market for hot dog stands crashes, and you'd have to sell 2 hot dog stands to get that $50K you require?

If you took the dividend, you'd still have 20 stands, and presumably they'd generate the same profit next year, and you'd be able to take another dividend next year.

If you retire when you are in a position to live off dividends, that the dividends are being paid from free cashflow of the businesses you own, then dividend investing does away with sequence risk.

Artificial dividends are killing the goose that laid the golden egg.

You're selling your principal, which is gradually reducing your claim on assets. This is a massive bet that both a) growth of the businesses you're invested in and b) the market assessment of the value of the business, continue.

It's a risk. It's called sequence risk. Once again, dividend investing does away with it because it presents you with an opportunity to make smart liquidity and cashflow management decisions.

I don't know about you, but the idea of dancing my portfolio down to $0 with the idea that I'll reach $0 on the day of my death sounds a lot worse than a portfolio of stocks that pay me a cash payment that matches my expenses in a way that I never need to sell the principal.

Any CFO worth his salt will make sure that the organization doesn't run into a cashflow problem. A cashflow problem is simply when you have more cash coming out than you have coming in.

When you're selling stock to meet retirement expenses, your cashflow is coming from that sale of stock. As we've seen, depending on whether the market went up or down early on in retirement will have a big impact on whether this year's cashflow will hurt next year's cashflow. As you can see on the Schwab chart, the value of the portfolio heads to zero.

When you're using dividends to

One objection dividend investing gets is that “investors shouldn't focus on dividends but instead on total returns”.

This is like if we were to say to a young man buying a suit: don't focus on the choice of fabric, the important thing is for the suit to look good.

It makes no sense. You can have a good-looking suit with a fabric which pleases you.

Of course, total returns should be the objective. I don't disagree, and will back up that statement in just a minute. But this objection is a false dichotomy, in that it says: you can either focus on dividends or on total returns, you choose.

In T. Harv Eker's book “The Secrets Of The Millionaire Mind”, he identifies either/or behavior as a mental construct of poor and unsuccessful people.

He implores us that “when presented with either/or, ask how can I have both?”

Can I have dividends which will meet my personal expenses in retirement AND get satisfactory total returns?

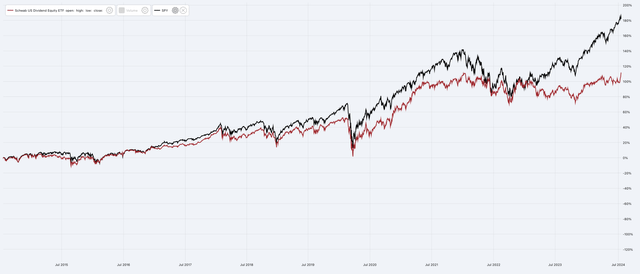

The naysayers will use the Schwab U.S. Dividend Equity ETF™ ( SCHD ) as an example that dividend investing is inferior.

SCHD vs SPY (Dividend Freedom Tribe)

Once again, this is misleading. It only proves that SCHD might be inferior. I have repeated this every time.

I always believe in total returns. In fact, we are value investors who use dividend investing because we believe it is the system that best matches the cashflow reality of individual investors.

Our motto is “buy low, sell high, get paid to wait.” We're looking to buy when undervalued, sell when overvalued, and build a massive stream of dividends in the process.

It is our belief that we can do this AND beat the market, which we'll loosely define as the S&P 500.

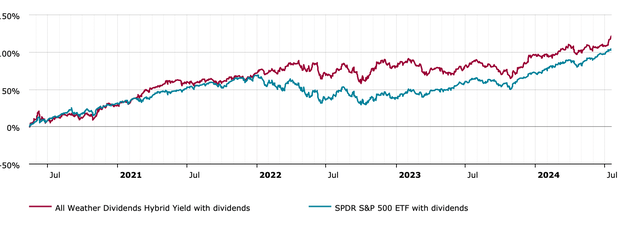

The track record which I have to show with this strategy, which is incontestable because it is traced on Seeking Alpha, can be found in the model portfolio I created here in May 2020 . I now call it our Hybrid All Weather Dividend Portfolio.

As we said then:

A secondary goal will also be to beat the S&P 500 in terms of total returns over the 10-year period. Failing to do so would make our efforts just an expensive hobby, as at the end of the decade we could just convert an S&P 500 ETF into dividend stocks and be better off, were we to fail.

We put time and resources into coding a time weighted portfolio tracker so that we could chart the exact performance of this portfolio against that of different indices, to make sure that over time, we were beating the market.

So far, so good.

Hybrid vs SPY (Dividend Freedom Tribe)

The portfolio has returned a total 121% vs. the S&P 500s 100.5% total return over the period. That's an extra 3% annualized rate of compounding or so, which, as I'm sure you can appreciate, is a big deal.

We did as well in 2020 and 2021, much better in 2022, worse in 2023 and most of H1 2024, and since June, we've started again doing much better.

We don't own a single one of the Mag 7 stocks, which means our performance will, of course, look quite different. I apologize for only being able to present 4 years of data here, but I've been writing on SA for over 9 years. The chances that I'm still writing here 6 years from now are quite high, and I'll hopefully be able to revisit our mandate of beating the S&P 500 while generating many more dividends.

This is to say, dividend investing and maximizing total returns aren't mutually exclusive.

Maximizing total returns and bad stock picking are, but that has nothing to do with whether a stock pays a dividend.

Conclusion: We don't live in a Barbie world

I'm a Barbie girl, in the Barbie world. Life in plastic, it's fantastic. You can brush my hair, undress me everywhere. Imagination, life is your creation -Aqua.

If we lived in a fake world, where everyone was rational, markets were efficient, agency costs didn't exist, returns were linear year in year out, and everyone acted in favor of the common good, then sure, Modigliani & Miller would have been right, dividends would be irrelevant.

But that just isn't the world we live in. Life isn't in plastic, you most certainly cannot brush my hair, nor would I advise you to attempt undressing me anywhere.

Oh, and dividends, they matter.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want to See Your Dividend Income Snowball...

The first thing you want to do is hit the orange “follow” button, so we can let you know when we write more dividend related articles.

But if you want our help in building a massive dividend income snowball, join the Dividend Freedom Tribe!

Click here to get a free trial.

This article was written by

We're a father & son team who take pride in providing some of the very best dividend research for investors like you.

We work hard, we leverage our skills and expertise to get an edge, and more importantly, we figure out how to get an edge on the big boys.

You won't get any white-shoe, silk gloved advice which is catered only to institutional investors.

Our dividend investing method simply works.

"Buy Low, Sell High, Get Paid To Wait" is our investing motto.

Together we lead the investing group The Dividend Freedom Tribe where we help investors achieve their retirement dreams of financial independence.

We cover a universe of 120 top dividend . Features include: a training course, three model portfolios, weekly in depth analysis, buy/watch/sell lists, access to MAD Dividends Plus for free, as well as a community of lively dividend investors available via chat.

Learn more.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GS O PFE OBDC PM ARE WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Related stocks.

| Symbol | Last Price | % Chg |

|---|---|---|

| - | - | |

| The Goldman Sachs Group, Inc. | ||

| - | - | |

| SPDR® S&P 500® ETF Trust | ||

| - | - | |

| Berkshire Hathaway Inc. | ||

| - | - | |

| Berkshire Hathaway Inc. | ||

| - | - | |

| Realty Income Corporation | ||

Related Analysis

Trending analysis, trending news.

Σκάφος ΑΤ 35: Το πρώτο Ελληνικό φουσκωτό κατασκευασμένο από 100% ναυπηγικό αλουμίνιο

- 1 Μαρτίου, 2024

Ο Γιάννης και ο Μάρκος, ιδρυτές της Alpha Tango, γνωρίστηκαν το 2013 σαν συμφοιτητές στο πανεπιστήμιο Strathclyde της Γλασκόβης όπου σπούδαζαν μηχανολόγοι ναυπηγοί. Το όραμα τους ήταν να σχεδιάσουν ένα μοναδικό σκάφος και να το βγάλουν σε παραγωγή.

Πρώτη παρουσίαση του ΑΤ 35 της Alpha Tango Yachts στην έκθεση Boat & Fishing Show 2024 , 7 -10 Μαρτίου, MEC Παιανίας.

Δέκα χρόνια μετά, αποφάσισαν να πραγματοποιήσουν το όνειρο τους και να συνεργαστούν στον σχεδιασμό του πρώτου σκάφους με την υπογραφή της εταιρίας τους. Κύριος στόχος τους ήταν να δημιουργήσουν ένα σκάφος γρήγορο, ελαφρύ αλλά στιβαρό, που να προσφέρει σχεδιαστική ελευθερία στην διαρρύθμιση και την λειτουργικότητα του, ώστε να να προσαρμόζεται στις ανάγκες του κάθε πελάτη.

Έτσι λοιπόν γεννήθηκε το AT 35, ένα από τα λίγα αλουμινένια σκάφη με διπλό στεπ και έδρα στην βάση του V και το πρώτο που κατασκευάστηκε στην Ελλάδα. Έχει ολικό μήκος 10.70m. Ο σχεδιασμός της ιδιαίτερης γάστρας του ΑΤ 35 βασίζεται στις απαιτητικές θάλασσες του Αιγαίου, ενώ έχει αγωνιστικές επιρροές.

Με 24 μοίρες στον καθρέφτη, τρία μεγάλα παρατροπίδια που διατρέχουν την γάστρα σε όλο τη μήκος της και την εμβληματική ψηλή του πλώρη, το ΑΤ 35 δεν μπορεί παρά να εντυπωσιάσει, τόσο σε όψη όσο και σε απόδοση. Κατασκευαστικά το ΑΤ 35 είναι μελετημένο για στρατιωτική χρήση, πράγμα που ισούται με ψηλές ταχύτητες με μεγάλα φορτία. Συγκεκριμένα ο καθρέφτης του μπορεί να σηκώσει μέχρι 1.500 άλογα, ενώ το σκάφος είναι μελετημένο για ταχύτητες άνω των 90 κόμβων με φουλ φορτία.

Προχωρώντας προς στο κατάστρωμα είναι εμφανές ότι η αισθητική και κατανομή του χώρου θυμίζει αυτή ενός 12μετρου σκάφους, κάτι που δημιουργεί μια ενδιαφέρουσα αντίθεση με την βαρέου τύπου κατασκευής της γάστρας. Η αξιοποίηση του χώρου κατά αυτόν τον τρόπο προσφέρει δυνατότητα μεταφοράς 12 καθήμενων. Όλα τα έπιπλα του σκάφους είναι σχεδιασμένα για να ζουν σε αρμονία με την σχεδιαστική γραμμή του, ενώ τα custom αλουμινένια καθίσματα τραβάνε τα βλέμματα.

Στην πλώρη βρίσκεται ένας μεγάλος καναπές, μήκους 2.10 μέτρων ο οποίος από κάτω φιλοξενεί κρεβάτι 2 ατόμων για τους λάτρεις του ναυτικού Camping. Η εμβληματική κονσόλα του, περιέχει ένα full size WC και μεγάλο αποθηκευτικό χώρο μήκους 1.80m και ύψους 1.75m. Πίσω από την κονσόλα βρίσκονται δυο σειρές καθισμάτων με αποθηκευτικούς χώρους από κάτω και ένα wet bar με νιπτήρα, ψυγείο, παγομηχανή και δυνατότητα εγκατάστασης κουζίνας υγραερίου. Τα παραπάνω προστατεύονται από μεγάλο Hard Top μήκους 2.4 μέτρων.

Στην πρύμνη συναντάμε 2 αντικριστούς καναπέδες 3 ατόμων έκαστος, με αποσπώμενο τραπέζι αναμεσά τους- μια από τις πολλές επιλογές διαρρύθμισης που προσφέρει η εταιρία. Η Alpha Tango Yachts προτείνει και πρυμναίους καναπέδες με διαρρύθμιση «Π», που θα μπορούν να καθίσουν 8 άτομα. Αυτό κάνει τους καθήμενους να ανέρχονται στους 14, γεγονός σπάνιο για 10μέτρο φουσκωτό. Αξιοσημείωτο είναι πως η διαρρύθμιση του deck είναι πλήρως διαμορφώσιμη, χωρίς εξτρά κόστος.

Η Alpha Tango Yachts έχει σχεδιάσει το ΑΤ 35 σε εκδόσεις Open και Cabin, και με πρόωση τόσο από εξωλέμβιους όσο και από έσω/έξω κινητήρες. Στο άμεσο μέλλον αναμένεται να παρουσιαστούν και τα επόμενα μοντέλα της εταιρίας, το ΑΤ 40, με ολικό μήκος τα 12.00m (και φοροαπαλλαγή για επαγγελματική χρήση), το 9 μέτρο ΑΤ30 καθώς και η νέα σειρά, POWER η οποία θα απαρτίζεται από το PR30, το PR 35 και το PR 40 αντίστοιχα.

Γιατί αλουμίνιο:

– Ελαφρύ: Τα Αλουμινένια σκάφη είναι γνωστά για την ελαφριά κατασκευή τους, και το ΑΤ 35 έρχεται για να το επιβεβαιώσει, με το εκτόπισμα του χωρίς υγρά να ανέρχεται στους μόλις 2.2 τόνους.

– Στιβαρή κατασκευή : Παρά την ελαφριά φύση τους, αλουμινένια σκάφη είναι στιβαρά και προσφέρουν εξαιρετική δομική ακεραιότητα, παρέχοντας σταθερότητα και ασφάλεια στο νερό. Ειδικότερα, το ΑΤ 35 είναι κατά 40% πιο άκαμπτο από αντίστοιχα πολυεστερικά σκάφη.

– Ανθεκτικό στη διάβρωση: Το ναυπηγικό αλουμίνιο είναι φυσικά ανθεκτικό στη διάβρωση, εξασφαλίζοντας ένα ανθεκτικό και μακράς διαρκείας σκάφος που μπορεί να αντέξει στις πιο αντίξοες συνθήκες θαλασσινών περιβαλλόντων, πράγμα που επιβεβαιώνει η μακροχρόνια χρήση του συγκεκριμένου υλικού στα επιβατικά πλοία.

– Σχεδιαστική Ευελιξία: Τα αλουμινένια σκάφη δεν κατασκευάζονται με καλούπι όπως τα πολυεστερικά: αυτό εγγυάται ότι κάθε σκάφος της Alpha Tango yachts είναι ξεχωριστό και 100% χειροποίητο, πράγμα που σημαίνει ότι η διάταξη του καταστρώματος αλλά και των λεπτομερειών είναι 100% διαμορφώσιμα.

– Εύκολα Επισκευάσιμο: Το αλουμίνιο είναι ένα υλικό που δεν παρουσιάζει ρωγμές, παρόλα αυτά εάν το σκάφος εμπλακεί σε ατύχημα, αρχικά επισκευάζεται τοπικά εντός λίγων λεπτών με μια ειδική πλαστελίνη, αποτρέποντας την εισροή υδάτων άμεσα, και έπειτα η επιδιόρθωση γίνεται τοπικά μόνο στο σημείο της ζημιάς χωρίς να επηρεάζεται η δομή του σκάφους, σε αντίθεση με τον πολυεστέρα που σε περίπτωση ρωγμής πρέπει να εντοπιστεί η έκταση της, και να επιδιορθωθεί πολύ μεγαλύτερο κομμάτι, επηρεάζοντας την δομική ακεραιότητα του σκάφους.

Πληροφορίες:

web: www.alphatangoyachts.com

ΔΕΙΤΕ ΑΚΟΜΑ

«e—ναυλοσύμφωνο»: Τι είχες Γιάννη, τι είχα πάντα…

Ιδιαίτερο ενδιαφέρον παρουσιάζει για τον ψηφιακό μετασχηματισμό η σχετική ανάρτηση στο επίσημο σάιτ του Υπουργείου Ναυτιλίας, η οποία αναφέρεται κοινή ανακοίνωση των συναρμόδιων Υπουργείων με αφορμή την υπογραφείσα Κ.Υ.Α. «Καθορισμός των διαδικασιών λειτουργίας και των όρων χρήσης της ηλεκτρονικής εφαρμογής

Φιέστα Ερντογάν στην κατεχόμενη Κύπρο για τα 50 του «Αττίλα»

Μισός αιώνα συμπληρώνεται από την τουρκική εισβολή στην Κύπρο την 20η Ιουλίου 1974 (την επιχείρηση Αττίλας Ι με την επίκληση του άρθρου 4 της Συνθήκης Εγγυήσεων από την Άγκυρα) και το Σάββατο ο τούρκος πρόεδρος, Ρετζέπ Ταγίπ Ερντογάν ετοιμάζει μία

Πέφτει σε… παγόβουνο η εταιρεία που ναυπήγησε τον Τιτανικό

Ειδάλλως, σχεδόν 1.500 θέσεις εργασίας βρίσκονται σε κίνδυνο, ειδικά τώρα που μόλις ανέλαβαν την εξουσία οι Εργατικοί στο Ηνωμένο Βασίλειο και έχουν δεσμευθεί για στήριξη τόσο των επιχειρήσεων όσο και των εργαζομένων, όπως αναφέρει ο Guardian. Από την πλευρά της,

Ο Σωτήρης, η Μαρία και τα παράδοξα της ναυτιλίας μας (*)

ΑΝΤΙΓΡΑΦΩ από το site της «Ναυτεμπορικής»: «Έρευνα: Mόνο το 13% των Ελλήνων γνωρίζει την παγκόσμια πρωτιά της ελληνικής ναυτιλίας, οι νέοι την αγνοούν εντελώς. Το 53% των Ελλήνων δεν θα επέλεγε ή δεν θα πρότεινε σε κάποιον δικό του την

ΡΟΗ ΕΙΔΗΣΕΩΝ

Η lidl έχει στόλο εννέα πλοίων, κως: συνελήφθη πλοίαρχος ε/γ–τ/ρ πλοίου, γιατί είχε 11 υπεράριθμους επιβάτες.

Chicago to Mackinac sailboat race: Storm snaps masts, tosses sailor into Lake Michigan

A fast-moving summer storm Saturday night on Lake Michigan left carnage in its path after three huge sailboats snapped masts and a fourth boat had to rescue a man after he fell overboard, all in the middle of the night under total darkness during the first day of the Chicago to Mackinac race .

“It was about 11:30 Eastern Time and we outpaced a couple storms. The team was getting ready … when a squall hit us. The wind picked up from about 18 knots to over 30 knots and shifted 80 degrees,” Skip Dieball, 53, of Wilmette, Illinois, a tactician racing on the 52-foot Usual Suspects, said on Sunday. “Sometimes in the daytime, you can see some of the shifts coming, the wind pattern on the water. But it was so dark we couldn’t see anything. We told each other we would prepare early. We were, and it just came really fast.”

Disaster was averted after Madcap, a Santa Cruz 52 owned and skippered by John Hoskins, responded to a man overboard report from Callisto, a J/125 owned and skippered by Jim Murray. Both boats resumed racing the 333-statute-mile (289-nautical-mile) race without injury.

In addition to Usual Suspects, owned by Eric Wynsma, masts broke on the 65-foot Sagamore owned by Laura and Tone Martin, along with the 45-foot Sapphire, owned by Robert Radway. No injuries were reported, according to Laura Muma, communications director for the Chicago to Mackinac race.

Despite being on high alert to take down sails, the demasting events were intense.

‘Loud as the loudest thunder’

As soon as the mast snapped, Dieball said the crew started doing a head count to be certain all 13 sailors were still onboard. The rig could have come down on the crew if they had been in their normal stations, but they were scattered. While the mast “broke violently,” Dieball said, “it did not come down violently.”

The race boat, with its custom carbon fiber mast, strong and light but brittle, is designed for high-performance racing and often used in America’s Cup races.

When the mast broke, it sounded like a “crack of thunder” immediately overhead, Dieball said. “It’s as loud as the loudest thunder.”

When the mast settled, the crew had to rapidly assess next steps. The biggest fear is that the broken mast will bang against the boat and puncture a hole, Dieball said. A mast on a boat that size can be 60 or 70 feet tall, he said.

“Part of your safety equipment is having cutting devices that get the mast away from the boat. The mast had broken in three different spots and it was time to start cutting things away,” Dieball said. “Carbon fiber, in many ways, is sharper than steel. We had to make sure no one was in a spot where one of the pieces would actually cut them.”

So sailors took out cutting tools and knives they’re required to carry as part of the racing protocol — and sliced away rigging as fast as possible, letting material sink into the water.

‘Survival mode’

Skipper Eric Wynsma, a real estate developer from Grand Rapids, had three of his grown kids racing, too. This was his 25th Chicago to Mackinac race.

“We were just in survival mode,” Dieball said, cutting away for about 30 minutes. “After the (storm) cell went through, the wind died off. So it wasn’t like we were battling elements. We were into the race about nine hours, finishing about a third of the course, and we returned to Muskegon.”

After stabilizing the situation, the Usual Suspects crew contacted the U.S. Coast Guard and reported debris in the water. The race boat didn’t need assistance once the rigging was cut away, Dieball said. They made certain nothing was wrapped around the propeller and Usual Suspects spent the next three hours motoring back, arriving about 5 a.m.

No one was freaking out, Dieball said. “It was all business.”

The costly damage prevents Usual Suspects from racing the Bayview Mackinac race from Port Huron to Mackinac, which starts Saturday.

Fast Tango fights DeTour

Tim Prophit , of St. Clair Shores, owner and skipper of the 40-foot Fast Tango, didn’t get slammed by the storm, but his nine-member crew prepared by making sail changes and reefing the main sail for better control.

“All of a sudden, the waves felt different, a different pattern, a different height. And the temps dropped,” he said Sunday while racing. “We were paying very close attention to the weather.”

Fast Tango won its class and placed second overall in the Chicago to Mackinac race last year, and was the overall winner in the Port Huron to Mackinac race.

This year, Fast Tango is battling the 34-foot DeTour, owned by Chuck Stormes, of Grosse Pointe Farms, no stranger to winning class and overall trophies.

Christy Storms said early Sunday afternoon she couldn’t look at the tracker to see how her husband was doing. It made her crazy. She didn’t know there had been a storm, she said, thank God, or she would have been worried sick.

“This is the first year I’ve been trying to not stalk him,” she said. “It’s tough looking every minute. It just makes me crazy.”

Family members are known to sleep with their phones under their pillows, call and text each other every hour through the night until the race is finished.In years past, Christy Storms said, “it was like crack. It just make me so anxious.”

So, she went online, noticed he was doing great, took a snapshot of the tracker, put her phone down and went to bed with their 11-year-old dog Striker.

Early Monday, Prophit confirmed that Fast Tango won first in class against 11 competitors. They crossed the finish line in 41 hours, 59 minutes, 47 seconds.

Chaos on other boats, too

Following the storm, 15- to 20-knot southerly winds continued to propel the 247-boat fleet north, Muma said in the race update.

While mast loss made headlines with sailing reporters, other boats had serious issues that went unreported. And they kept going, hoping for the best.

Mark DenUyl, of Marysville, Michigan, owner and skipper of the 34.5-foot Good Lookin’, watched his carbon fiber bowsprit snap in half during the high winds right about 11:30 p.m. Saturday. Now it’s held together with electrical tape and sail tape.

Crew member Brennan Churchill, 22, texted his dad at home in Kimball, Michigan, with an update on the damaged equipment used to extend the sail, so it captures more wind.

“He knew better than to tell his mother,” Tracy Heany Churchill said Sunday. “He knows I go into freakout mode.”

Ron Churchill always sails with his son, who won his first Mackinac race at age 15, but Ron couldn’t leave work as a senior operations manager for a natural gas storage facility to do both the Chicago and Port Huron races to Mackinac.

“I feel like I’m lost right now. I just feel like I’m supposed to be there,” Ron Churchill said Sunday.

Brennan Churchill described the boat tipping so far to one side that the crew was in waist-deep water, his father said. “Everybody stayed on the boat. Water was washing over them.”

The sudden gust of wind created such force that it likely flexed and snapped, he said. As a result of the damage, the crew held steady until daylight to try and figure out what to do, Churchill said. “They did a good job with just staying composed and keeping the boat moving well.”

On Monday morning, Good Lookin’ crossed the finish line in third in class against a dozen other J/105 boats despite damage to critical equipment.

Cara DenUyl and her 19-year-old daughter, Riley, woke up at 5:30 a.m. Monday to watch online the Good Lookin’ finish. “It was a nail-biter. It was close between second and third. They were in second place at 2 a.m. Sunday, when that storm hit. Then they fell back all the way to seventh place. At the time, we didn’t know the storm had hit. Somehow they got everything fixed enough to keep going, thankfully. I feel relief that they made the podium.”

‘Breathtaking’ speed

With storms come great wind. Or, in sailor speak, great air.

Winn Soldani, race chair of the Chicago to Mackinac race, said this weekend’s storms brought “epic” conditions that weather models predicted, which is important for safety.

“We’re watching boats going 20 knots, or about 23 mph, and it’s breathtaking,” Soldani told Shifting Gears from the finish line near the Mission Point hotel on Mackinac Island on Sunday.

“When the squalls hit, the wind changed direction very rapidly, from out of the south to out of the west, at 33 to 35 mph,” he said. “Some of these sails are the size of tennis courts. They’re huge. So this changes pressure on the mast.”

That’s what causes masts to snap, Soldani said. Strict safety protocols protect the 2,200 sailors racing this year, and that’s why they’re required to wear special tracking devices on their bodies at all times.

Storm winds create record-setting conditions

As a result of the strong winds, this race broke the speed record.

The 80-foot Maverick finished in 22 hours, 24 minutes, 23 seconds, breaking a record set 22 years ago by 66 minutes, 11 seconds.

Sanford Burris, of Kirtland, Ohio, sailed with his sons and friends on the carbon fiber Andrews 80 they have spent the past three years upgrading, according to Muma. The 20-person crew included Rodney Keenan, founder of Evolution Sails.

“The team celebrated briefly as the Maverick team crossed the race to Mackinac finish line between Mackinac Island and the Round Island lighthouse … and then kept on sailing,” said the Chicago to Mackinac news release.

Maverick is one of 25 sailboats registered for this year’s “Super Mac” race, a combination of the Chicago Mackinac and the Bayview Mackinac races, which means they will continue into Lake Huron, heading south to Port Huron, for a total of 565 statute miles (495 nautical miles).

More: Star Line Mackinac Island Ferry Co. sells to Florida billionaire

Phoebe Wall Howard, a Free Press auto reporter for nearly seven years, now writes a column on car culture, consumer trends and life that will appear periodically on Freep.com and in print. Those columns and others will appear on her Substack at https://phoebewallhoward.substack.com/about Contact her at [email protected].

Now offering NEW ASA Certifications. Take 50% Off with code ASA50. Learn More .

- Dates & Costs

- Request Brochure

- Alpha Adventures

- Tango Adventures

Follow Our Journey! Alpha & Tango – Day 6

Written by Anna, a Mate on Maora

We started the day bright and early to set up a special breakfast buffet in honor of Ceci, the birthday girl! The spread included a delicious assortment of watermelon, eggs, sausages, bagels, orange juice, and a variety of birthday treats. To make the morning even more special, we showered Ceci with a few small gifts and heartfelt cards.

Once the celebrations were underway, we got ready to leave the dock at Soper’s Hole Marina. Julien, our skipper for the day, expertly sailed us to The Bight. The afternoon was filled with fun and adventure as we indulged in various watersports, made friendship bracelets, and enjoyed snorkeling and diving in the crystal-clear waters. The weather was absolutely perfect—sunny with a light breeze, adding to the joy of the day.

As the evening approached, Char, Finn, and Reese took charge of dinner, whipping up a delicious meal of mac and cheese, followed by a homemade cake for dessert. The festivities didn’t end there! We hosted a social gathering, inviting people from other boats to join us for a few hours of mingling and fun. It was a delightful way to end a day full of celebrations and activities.

To see more photos of our Campers’ adventures in the BVI, download the Campanion App and follow up on instagram @sailcaribbean.

Related Posts

The greatest challenge during the program was staying entertained during the quarantine period. Not being able to leave your boat and not having a phone, which was a crutch against boredom, it was difficult at first to stay entertained.

We use cookies to improve your browsing experience on our website. By closing this banner or interacting with our site, you acknowledge and agree to our privacy policy .

Please wait while flipbook is loading. For more related info, FAQs and issues please refer to DearFlip WordPress Flipbook Plugin Help documentation.

Contact us for more information. You can reach us here

COMMENTS

fleet About us fleet About us NEWS & EVENTS NEWS & EVENTS

The design of Alpha Tango Yachts is what makes them special because they were built to meet the needs of a wide range of active users. The deep-v aluminum hull is essential to our boats' sturdiness and outstanding driving characteristics. Aluminum is a popular choice among leisure boaters as well as professional boaters due to its benefits.

fleet RIB S e r i e s Power S e r i e s Tender S e r i e s coming soon custom line

The design of Alpha Tango Yachts is what makes them special because they were built to meet the needs of a wide range of active users. The deep-v aluminum hu...

Alpha Tango Yachts. The AT35 Hull No.01 has officially hit the water. The 1st Stepped Hull made of 100% Marine Grade Aluminium in Greece. Today marks a special moment in marine history as we launched our new vessel, the AT35, designed to redefine water experience. Crafted with precision and engineering excellence, this vessel embodies the ...

02.25.2024 Alpha Tango Yachts BOAT & FISHING SHOW Το νέο φουσκωτό από ναυπηγικό αλουμίνιο AT 35 της Alpha Tango Yachts σε πρώτη παρουσίαση στην έκθεση σκαφών Boat & Fishing Show 2024, 7 - 10 Μαρτίου, MEC Παιανίας.

The U.S. government on Monday seized a 254-foot yacht in Spain owned by an oligarch with close ties to Russian President Vladimir Putin, a first by the Biden administration under sanctions imposed after the Kremlin's invasion of Ukraine and targeting pricey assets of Russian elites.. Spain's Civil Guard and U.S. federal agents descended on the Tango at the Marina Real in the port of Palma de ...

news & events BOAT & FISHING SHOW 2024 7-10.03.2024 Our first model, the AT35 will make its debut to the public at the Boat & Fishing Show 2024. Join us in stand A11 to get up close and personal with the AT35 and see what makes it so unique. See you all there!

If you are looking to buy a yacht «ALPHA TANGO» or need additional information on the purchase price of this TIARA, please call: +1-954-274-4435 (USA) Cruiser «ALPHA TANGO» built by manufacturer TIARA in 2014 — available for sale. Yacht location: USA. If you are looking to buy a yacht «ALPHA TANGO» or need additional information on the ...

Η ALPHA TANGO YACHTS σχεδίασε και κατασκεύασε το AT 35, ένα καινοτόμο ελληνικό 11μετρο φουσκωτό σκάφος κατασκευασμένο από 100% ναυπηγικό αλουμίνιο. Ο Γιάννης και ο Μάρκος, ιδρυτές της Alpha Tango, γνωρίστηκαν το 2013 σαν συμφοιτητές στο ...

Winner of design et al's Best Deck Design Award and shortlisted for Motor Yacht Exterior Design 25-40 Meters Award. Alpha Yachts ignored all preconceived compromises to create a yacht that is simply incomparable to all other yachts in her size range. As Giorgio Cassetta, designer of the Spritz 102', eloquently states, "To design the ...

Alpha & Tango - Day 9. By Vada H July 17, 2024. Written by Hannah C., a Mate on Jackalope. ... Alpha Adventures Yacht Shots BVI Professional Photography Delta Adventures Delta 2 Day 10: 100 NM Journey In 17 Hours! Foxtrot Adventures Foxtrot 1 & Sierra 1 Day 16: The ...

Alpha & Tango - Day 10. By Vada H July 18, 2024. Written by Watt C., a Mate on Betty's Dream. Today was a busy day on fleet. We woke up on the docks at the beautiful Scrub Island Resort and enjoyed a great breakfast on the boat. ... Early Alpha, Foxtrot, Charlie, Sierra, & Tango- Day 4 The greatest challenge during the program was staying ...

RIB S e r i e s

The design of Alpha Tango Yachts is what makes them special because they were built to meet the needs of a wide range of active users. The deep-v aluminum hu...

Alpha & Tango - Day 7. By Vada H July 15, 2024. Written by Margo M., a Mate on Topaz ... We made a brief pit stop at Nanny Cay to top up our boats' water supplies. The kids learned about Mediterranean anchoring during this time, adding a valuable skill to their sailing repertoire. ... Early Alpha, Foxtrot, Charlie, Sierra, & Tango- Day 13

Dividends matter in practice, despite academic theories suggesting otherwise. Dividends align incentives between management and shareholders, optimizing free cash flow growth and reducing agency ...

CONTACT Send us your enquiry Contact us directly [email protected] [email protected]

Η Alpha Tango Yachts έχει σχεδιάσει το ΑΤ 35 σε εκδόσεις Open και Cabin, και με πρόωση τόσο από εξωλέμβιους όσο και από έσω/έξω κινητήρες. Στο άμεσο μέλλον αναμένεται να παρουσιαστούν και τα επόμενα ...

Early Monday, Prophit confirmed that Fast Tango won first in class against 11 competitors. They crossed the finish line in 41 hours, 59 minutes, 47 seconds. Chaos on other boats, too

Alpha & Tango - Day 6. By Vada H July 14, 2024. Written by Anna, a Mate on Maora ... We hosted a social gathering, inviting people from other boats to join us for a few hours of mingling and fun. It was a delightful way to end a day full of celebrations and activities. Related Posts. View All Posts. Alpha Adventures Alpha 4, Charlie 3, ...

AT35 Contact us for more information. You can reach us here